10 Dwp Payment Updates: Essential Guide For 2024

DWP Payment Updates: What You Need to Know for 2024

The Department for Work and Pensions (DWP) is committed to ensuring that benefits and payments are processed efficiently and accurately. As we enter a new year, it’s important to stay informed about the latest updates and changes to DWP payments. Here, we provide you with a comprehensive guide to the essential DWP payment updates for 2024, covering various benefits and schemes.

Universal Credit Changes

One of the significant updates for 2024 is the ongoing reform of the Universal Credit (UC) system. The DWP aims to simplify and improve the UC process, making it more accessible and responsive to claimants’ needs. Here are some key changes to note:

- UC Tapering: The UC tapering rate, which determines how much benefit is reduced as earnings increase, will be reduced from 63% to 55%. This change aims to encourage claimants to take up work by ensuring they keep a higher proportion of their earnings.

- Childcare Support: The DWP has expanded the childcare support available to UC claimants. Now, claimants can receive up to 85% of their eligible childcare costs, up from the previous 80%. This increase aims to support working parents and reduce the financial burden of childcare.

- Housing Benefit Transition: Claimants transitioning from Housing Benefit to UC will have their rent arrears covered by the DWP for an additional 12 months. This extension provides a safety net for those making the switch, ensuring they can manage their housing costs during the transition period.

Benefits and Payment Adjustments

Several benefits and payments will undergo adjustments in 2024 to keep up with the cost of living and inflation. Here’s an overview:

- State Pension: The full new State Pension will increase to £185.15 per week, up from £185.10 in 2023. This slight increase aims to provide a more comfortable retirement for those relying on the State Pension.

- Personal Independence Payment (PIP): The standard daily living component of PIP will increase to £96.35 per week, while the enhanced daily living component will rise to £164.90 per week. These adjustments ensure that PIP claimants can better manage their daily needs and expenses.

- Employment and Support Allowance (ESA): The basic rate of ESA will increase to £61.45 per week, while the higher rate will be £122.90 per week. These changes aim to provide financial support to those with limited capacity for work due to illness or disability.

New Claimant Commitments

The DWP is introducing new claimant commitments to ensure that benefit claimants actively engage in finding work or improving their work prospects. Here’s what you need to know:

- Jobcentre Plus Appointments: Claimants will be required to attend regular appointments at their local Jobcentre Plus office. These appointments will involve discussing job search activities, training opportunities, and any barriers to employment.

- Work-Related Activities: Claimants will be expected to participate in work-related activities, such as job searches, training courses, or voluntary work. These activities aim to enhance their employability and increase their chances of finding suitable employment.

- Sanctions: Failure to comply with the new claimant commitments may result in sanctions, which can include a reduction or suspension of benefits. It’s important to understand your responsibilities and actively engage in the process to avoid any negative consequences.

Online Services and Digital Transformation

The DWP is investing in digital transformation to improve the efficiency and accessibility of its services. Here are some key developments:

- Online Claims: The DWP encourages claimants to make their benefit claims online through the government’s website. This process is designed to be user-friendly and secure, allowing claimants to submit their applications from the comfort of their homes.

- My Account: Claimants can access their personal My Account portal, where they can manage their benefits, update personal details, and view payment histories. This online platform provides a convenient way to stay on top of their benefit claims.

- Digital Verification: The DWP is implementing digital verification processes to streamline the application and assessment stages. Claimants may be required to provide identity and residency documents online, reducing the need for physical appointments and speeding up the overall process.

