10+ Ways To Get Proof Of Address From Hmrc: The Essential Guide

Introduction

Proof of address is an essential document required for various official purposes, and in the United Kingdom, the Her Majesty’s Revenue and Customs (HMRC) is a primary source for obtaining this verification. Whether you’re applying for a new job, opening a bank account, or dealing with legal matters, having a valid proof of address is crucial. In this guide, we will explore over ten ways to obtain proof of address from HMRC, ensuring you have the necessary documentation to navigate these situations smoothly.

Understanding the Importance of Proof of Address

Proof of address serves as official documentation that verifies your residential address. It is often required by government agencies, financial institutions, and other organizations to confirm your identity and prevent fraud. Without a valid proof of address, you may face challenges when accessing essential services and conducting important transactions.

Methods to Obtain Proof of Address from HMRC

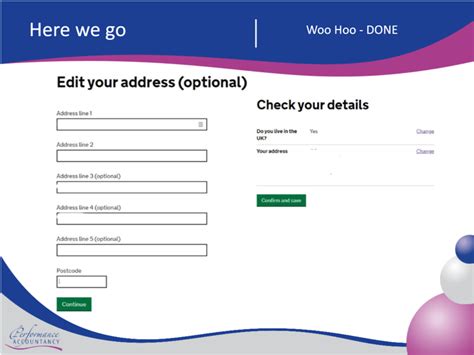

1. HMRC Online Account

The HMRC Online Account is a convenient way to access and manage your tax affairs digitally. By creating an online account, you can view and download your Personal Tax Account Statement, which includes your address details. This statement can serve as proof of address for various purposes.

2. HMRC Tax Code Notice

Your Tax Code Notice, sent by HMRC, contains important information about your tax affairs, including your address. This notice can be used as proof of address, especially when dealing with tax-related matters or verifying your identity with government agencies.

3. HMRC P60 Form

The P60 form is a certificate of tax credits and deductions provided by your employer at the end of the tax year. It includes your personal details, such as name, National Insurance number, and address. The P60 can be presented as proof of address when required.

4. HMRC PAYE Coding Notice

If you are an employee, you may receive a PAYE Coding Notice from HMRC. This notice includes your tax code and personal details, including your address. It can be used as proof of address when applying for certain services or when dealing with financial institutions.

5. HMRC Self-Assessment Tax Return

If you are self-employed or have additional income sources, you may need to complete a Self-Assessment Tax Return. The tax return document, which includes your address, can serve as proof of address for various purposes.

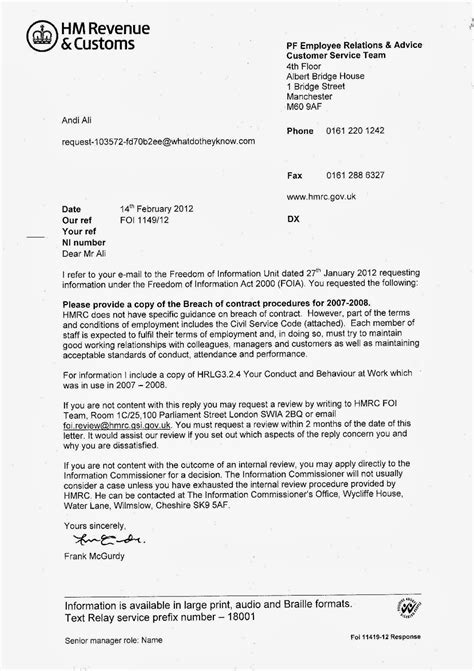

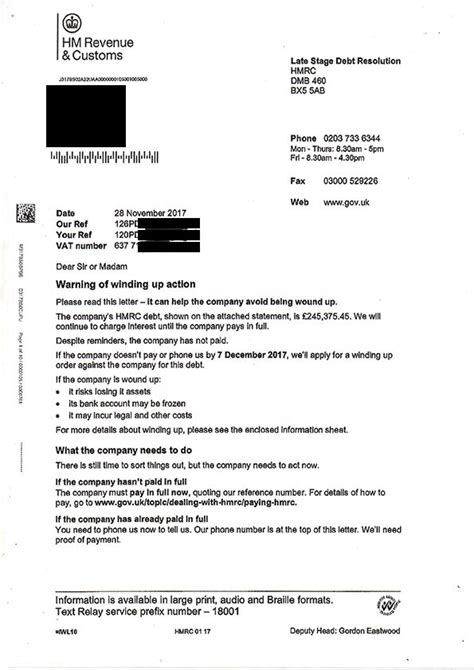

6. HMRC Correspondence

Any official correspondence you receive from HMRC, such as letters, notices, or statements, can be used as proof of address. These documents often include your name and address, making them valid for verification purposes.

7. HMRC Helpline

You can contact the HMRC helpline and request a letter confirming your address. This letter will be sent to your registered address and can be used as proof of address for various official requirements.

8. HMRC Office Visit

If you prefer a more traditional approach, you can visit your local HMRC office and request a letter confirming your address. This option may take longer but provides a physical copy of your proof of address.

9. HMRC Online Services

HMRC offers various online services that can provide proof of address. For example, you can use the “View your tax code” service to access and download a document containing your address details.

10. HMRC Email or Text Message

In some cases, HMRC may send you an email or text message containing your address details. These electronic communications can be used as proof of address, especially when dealing with online services or applications.

11. HMRC Tax Credits Helpline

If you receive tax credits, you can contact the HMRC Tax Credits Helpline and request a letter confirming your address. This letter will be sent to your registered address and can be used as proof of address.

Notes

- It’s important to note that the acceptance of these proof of address documents may vary depending on the organization or institution you are dealing with. Always check their specific requirements before submitting any documentation.

- Ensure that the information on your proof of address documents is up-to-date and accurate. Inaccurate or outdated details may lead to complications and delays.

- Keep multiple copies of your proof of address documents, both in physical and digital formats, for easy access when needed.

- If you have recently moved, it’s crucial to update your address with HMRC to ensure that your proof of address documents reflect your current residence.

Conclusion

Obtaining proof of address from HMRC is a straightforward process, and by utilizing the methods outlined above, you can easily acquire the necessary documentation. Remember to keep your personal information updated with HMRC to avoid any issues with your proof of address. With a valid proof of address, you can confidently navigate various official procedures and transactions, ensuring a smooth and hassle-free experience.

FAQ

Can I use my HMRC correspondence as proof of address for a bank account opening?

+Yes, you can use your HMRC correspondence, such as letters or notices, as proof of address when opening a bank account. However, it’s always advisable to check with your specific bank for their acceptance criteria.

How long is the proof of address valid for?

+The validity period for proof of address can vary depending on the organization or institution. Some may accept documents within the last three months, while others may have different requirements. It’s best to confirm the validity period with the specific organization.

Can I use my HMRC Tax Code Notice as proof of address for a job application?

+Yes, your HMRC Tax Code Notice can be used as proof of address for job applications. However, it’s recommended to check with the employer’s specific requirements to ensure it meets their criteria.

What if I don’t have any of the mentioned HMRC documents?

+If you don’t have any of the mentioned HMRC documents, you can contact HMRC and request a letter confirming your address. Alternatively, you can explore other proof of address options, such as utility bills or bank statements.

Can I use my HMRC online account as proof of address for a rental application?

+Yes, your HMRC online account can be used as proof of address for rental applications. However, it’s essential to check with the landlord or letting agent to confirm their acceptance of this document.