16 Tips To Sorn A Taxed Vehicle: Essential Guide

An Easy Guide to SORN Your Taxed Vehicle

SORNing a taxed vehicle is a straightforward process that allows you to take your car off the road temporarily while keeping it legally registered. This guide will walk you through the steps, providing a comprehensive overview of the SORN process, its benefits, and the key considerations to ensure a smooth experience.

What is SORN?

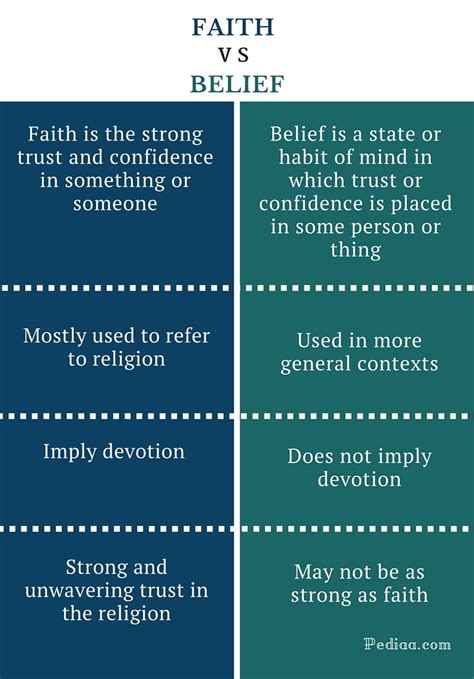

SORN, which stands for Statutory Off-Road Notification, is a legal requirement in the UK that allows vehicle owners to declare their car as off-road and no longer in use. This notification informs the DVLA (Driver and Vehicle Licensing Agency) that the vehicle is not being driven on public roads and is, therefore, exempt from road tax.

Why SORN Your Vehicle?

SORNing your vehicle offers several advantages:

- Cost Savings: By SORNing your vehicle, you can avoid paying road tax, which can be a significant financial benefit, especially if your car is not in regular use.

- Avoid Penalties: Keeping an untaxed vehicle on a public road without a valid SORN is illegal and can result in fines and penalties. SORNing ensures you remain compliant with the law.

- Protection from Theft: Declaring your vehicle off-road reduces the risk of theft or unauthorized use, as it is not considered an active target for potential thieves.

- Maintenance and Repairs: SORNing provides an opportunity to focus on maintenance and repairs without the pressure of keeping the vehicle roadworthy for daily use.

When to SORN Your Vehicle

Consider SORNing your vehicle in the following scenarios:

- Seasonal Use: If you have a classic car or a vehicle used only during specific seasons, such as a winter-only or summer-only vehicle, SORNing during the off-season can be beneficial.

- Long-Term Storage: If you plan to store your vehicle for an extended period, such as during a long-term trip or while waiting for a potential buyer, SORNing ensures it remains legally registered.

- Vehicle Repairs: During extensive repairs or modifications, SORNing your vehicle allows you to work on it without the need for road tax.

- Change of Circumstances: If your vehicle is no longer in regular use due to a change in your lifestyle, such as a new job or reduced mobility, SORNing can be a practical solution.

Step-by-Step Guide to SORN Your Taxed Vehicle

Follow these simple steps to SORN your taxed vehicle:

- Check Eligibility: Ensure your vehicle meets the SORN requirements. Most vehicles, including cars, motorcycles, and goods vehicles, are eligible for SORN.

- Gather Information: You will need your vehicle registration number, make, and model. If you have a V5C registration certificate (log book), you’ll also need the 11-digit reference number.

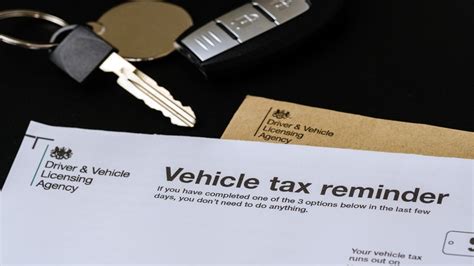

- Online SORN: The easiest and quickest way to SORN your vehicle is through the DVLA’s online SORN service. Simply enter your details and follow the instructions.

- Phone SORN: If you prefer, you can SORN your vehicle by calling the DVLA on 0300 123 4321. Have your vehicle details ready when you call.

- Post SORN: You can also complete a SORN declaration form (V890) and send it to the DVLA by post. This method is less convenient and may take longer to process.

- Keep Evidence: Once your SORN is confirmed, keep a record of the confirmation as proof that your vehicle is off-road.

