10 Income And Expenditure Statement Essentials: A Complete Guide To Financial Success

Understanding the Income and Expenditure Statement: A Key to Financial Management

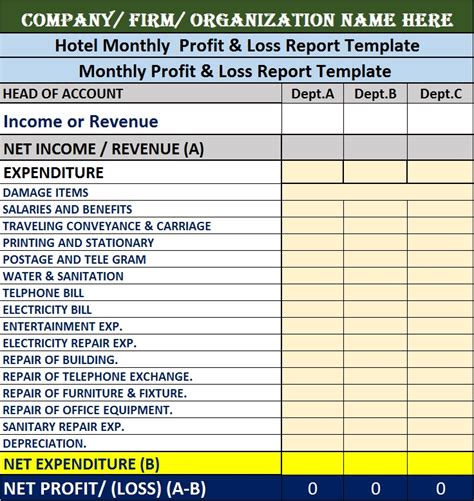

The income and expenditure statement, often referred to as the profit and loss statement or income statement, is a crucial financial tool for businesses and individuals alike. It provides a comprehensive overview of an entity’s financial performance over a specific period, typically a month, quarter, or year. By analyzing income, expenses, and the resulting net profit or loss, this statement offers valuable insights into the health and sustainability of a business or personal finances. In this guide, we will delve into the ten essential components of an income and expenditure statement, exploring their significance and how they contribute to financial success.

1. Statement Period and Frequency

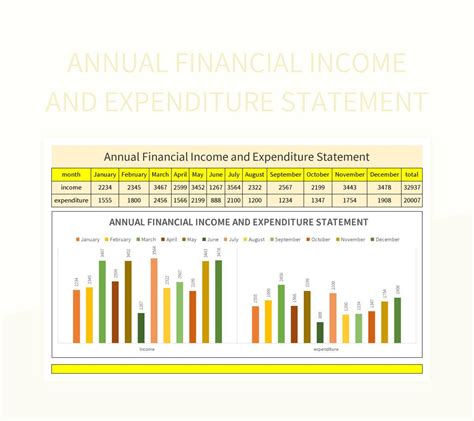

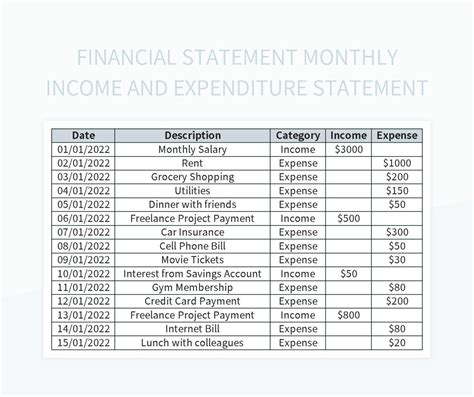

An income and expenditure statement covers a specific period, such as a month, quarter, or year. The choice of period depends on the nature of the business and the frequency of financial reporting requirements. For instance, monthly statements are common for small businesses with fluctuating revenue streams, while quarterly or annual statements are standard for larger corporations.

2. Revenue or Income

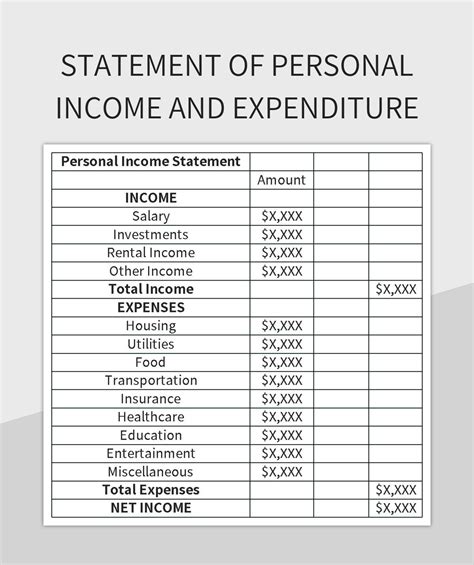

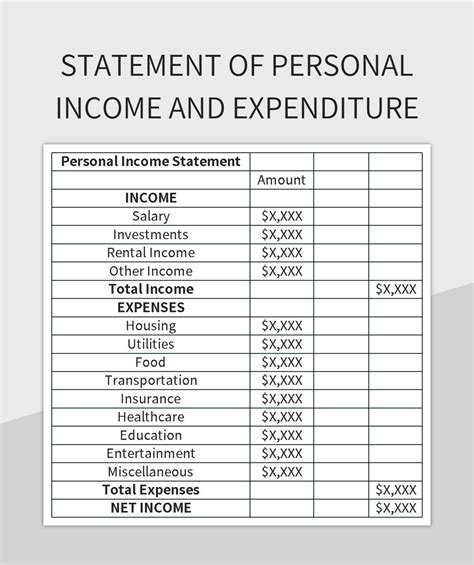

Revenue, or income, is the lifeblood of any business. It represents the total amount earned from the sale of goods or services during the statement period. This section includes all income sources, such as sales revenue, interest income, rental income, and any other income generated by the business. Accurate recording of revenue is vital for assessing the business’s financial health and identifying trends.

