10 Household Support Grant Tips: A Comprehensive Guide

Introduction

Welcome to our comprehensive guide on the Household Support Grant, a vital initiative aimed at providing financial assistance to eligible households during challenging economic times. In this blog post, we will explore ten essential tips to help you navigate the process and maximize the benefits of this grant. Whether you are a first-time applicant or seeking clarification on certain aspects, this guide will equip you with the knowledge and tools to make the most of this valuable support. So, let’s dive in and discover how you can access and utilize the Household Support Grant effectively!

Understanding the Household Support Grant

The Household Support Grant is a government-funded program designed to offer financial relief to households facing economic hardships. It aims to provide temporary assistance to eligible individuals and families, helping them meet their basic needs and maintain financial stability. This grant recognizes the challenges many households encounter due to various factors, such as rising living costs, unexpected expenses, or temporary income loss. By offering a much-needed financial boost, the Household Support Grant plays a crucial role in supporting vulnerable communities and promoting overall economic well-being.

Eligibility Criteria

To ensure a fair and inclusive application process, the Household Support Grant has established clear eligibility criteria. Understanding these criteria is essential to determine whether you or your household qualify for the grant. Here are the key factors to consider:

- Income Level: The grant is primarily targeted at low-income households. Your household’s total income, including wages, benefits, and other sources, will be assessed to determine eligibility.

- Residency: You must be a resident of the country or region where the grant is being offered. Each region may have specific residency requirements, so it’s important to verify the criteria for your area.

- Household Composition: The grant takes into account the number of individuals in your household and their respective ages. Larger households or those with dependent children may have a higher chance of qualifying.

- Financial Status: Your financial situation, including any outstanding debts or expenses, will be evaluated. The grant aims to support households with limited financial resources and those facing economic difficulties.

- Other Factors: Depending on the region and the specific grant program, additional criteria may be considered. These could include employment status, disability, or other vulnerability factors.

Application Process

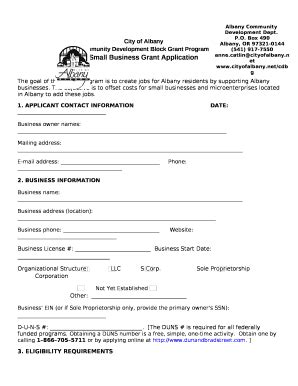

Now that you have a better understanding of the eligibility criteria, let’s explore the application process for the Household Support Grant. Following these steps will help ensure a smooth and successful application:

- Gather Required Documents: Before starting your application, gather all the necessary documents. This typically includes proof of identity, income statements, residency documentation, and any supporting evidence related to your financial situation.

- Visit the Official Website: Access the official website of the Household Support Grant program in your region. Here, you will find detailed information about the grant, including eligibility criteria, application guidelines, and any specific requirements.

- Read the Application Instructions: Carefully read through the application instructions provided on the website. Pay attention to any specific deadlines, submission methods, and any additional forms or documentation that may be required.

- Complete the Application Form: Download and complete the application form provided on the website. Ensure that you provide accurate and up-to-date information. Double-check your responses to avoid any errors or omissions.

- Submit Your Application: Follow the instructions on the website to submit your completed application. This may involve uploading your application form and supporting documents online or sending them via mail to the designated address.

- Wait for Processing: Once you have submitted your application, allow sufficient time for processing. The processing time may vary depending on the volume of applications and the efficiency of the system. Be patient and keep an eye on your email or the official website for any updates.

Maximizing Your Chances of Approval

To increase your chances of receiving the Household Support Grant, it’s essential to present a strong and compelling application. Here are some tips to help you maximize your chances of approval:

- Highlight Your Financial Need: Clearly demonstrate your household’s financial need and the impact it has on your daily life. Provide evidence of any recent financial hardships, such as job loss, medical expenses, or unexpected costs.

- Provide Detailed Documentation: Ensure that you submit all the required documents and supporting evidence. Organize your paperwork in a clear and concise manner, making it easier for the reviewers to assess your eligibility.

- Be Honest and Transparent: Provide accurate and truthful information throughout your application. Any misrepresentation or omission of relevant details may lead to disqualification.

- Explain Special Circumstances: If your household faces unique or challenging circumstances, such as disability, illness, or caring for a dependent, explain these factors in your application. This can help the reviewers understand your specific needs and make an informed decision.