Important Considerations

- Vehicle Storage: When SORNing your vehicle, ensure it is stored in a safe and secure location, such as a private driveway or a locked garage. Avoid leaving it on public roads or in unauthorized areas.

- Insurance: Remember that SORNing your vehicle does not exempt you from having valid insurance. You must maintain comprehensive or third-party insurance coverage for your vehicle, even when it is off-road.

- Vehicle Condition: Regularly inspect your SORNed vehicle to ensure it remains in good condition. Check for any signs of damage, rust, or deterioration, and address any issues promptly.

- Re-taxing: When you decide to put your vehicle back on the road, you’ll need to re-tax it. The DVLA will send you a reminder, but it’s essential to ensure your vehicle is roadworthy and has a valid MOT (if required) before re-taxing.

Benefits of SORN

SORNing your vehicle offers several advantages:

- Cost Savings: By SORNing, you can avoid unnecessary road tax expenses when your vehicle is not in use.

- Legal Compliance: It ensures you remain within the law and avoids penalties for keeping an untaxed vehicle on public roads.

- Flexibility: SORNing provides the flexibility to take your vehicle off the road temporarily without the hassle of selling or disposing of it.

- Maintenance Focus: With your vehicle SORNed, you can concentrate on maintenance and upgrades without the pressure of roadworthiness requirements.

Table: SORN vs. Selling or Disposing of Your Vehicle

| Criteria | SORN | Sell or Dispose |

|---|---|---|

| Flexibility | Retains ownership and flexibility to reactivate | Permanent transfer of ownership |

| Cost | Avoids road tax, but insurance is still required | No ongoing costs, but may incur disposal fees |

| Legal Requirements | Must declare vehicle off-road and maintain insurance | Must comply with disposal regulations and transfer ownership |

| Vehicle Condition | Can focus on maintenance and repairs | May need to sell as-is or at a lower price due to condition |

SORNing and MOT

It’s important to note that SORNing your vehicle does not affect its MOT (Ministry of Transport) status. If your vehicle requires an MOT test, you must ensure it passes the test before putting it back on the road. The MOT test assesses the safety and roadworthiness of your vehicle, regardless of whether it is taxed or SORNed.

Reactivating Your Vehicle

When you’re ready to put your SORNed vehicle back on the road, follow these steps:

- Check Vehicle Condition: Ensure your vehicle is in good working order and meets all safety requirements.

- MOT Test (if required): If your vehicle’s MOT certificate has expired, you must get an MOT test before re-taxing.

- Re-tax Your Vehicle: Use the DVLA’s online service or visit a Post Office that offers vehicle tax services to re-tax your vehicle.

- Update Insurance: Contact your insurance provider to update your policy and ensure your vehicle is covered for road use.

Common Questions and Concerns

- Can I drive my SORNed vehicle? No, SORNed vehicles are not allowed on public roads. Driving a SORNed vehicle is illegal and can result in penalties.

- Do I need to inform the DVLA if I sell my SORNed vehicle? Yes, if you sell your SORNed vehicle, you must inform the DVLA and cancel the SORN. The new owner will need to register the vehicle and pay road tax.

- Can I SORN a leased vehicle? Yes, you can SORN a leased vehicle as long as you have the permission of the leasing company. Check your lease agreement for any specific requirements.

- What happens if I forget to SORN my vehicle? If you forget to SORN your vehicle and it remains untaxed on public roads, you may receive a fine. It’s essential to keep track of your vehicle’s tax status and SORN it promptly when needed.

Conclusion

SORNing your taxed vehicle is a straightforward process that offers flexibility and cost savings. By following the steps outlined in this guide, you can easily declare your vehicle off-road and maintain legal compliance. Remember to keep your vehicle in good condition, maintain insurance coverage, and re-tax it when ready to put it back on the road. With SORN, you can enjoy the benefits of vehicle ownership without the ongoing expenses and legal obligations of road tax.

💡 Note: Always refer to the official DVLA website for the most up-to-date information and guidelines on SORNing your vehicle.

FAQ

Can I SORN my vehicle if it has an outstanding MOT failure?

+Yes, you can SORN your vehicle even if it has an outstanding MOT failure. SORNing your vehicle will not affect its MOT status, and you can still work on addressing the issues that led to the failure.

How long can I keep my vehicle SORNed?

+There is no time limit for keeping your vehicle SORNed. You can keep it off the road for as long as you need, as long as you maintain insurance coverage and ensure its condition remains satisfactory.

Do I need to inform the DVLA if I move house while my vehicle is SORNed?

+Yes, it’s important to update your address with the DVLA, even if your vehicle is SORNed. You can do this online or by post using the appropriate forms.