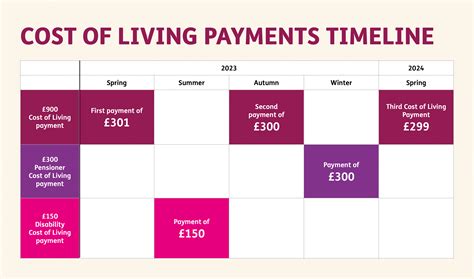

Payment Timelines and Frequency

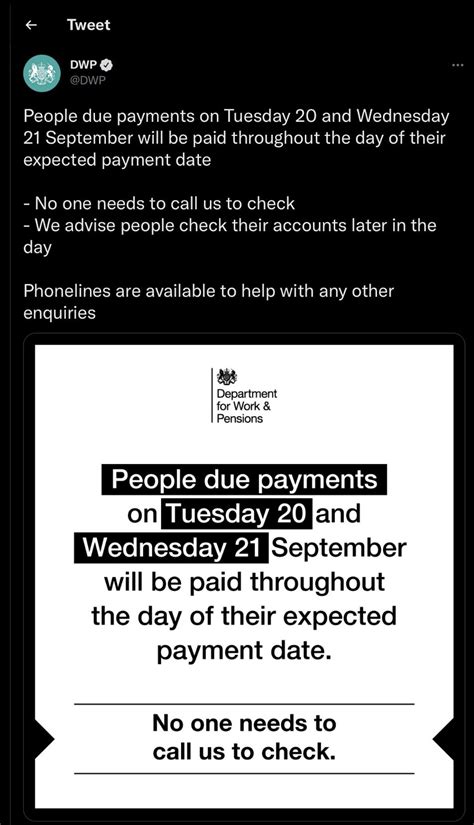

The DWP has made some adjustments to payment timelines and frequencies to improve efficiency and reduce delays:

- Payment Dates: DWP payments are typically made twice a month, on specific dates. It’s important to be aware of these payment dates to manage your finances effectively. You can find the payment dates for your benefit on the DWP website or by contacting the relevant helpline.

- Payment Frequency: Most benefits are paid weekly or fortnightly, ensuring regular income for claimants. However, some benefits, such as the State Pension, are paid monthly. Understanding the frequency of your payments is crucial for financial planning.

- Payment Methods: The DWP offers various payment methods, including direct deposit into a bank account, prepaid cards, or postal orders. You can choose the most convenient and secure method for receiving your benefits.

Special Circumstances and Support

The DWP recognizes that certain circumstances may require additional support or consideration. Here’s an overview:

- Disability Benefits: If you have a disability or long-term health condition, you may be eligible for additional benefits, such as Personal Independence Payment (PIP) or Attendance Allowance. These benefits provide financial support to help manage the extra costs associated with your condition.

- Housing and Council Tax Support: The DWP works closely with local authorities to provide housing and council tax support to eligible claimants. This support aims to ensure that individuals and families can afford their housing costs and avoid falling into rent arrears.

- Carer’s Allowance: If you provide care for someone with a disability, you may be eligible for Carer’s Allowance. This benefit recognizes the valuable contribution of carers and provides financial support to help manage the demands of caring for a loved one.

Staying Informed and Seeking Assistance

It’s essential to stay informed about the latest DWP payment updates and changes. Here are some resources to help you:

- DWP Website: The official DWP website is a valuable source of information, providing detailed guides, eligibility criteria, and application processes for various benefits. You can also find contact details for helplines and local offices.

- Benefits Calculators: Online benefits calculators can help you estimate your eligibility for different benefits and the potential amount you may receive. These tools can be a useful starting point for understanding your entitlements.

- Citizen’s Advice: Citizen’s Advice provides free, independent advice on a wide range of issues, including benefits and financial support. Their experts can assist you in navigating the complex benefits system and ensure you receive the support you’re entitled to.

Summary

Staying informed about DWP payment updates is crucial for managing your finances and accessing the support you need. From Universal Credit reforms to benefit adjustments and new claimant commitments, 2024 brings several changes to the benefits system. By understanding these updates and utilizing the available resources, you can ensure a smooth and successful benefits journey.

FAQ

What is the new UC tapering rate for 2024?

+

The UC tapering rate will be reduced from 63% to 55% in 2024, allowing claimants to keep a higher proportion of their earnings.

How much will the State Pension increase in 2024?

+

The full new State Pension will increase to £185.15 per week in 2024, up from £185.10 in 2023.

What are the new claimant commitments for 2024?

+

New claimant commitments include regular Jobcentre Plus appointments, work-related activities, and potential sanctions for non-compliance.

How can I make a benefit claim online?

+

You can make a benefit claim online through the government’s website. The process is designed to be user-friendly, and you’ll need to provide personal and financial information.

What support is available for claimants with disabilities?

+

Claimants with disabilities may be eligible for benefits such as Personal Independence Payment (PIP) or Attendance Allowance, providing financial support for additional costs.