- Seek Support: If you are unsure about any aspect of the application process or have questions, don’t hesitate to seek assistance. Contact the grant program’s helpline or visit their website for further guidance and support.

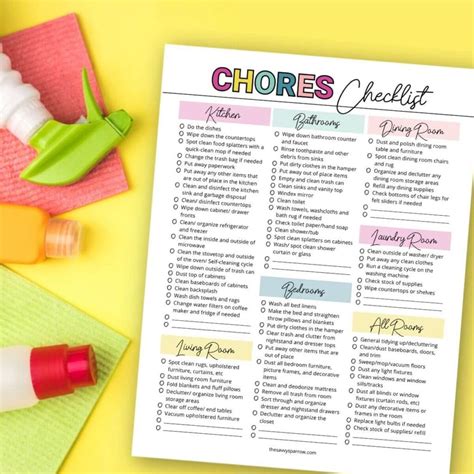

Preparing Your Supporting Documents

When applying for the Household Support Grant, it’s crucial to have all the necessary supporting documents ready. These documents will provide evidence of your eligibility and help strengthen your application. Here’s a list of commonly required supporting documents:

- Proof of Identity: Provide a valid form of identification, such as a passport, driver’s license, or national ID card. Ensure that the document is up-to-date and clearly displays your name, date of birth, and other relevant details.

- Income Statements: Gather recent income statements or payslips that demonstrate your household’s income. If you are self-employed or have multiple sources of income, provide evidence of all income streams.

- Residency Documentation: Submit proof of residency, such as a utility bill, rental agreement, or council tax statement. Ensure that the document includes your name and the address of your current residence.

- Financial Records: Collect any relevant financial records, such as bank statements, loan agreements, or benefit statements. These documents will help verify your financial situation and any outstanding debts or expenses.

- Dependents’ Information: If you have dependent children or other dependents, provide their birth certificates or proof of relationship. This information is essential for assessing your household composition and eligibility.

- Other Supporting Evidence: Depending on your specific circumstances, you may need to provide additional supporting evidence. This could include medical records, disability certificates, or any other relevant documentation that supports your application.

Common Mistakes to Avoid

To ensure a successful application, it’s important to be aware of common mistakes that applicants often make. By avoiding these pitfalls, you can increase your chances of approval and avoid unnecessary delays or rejections. Here are some mistakes to steer clear of:

- Submitting Incomplete Applications: Double-check your application form and supporting documents to ensure completeness. Incomplete applications may result in delays or even disqualification.

- Providing Inaccurate Information: Be truthful and accurate in your application. Misrepresenting your financial situation, income, or other details can lead to serious consequences, including rejection or legal action.

- Missing Deadlines: Pay close attention to the application deadlines and ensure that you submit your application on time. Late applications may not be considered, so plan ahead and allow sufficient time for completion.

- Failing to Read Instructions: Carefully read and understand the application instructions provided on the official website. Ignoring important guidelines or requirements may result in your application being rejected.

- Not Providing Supporting Documents: Ensure that you submit all the required supporting documents. Missing or incomplete documentation can weaken your application and impact your chances of approval.

Additional Tips for a Successful Application

Beyond the basic application process, there are several additional tips and strategies you can employ to enhance your chances of receiving the Household Support Grant. Consider the following suggestions:

- Stay Organized: Keep a record of all your application materials, including the application form, supporting documents, and any correspondence with the grant program. This will help you stay organized and easily locate important information if needed.

- Proofread Your Application: Before submitting your application, carefully proofread it for any errors or typos. A well-written and error-free application demonstrates attention to detail and can leave a positive impression on the reviewers.

- Seek Feedback: If you have the opportunity, seek feedback on your application from trusted individuals or organizations. This can help you identify any areas for improvement and ensure that your application is as strong as possible.

- Be Proactive: Stay proactive throughout the application process. Regularly check your email and the official website for updates or any additional requirements. Being responsive and engaged can demonstrate your commitment and dedication.

- Stay Informed: Keep yourself updated on any changes or updates to the Household Support Grant program. Follow the official channels, such as the website or social media pages, to stay informed about eligibility criteria, application deadlines, and any new developments.