3. Cost of Goods Sold (COGS)

For businesses involved in the production or sale of goods, the cost of goods sold (COGS) is a critical expense category. COGS includes the direct costs associated with producing or acquiring the goods sold during the statement period. These costs typically comprise raw materials, direct labor, and overhead expenses directly attributable to production. Understanding COGS helps businesses determine their gross profit margin and assess the efficiency of their production processes.

4. Operating Expenses

Operating expenses encompass all costs incurred to run the business, excluding COGS. These expenses are vital for maintaining day-to-day operations and can include rent, utilities, salaries, marketing, insurance, and administrative costs. Effective management of operating expenses is crucial for maximizing profitability and ensuring the long-term viability of the business.

5. Depreciation and Amortization

Depreciation and amortization are non-cash expenses that account for the gradual reduction in the value of tangible and intangible assets over time. Depreciation applies to tangible assets like buildings, equipment, and vehicles, while amortization relates to intangible assets such as patents, trademarks, and goodwill. Including these expenses in the income statement provides a more accurate representation of the business’s financial performance by considering the cost of asset usage.

6. Interest Expense

Interest expense represents the cost of borrowing money, whether through loans, mortgages, or other forms of debt financing. It is a significant expense for businesses with substantial debt obligations and can impact their profitability. Tracking interest expense is essential for understanding the financial burden of debt and making informed decisions about borrowing strategies.

7. Taxes

Taxes are an unavoidable expense for businesses and individuals alike. The income and expenditure statement includes various tax expenses, such as income tax, sales tax, and payroll tax. Accurate tax reporting is crucial to comply with legal requirements and avoid penalties. Businesses must also consider the impact of tax incentives and deductions to optimize their financial position.

8. Net Profit or Loss

The net profit or loss is the most critical metric on the income and expenditure statement. It represents the difference between total revenue and total expenses, including COGS, operating expenses, depreciation, amortization, interest expense, and taxes. A positive net profit indicates financial success, while a negative net loss suggests the need for financial adjustments and strategic changes.

9. Comparative Analysis

Comparative analysis involves comparing the current income and expenditure statement with previous periods or industry benchmarks. This analysis helps identify trends, assess the effectiveness of business strategies, and make informed decisions about future financial planning. It provides valuable insights into areas where the business excels or requires improvement.

10. Cash Flow Management

While the income and expenditure statement provides a snapshot of financial performance, it is essential to consider cash flow management. Cash flow refers to the actual movement of money in and out of the business, and it can differ from the reported profits on the income statement. Effective cash flow management ensures that the business has sufficient liquidity to meet its financial obligations and invest in growth opportunities.

Conclusion:

The income and expenditure statement is a powerful tool for businesses and individuals to assess their financial health and make informed decisions. By understanding the essential components discussed in this guide, individuals and business owners can gain valuable insights into their financial performance, identify areas for improvement, and ultimately achieve financial success. Remember, a well-prepared income and expenditure statement is a cornerstone of effective financial management.

FAQ:

What is the difference between revenue and income in an income statement?

+

Revenue, or sales revenue, specifically refers to the income generated from the sale of goods or services. Income, on the other hand, is a broader term that includes revenue as well as other sources of earnings, such as interest income, rental income, and dividends.

How often should I prepare an income and expenditure statement for my business?

+

The frequency of preparing an income and expenditure statement depends on your business needs and legal requirements. Many businesses prepare monthly statements to track performance and make timely adjustments. However, quarterly or annual statements are also common, especially for tax and regulatory purposes.

Can I use an income and expenditure statement for personal finance management?

+

Absolutely! An income and expenditure statement is not limited to businesses; it can be a valuable tool for individuals to manage their personal finances. By tracking income, expenses, and net worth, individuals can make informed decisions about budgeting, saving, and investing.

What are some common challenges in preparing an accurate income and expenditure statement?

+

Common challenges include accurate tracking of income and expenses, especially for small businesses with multiple revenue streams. Additionally, understanding and allocating costs correctly, especially for indirect expenses like overhead, can be complex. Seeking professional advice or using accounting software can help overcome these challenges.