15+ Uk Tax Rates: Essential Guide To Understanding Your Tax Liability

Navigating the UK Tax System: A Comprehensive Guide to Tax Rates

Understanding the UK tax system is crucial for individuals and businesses alike. With a range of tax rates and liabilities, it can be overwhelming to navigate. This guide aims to simplify the process by providing an in-depth look at the various tax rates in the UK, ensuring you have a clear understanding of your tax obligations.

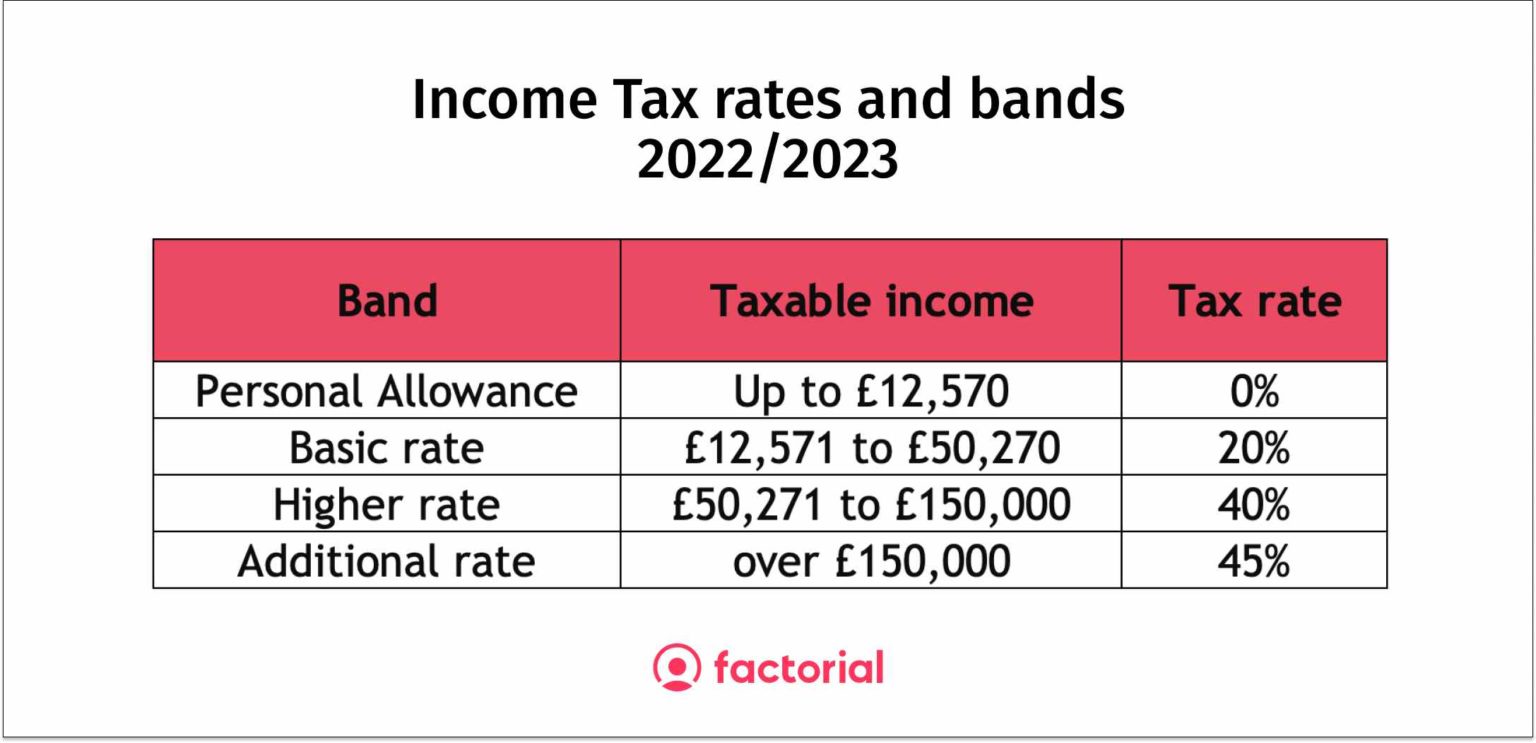

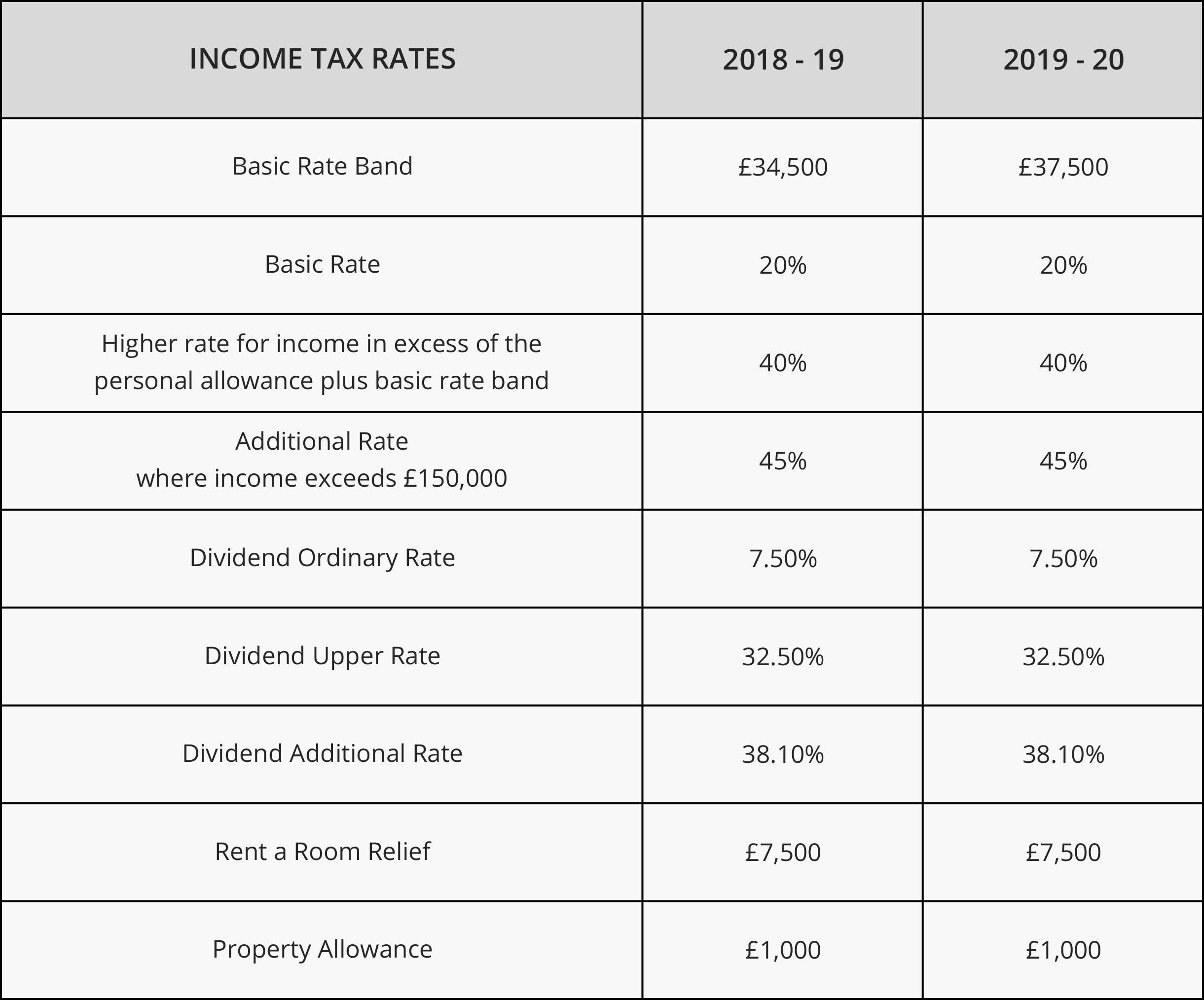

Income Tax Rates

Income tax is one of the primary sources of revenue for the UK government, and it is applied to various forms of income, including wages, salaries, pensions, and investment income. The income tax rates are progressive, meaning the tax rate increases as your income rises.

Here is an overview of the current income tax rates for the 2023-2024 tax year:

- Basic Rate (20%): Applicable to income between £12,571 and £50,270. This rate applies to most individuals and is the starting point for income tax calculations.

- Higher Rate (40%): Individuals earning between £50,271 and £150,000 fall into this tax bracket. The higher rate is for those with higher income levels.

- Additional Rate (45%): The highest income tax rate is reserved for those earning over £150,000. This rate ensures a fair contribution from the highest earners.

It’s important to note that these rates are subject to change annually, so it’s advisable to stay updated with the latest tax information.

National Insurance Contributions

National Insurance Contributions (NICs) are another crucial aspect of the UK tax system. These contributions fund various welfare benefits, including the state pension, unemployment benefits, and healthcare. NICs are paid by employees, employers, and the self-employed.

The NICs rates for the 2023-2024 tax year are as follows:

Employee’s NICs:

- Class 1: Applicable to earnings over £9,880, with a rate of 12% for earnings up to £50,270 and 2% for earnings over £50,270.

- Class 2: A flat weekly rate for self-employed individuals with small profits.