Understanding the Grant Amount and Usage

Once you have been approved for the Household Support Grant, it’s important to understand the grant amount and how it can be used. Here’s what you need to know:

- Grant Amount: The grant amount may vary depending on your household’s specific circumstances and the region you reside in. It is typically calculated based on factors such as income level, household size, and any additional vulnerability factors.

- Usage Guidelines: The grant is intended to be used for essential household expenses, such as food, utilities, rent or mortgage payments, and other basic needs. It is not intended for luxury items or non-essential purchases.

- Reporting Requirements: Depending on the grant program, you may be required to provide periodic reports or updates on how the grant funds are being utilized. This helps ensure that the grant is being used for its intended purpose and allows for any necessary adjustments.

- Reimbursement Process: In some cases, the grant may be provided as a reimbursement rather than a direct payment. This means that you will need to incur eligible expenses and then submit receipts or proof of payment to receive the grant funds.

- Record-Keeping: It’s important to keep accurate records of your grant-related expenses and any supporting documentation. This will help you stay organized and provide evidence of proper grant usage if needed.

Seeking Assistance and Support

Applying for the Household Support Grant can be a complex process, and it’s normal to have questions or encounter challenges along the way. Fortunately, there are various resources and support systems available to help you navigate this journey. Here are some options to consider:

- Helpline or Customer Service: Contact the grant program’s helpline or customer service team. They can provide guidance, answer your questions, and offer support throughout the application process.

- Community Organizations: Reach out to local community organizations or charities that specialize in providing support to vulnerable households. These organizations may have experience with the grant application process and can offer valuable assistance.

- Social Services: If you are facing significant financial difficulties or require additional support, consider reaching out to social services or welfare agencies. They can provide guidance and connect you with relevant resources and programs.

- Online Resources: Utilize online resources, such as government websites, forums, or community platforms, to gather information and connect with others who have gone through the application process. Sharing experiences and insights can be beneficial.

- Professional Advisors: In some cases, seeking advice from professional advisors, such as financial counselors or legal experts, may be beneficial. They can provide personalized guidance and help you navigate complex financial situations.

Conclusion

The Household Support Grant is a valuable initiative that provides much-needed financial assistance to eligible households. By following the tips and guidelines outlined in this comprehensive guide, you can navigate the application process with confidence and increase your chances of receiving this vital support. Remember to stay organized, provide accurate and complete information, and seek assistance when needed. With your dedication and perseverance, you can access the Household Support Grant and take a step towards financial stability and a brighter future.

FAQ

Can I apply for the Household Support Grant if I am not a citizen of the country?

+

The eligibility criteria for the Household Support Grant may vary depending on the region and the specific grant program. While some programs may prioritize citizens or permanent residents, others may consider non-citizens on a case-by-case basis. It’s important to check the official website or contact the grant program’s helpline to determine your eligibility.

How long does it usually take to receive a decision on my Household Support Grant application?

+

The processing time for Household Support Grant applications can vary depending on several factors, including the volume of applications, the complexity of your case, and the efficiency of the system. In general, it is recommended to allow several weeks to a few months for your application to be processed. It’s a good idea to regularly check the official website or contact the grant program for updates on the status of your application.

Can I apply for the Household Support Grant if I have already received other government benefits?

+

The eligibility criteria for the Household Support Grant may take into account any other government benefits you are receiving. It is important to disclose all sources of income and benefits when completing your application. The grant program will assess your overall financial situation to determine if you meet the eligibility requirements. It’s recommended to consult the official guidelines or seek advice from the grant program’s helpline to ensure you understand the specific criteria.

Are there any restrictions on how I can use the Household Support Grant funds?

+

The Household Support Grant is intended to be used for essential household expenses, such as food, utilities, rent or mortgage payments, and other basic needs. It is not intended for luxury items or non-essential purchases. The grant program may have specific guidelines or restrictions on how the funds can be used. It’s important to carefully read the grant terms and conditions to ensure you understand the allowed usage.

Can I reapply for the Household Support Grant if my initial application was unsuccessful?

+

If your initial application for the Household Support Grant was unsuccessful, you may be able to reapply in the future. However, it’s important to carefully review the reasons for your previous rejection and address any issues or deficiencies in your application. Consider seeking feedback from the grant program or seeking assistance to strengthen your application. Each grant program may have specific guidelines on reapplication, so it’s recommended to check the official website or contact the helpline for more information.