12 Tips For Local Government Finance: A Comprehensive Guide To Budgeting

Introduction to Local Government Finance

Managing local government finances is a critical task that requires careful planning, efficient resource allocation, and effective budgeting strategies. With limited resources and the need to provide essential services to citizens, local governments must adopt a proactive approach to financial management. This comprehensive guide will provide you with 12 essential tips to enhance your local government’s financial management and budgeting processes.

Tip 1: Establish Clear Financial Goals

Define your local government’s financial objectives clearly. Identify the key areas you want to focus on, such as infrastructure development, social services, or economic growth. Setting specific and measurable goals will help guide your budgeting decisions and ensure that your financial resources are allocated efficiently.

Tip 2: Conduct a Comprehensive Financial Analysis

Perform a thorough analysis of your local government’s financial health. Review your revenue streams, including taxes, fees, and grants, and assess their stability and growth potential. Analyze your expenses, identifying areas where costs can be optimized without compromising service delivery. This analysis will provide valuable insights for informed budgeting decisions.

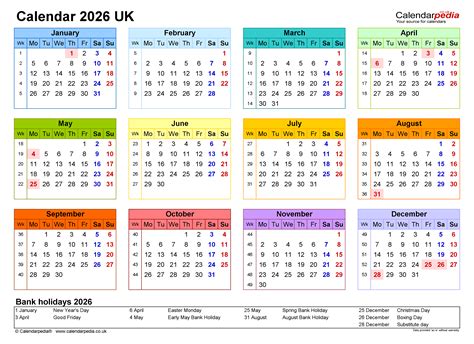

Tip 3: Develop a Realistic Budget Timeline

Create a well-structured budget timeline that aligns with your financial goals. Determine the key milestones and deadlines for budget preparation, approval, and implementation. A clear timeline will ensure that your budgeting process is efficient and that all stakeholders are involved at the right stages. It also helps to avoid last-minute surprises and ensures a more accurate budget.

Tip 4: Engage Stakeholders and Community Input

Involve your community and key stakeholders in the budgeting process. Seek their input and feedback on budget priorities and potential initiatives. Conduct public consultations, town hall meetings, or online surveys to gather valuable insights. Engaging stakeholders fosters transparency, builds trust, and ensures that the budget reflects the needs and aspirations of your community.

Tip 5: Prioritize Essential Services

Identify and prioritize the essential services that your local government must provide to its citizens. These services may include public safety, healthcare, education, and basic infrastructure maintenance. Ensure that sufficient funding is allocated to these critical areas to maintain the quality and accessibility of these services.

Tip 6: Optimize Revenue Streams

Maximize your local government’s revenue potential by exploring innovative ways to generate income. Evaluate the feasibility of introducing new taxes, fees, or user charges for specific services. Consider partnerships with private entities or grants from external organizations to diversify your revenue sources. Optimizing revenue streams will provide a more stable financial foundation.

Tip 7: Implement Cost-Saving Measures

Identify cost-saving opportunities within your local government’s operations. Review your procurement processes to ensure competitive pricing and efficient contract management. Explore shared services or outsourcing options to reduce administrative costs. Implementing cost-saving measures will free up resources for other priority areas.

Tip 8: Embrace Technology for Financial Management

Leverage technology to streamline your local government’s financial management processes. Implement robust accounting software and financial management systems to enhance accuracy and efficiency. Utilize data analytics tools to identify trends, detect anomalies, and make data-driven decisions. Technology can significantly improve the transparency and effectiveness of your financial operations.

Tip 9: Foster a Culture of Financial Accountability

Promote a culture of financial accountability within your local government. Establish clear policies and guidelines for financial management, ensuring that all departments and employees understand their roles and responsibilities. Regularly monitor financial performance, conduct internal audits, and encourage open communication about financial matters. A culture of accountability will help prevent financial mismanagement and promote responsible spending.

Tip 10: Build Financial Resilience

Develop strategies to build financial resilience and mitigate risks. Create a robust reserve fund to address unforeseen emergencies or economic downturns. Implement effective debt management practices to maintain a healthy debt-to-revenue ratio. Building financial resilience will ensure that your local government can weather financial challenges and maintain stability.

Tip 11: Monitor and Evaluate Budget Performance

Establish a robust system for monitoring and evaluating your budget’s performance. Regularly track actual revenue and expenditure against your budgeted figures. Identify variances and take corrective actions as needed. Evaluating budget performance allows you to make informed adjustments and ensures that your financial resources are utilized efficiently.

Tip 12: Continuous Learning and Improvement

Encourage a culture of continuous learning and improvement within your local government’s financial management team. Stay updated with best practices and emerging trends in public finance. Attend workshops, conferences, and training sessions to enhance your skills and knowledge. Continuous learning will enable your team to adapt to changing financial landscapes and implement innovative solutions.

Conclusion

By implementing these 12 tips, your local government can enhance its financial management and budgeting processes, leading to improved service delivery and better outcomes for your community. Remember, effective financial management is a continuous journey that requires dedication, collaboration, and a commitment to transparency and accountability. Stay proactive, adapt to changing circumstances, and embrace innovation to ensure the long-term financial health and sustainability of your local government.

🌟 Note: These tips provide a comprehensive framework for local government finance, but it's essential to adapt them to your specific context and regulations. Stay informed, seek expert advice when needed, and continuously strive for financial excellence.

FAQ

How often should local governments review their financial goals and objectives?

+

Local governments should review their financial goals and objectives annually or whenever there are significant changes in the economic landscape or community needs. Regular reviews ensure that budgets remain aligned with evolving priorities.

What are some common challenges in local government finance, and how can they be addressed?

+

Common challenges include limited revenue sources, aging infrastructure, and rising costs. Addressing these challenges requires a strategic approach, such as diversifying revenue streams, implementing cost-saving measures, and exploring public-private partnerships.

How can local governments involve the community in the budgeting process effectively?

+

Local governments can involve the community through public meetings, online platforms, and community engagement events. Providing clear and accessible information about the budget process and its impact on services encourages meaningful participation and fosters trust.

What role does technology play in modern local government finance?

+

Technology plays a crucial role in enhancing efficiency, transparency, and data-driven decision-making. Implementing robust financial management systems, utilizing data analytics, and embracing digital payment methods can revolutionize local government finance.

How can local governments build financial resilience in an uncertain economic environment?

+

Building financial resilience involves diversifying revenue sources, maintaining healthy reserves, and implementing prudent debt management practices. Regular stress testing and scenario planning can help local governments prepare for economic downturns and unforeseen events.