- Class 3: Voluntary contributions for those who want to fill gaps in their NIC record.

Employer’s NICs: Employers pay NICs based on their employees’ earnings. The rates vary depending on the employee’s income and whether they are under the Upper Earnings Limit (UEL) or the Primary Threshold.

Capital Gains Tax

Capital Gains Tax (CGT) is applied when you sell or dispose of assets, such as property, shares, or investments, and make a profit. The tax is calculated on the gain made, not the total sale price. The CGT rates are as follows:

- Basic Rate (10%): Applicable to individuals with a taxable income below the higher-rate threshold.

- Higher Rate (20%): Individuals with a taxable income above the higher-rate threshold fall into this bracket.

It’s worth noting that certain assets, like your primary residence, may be exempt from CGT.

Value Added Tax (VAT)

VAT is a consumption tax added to the sale of most goods and services in the UK. It is typically charged at a rate of 20%, but there are also reduced rates for specific items like children’s car seats and zero-rated items like most food products.

Corporation Tax

Corporation tax is levied on the profits of limited companies and other organizations. The current rate for the 2023-2024 tax year is 19%. This rate is applicable to both small and large companies.

Inheritance Tax

Inheritance tax is applied when you pass on your estate, including property, money, and possessions, to your beneficiaries after your death. The current threshold for inheritance tax is £325,000. Any assets above this threshold may be subject to a 40% tax rate.

Council Tax

Council tax is a local tax paid by homeowners and tenants to fund local services. The amount you pay depends on the value of your property and the council’s tax bands. There are eight bands (A to H), with band D serving as the reference point.

Stamp Duty Land Tax (SDLT)

SDLT is a tax on the purchase of land and property in the UK. The rate varies depending on the price of the property and whether it is a residential or non-residential property. There are also additional rates for second homes and buy-to-let properties.

Other Taxes

The UK tax system encompasses various other taxes, including:

- Excise duties on items like alcohol, tobacco, and fuel.

- Insurance Premium Tax on general insurance premiums.

- Air Passenger Duty on flights departing from the UK.

- Climate Change Levy on energy used by businesses.

Tax Credits and Benefits

The UK government offers various tax credits and benefits to support individuals and families. These include:

- Child Tax Credit: A benefit for families with children, providing financial support.

- Working Tax Credit: Designed to support low-income workers.

- Childcare Tax Credit: Helps with the cost of registered childcare.

- Marriage Allowance: Allows eligible couples to transfer £1,260 of their Personal Allowance to their partner, reducing their tax bill.

Tax Planning and Strategies

Understanding the tax system is crucial for effective tax planning. Here are some strategies to consider:

- Maximize your tax-free personal allowance by ensuring you are aware of all available allowances and reliefs.

- Utilize tax-efficient savings accounts, such as ISAs (Individual Savings Accounts) and pensions, to reduce your taxable income.

- If you are self-employed, keep accurate records and claim all allowable expenses to reduce your tax liability.

- Consider investing in tax-efficient assets, like EIS (Enterprise Investment Scheme) or VCT (Venture Capital Trust) shares, to benefit from tax reliefs.

Seeking Professional Advice

The UK tax system can be complex, and it’s always advisable to seek professional advice from a qualified accountant or tax advisor. They can provide personalized guidance based on your unique circumstances and ensure you are compliant with all tax regulations.

Conclusion

Navigating the UK tax system requires a thorough understanding of the various tax rates and liabilities. From income tax to national insurance, capital gains tax, and more, this guide has provided an overview of the essential tax rates. By staying informed and seeking professional advice when needed, you can ensure you meet your tax obligations effectively. Remember, staying up-to-date with tax changes is crucial for accurate financial planning.

💰 Note: Tax rates and regulations are subject to change. Always consult official sources or seek professional advice for the most accurate and up-to-date information.

FAQ

What is the personal allowance for the 2023-2024 tax year?

+The personal allowance for the 2023-2024 tax year is £12,570. This is the amount of income you can earn before income tax is applied.

Are there any tax-free allowances for capital gains?

+Yes, there is an annual exempt amount for capital gains tax. For the 2023-2024 tax year, it is £13,100. Any gains above this amount are subject to CGT.

What is the current rate for inheritance tax?

+The current rate for inheritance tax is 40%. However, there are various exemptions and reliefs that can reduce the amount of tax payable.

Are there any tax breaks for homeowners?

+Yes, homeowners can benefit from various tax breaks, including the main residence nil-rate band for inheritance tax and the relief on gains from selling your main residence.

How can I reduce my tax liability as a business owner?

+Business owners can explore tax-efficient strategies like incorporating their business, utilizing tax-efficient savings plans, and claiming allowable expenses to reduce their tax liability.