4 Steps To Reach Hmrc Tax Experts Now

Navigating tax-related matters can be a daunting task, but reaching the right experts at HMRC (Her Majesty's Revenue and Customs) can provide the guidance and support you need. Whether you have questions about tax returns, self-assessment, or any other tax-related queries, this guide will walk you through the process of connecting with HMRC's tax experts efficiently.

Step 1: Understand Your Tax Query

Before reaching out to HMRC, it's essential to have a clear understanding of your tax-related issue. Take some time to gather all the relevant information and documents related to your query. This will not only help you explain your situation accurately but also assist the tax experts in providing the most suitable advice.

- Identify the specific tax issue you're facing, such as tax calculations, eligibility for tax credits, or business tax obligations.

- Collect any necessary documentation, including tax returns, payroll records, or correspondence related to your tax matter.

- Note down the key points and questions you want to discuss with the HMRC experts.

Step 2: Choose the Right Contact Method

HMRC offers various channels to connect with their tax experts, allowing you to choose the most convenient and suitable option. Consider the following contact methods:

Online Services

- HMRC Website: Visit the official HMRC website (https://www.gov.uk/government/organisations/hm-revenue-customs) and navigate to the "Contact Us" section. Here, you'll find a range of online services and tools to assist with your tax queries.

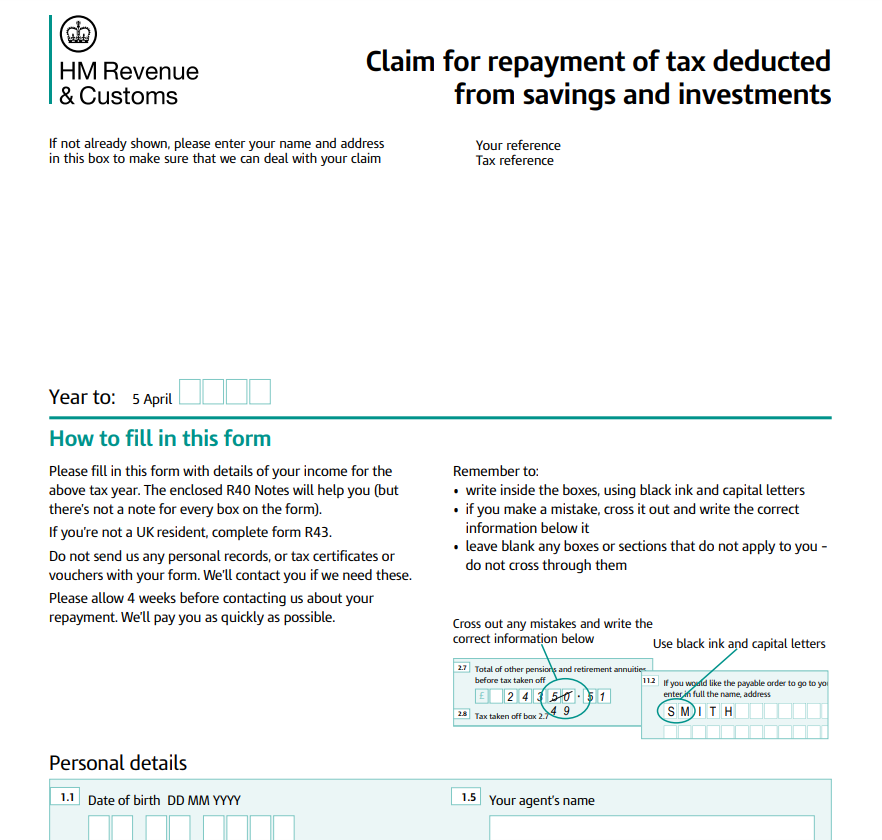

- Online Forms: HMRC provides dedicated online forms for different tax-related issues. These forms allow you to provide detailed information about your query and receive a response via email or post.

- Web Chat: If you prefer real-time assistance, HMRC offers a web chat feature. You can initiate a chat with an HMRC representative, who will guide you through your tax-related concerns.

Telephone Support

HMRC operates a dedicated telephone helpline to assist taxpayers. You can call the relevant HMRC department based on your query. Here are the contact numbers for some common tax-related matters:

| Department | Contact Number |

|---|---|

| Self-Assessment | 0300 200 3300 |

| Income Tax | 0300 200 3300 |

| National Insurance | 0300 200 3500 |

| VAT (Value Added Tax) | 0300 200 3700 |

| Capital Gains Tax | 0300 200 3555 |

Face-to-Face Appointments

In certain cases, you may prefer to schedule a face-to-face appointment with an HMRC tax expert. This option is particularly useful for complex tax matters or when you require personalized guidance. To book an appointment, follow these steps:

- Visit the HMRC website and navigate to the "Contact Us" section.

- Select the "Book an appointment" option.

- Choose the relevant tax department and provide the necessary details.

- Select a convenient date and time for your appointment.

- Attend the appointment at your chosen HMRC office.

Step 3: Prepare for Your Interaction

To make the most of your interaction with HMRC's tax experts, it's essential to be well-prepared. Here are some tips to ensure a smooth and productive conversation:

- Have your National Insurance number, Unique Taxpayer Reference (UTR), or other relevant identification details ready.

- Gather all the necessary documents and information related to your tax query.

- Make a list of specific questions or concerns you want to address during the interaction.

- If using online services, ensure you have a stable internet connection and are familiar with the HMRC website's navigation.

- Be prepared to provide additional information or clarify any details requested by the tax expert.

Step 4: Engage with HMRC Tax Experts

Now that you've chosen your preferred contact method and prepared for the interaction, it's time to engage with HMRC's tax experts. Whether you're using online services, calling the helpline, or attending a face-to-face appointment, follow these guidelines:

Online Services and Web Chat

- Log in to your HMRC online account or create one if you don't have one.

- Access the relevant online service or initiate a web chat session.

- Provide accurate and detailed information about your tax query.

- Wait for a response from the tax expert. They will guide you through the necessary steps or provide the required assistance.

Telephone Support

- Call the appropriate HMRC department based on your tax query.

- Have your relevant identification details and tax information ready.

- Be patient and follow the automated instructions to connect with a tax expert.

- Clearly explain your tax-related issue and provide any necessary details.

- Listen carefully to the expert's advice and take notes if needed.

Face-to-Face Appointments

- Arrive at the HMRC office on time for your scheduled appointment.

- Bring all the necessary documents and identification.

- Introduce yourself to the tax expert and provide a brief overview of your tax query.

- Engage in a constructive conversation, asking questions and seeking clarification as needed.

- Take notes during the appointment to refer to later.

Additional Tips and Considerations

- Keep a record of your interactions with HMRC, including dates, times, and the advice received.

- If you're unsure about the best contact method, start with the HMRC website's online services, as they often provide helpful guidance and resources.

- Be patient and respectful during your interactions with HMRC tax experts. They are there to assist you, but high call volumes or online service delays may occur during peak periods.

- If you have a complex tax issue, consider seeking professional tax advice from a qualified accountant or tax advisor.

Conclusion

Reaching HMRC's tax experts is a straightforward process, thanks to the various contact methods they offer. By understanding your tax query, choosing the right contact method, preparing adequately, and engaging constructively, you can obtain the guidance and support you need to navigate your tax-related matters efficiently. Remember, staying informed and organized will make your interactions with HMRC smoother and more productive.

How long does it take to receive a response from HMRC’s online services or web chat?

+

Response times may vary depending on the volume of queries and the complexity of your tax issue. Generally, you can expect a response within a few hours to a couple of days. However, during peak periods, response times may be longer.

Can I track the status of my HMRC online query or appointment?

+

Yes, HMRC provides tracking options for online queries and appointments. You can log in to your HMRC online account to check the status of your query or appointment. Additionally, you may receive updates via email or text messages.

What if I’m not satisfied with the response from HMRC’s tax experts?

+

If you have concerns or are not satisfied with the response, you can escalate the matter to HMRC’s complaints department. Visit the HMRC website for information on how to submit a complaint and the steps involved.

Are there any alternative ways to seek tax advice besides HMRC’s experts?

+

Yes, you can consider seeking advice from qualified accountants, tax advisors, or legal professionals who specialize in tax matters. They can provide personalized guidance based on your specific circumstances.