5 Steps To Create The Ultimate Tax Refund Online

Introduction to Maximizing Your Tax Refund

Filing your taxes can be a daunting task, but with the right approach, you can turn it into an opportunity to boost your finances. In this comprehensive guide, we’ll walk you through the process of creating the ultimate tax refund online, maximizing your savings and ensuring a smooth experience. By following these steps, you’ll be well on your way to a successful tax season and a substantial refund.

Step 1: Gather Your Documents

Before diving into the online filing process, it’s crucial to have all the necessary documents organized and ready. This step is essential for an accurate and efficient tax return. Here’s what you’ll need:

- Income Statements: Collect all income-related documents, including W-2 forms from your employer(s), 1099 forms for any freelance or contract work, and any other income statements.

- Expenses and Deductions: Gather records of expenses that may qualify for deductions, such as medical expenses, charitable donations, education costs, and business-related expenses. Keep track of receipts and any relevant documentation.

- Investment and Retirement Accounts: If you have investments or retirement accounts, gather statements and records to report any gains, losses, or contributions.

- Previous Year’s Tax Returns: Review your previous tax returns to ensure consistency and identify any changes or improvements you can make this year.

- Personal Information: Have your personal details, such as Social Security numbers, bank account information (for direct deposit), and contact information, readily available.

By taking the time to gather these documents, you’ll streamline the online filing process and increase the accuracy of your tax return.

Step 2: Choose the Right Tax Preparation Software

With a wide range of tax preparation software and online tools available, selecting the right one for your needs is crucial. Consider the following factors when making your choice:

- Ease of Use: Opt for software that is user-friendly and intuitive, especially if you’re new to online tax filing. Look for platforms with a simple interface and clear instructions.

- Accuracy: Prioritize software that is known for its accuracy and reliability. Check reviews and ratings to ensure the platform has a good track record.

- Features: Choose software that offers features tailored to your specific tax situation. For example, if you have a complex tax profile with multiple sources of income or investments, select a platform that can handle these scenarios.

- Support: Look for software that provides excellent customer support, offering guidance and assistance throughout the filing process.

Some popular tax preparation software options include:

- TurboTax: Known for its user-friendly interface and comprehensive features, TurboTax offers a range of plans to suit different tax situations.

- H&R Block Online: With a focus on simplicity and affordability, H&R Block Online provides a straightforward filing experience.

- TaxAct: TaxAct is a cost-effective option, offering basic and premium plans to cater to various tax needs.

- FreeTaxUSA: As the name suggests, FreeTaxUSA offers free filing for simple tax returns, making it an attractive choice for those with straightforward tax situations.

By selecting the right tax preparation software, you’ll have a smoother and more accurate filing experience, increasing your chances of a substantial tax refund.

Step 3: Start the Online Filing Process

Now that you have your documents ready and have chosen your tax preparation software, it’s time to begin the online filing process. Follow these steps to ensure a seamless experience:

- Create an Account: Sign up for an account with your chosen tax preparation software. Provide your personal information and any required details to set up your profile.

- Enter Your Information: Start by entering your personal details, including your name, address, and Social Security number. Ensure accuracy to avoid any delays or errors.

- Add Income and Deductions: Input all your income sources and any applicable deductions. Be thorough and precise, as this step is crucial for calculating your tax liability and potential refund.

- Review and Verify: Take the time to review all the information you’ve entered. Double-check for any errors or omissions, as this step can prevent unnecessary delays or discrepancies.

- E-File Your Return: Once you’re satisfied with the accuracy of your tax return, proceed with e-filing. This electronic filing method is fast, secure, and convenient, allowing you to receive your refund quickly.

By following these steps, you’ll navigate the online filing process with ease and confidence, setting the stage for a successful tax refund.

Step 4: Maximize Your Deductions and Credits

Maximizing your deductions and credits is a key strategy to increase your tax refund. Here are some essential tips to consider:

- Itemize Your Deductions: If your itemized deductions exceed the standard deduction, consider itemizing. This involves listing specific expenses, such as mortgage interest, state taxes, and charitable contributions, to reduce your taxable income.

- Take Advantage of Tax Credits: Tax credits are highly beneficial as they directly reduce your tax liability. Explore credits like the Child Tax Credit, Education Credits, and the Earned Income Tax Credit to see if you qualify.

- Deduct Business Expenses: If you operate a business or are self-employed, make sure to deduct all eligible business expenses. This can include office supplies, equipment, and even a portion of your home office expenses.

- Medical and Dental Expenses: If you’ve incurred significant medical or dental expenses, you may be able to deduct them if they exceed a certain percentage of your adjusted gross income. Keep track of these expenses throughout the year.

- Charitable Contributions: Donating to qualified charities can result in tax deductions. Ensure you have records of your donations, including receipts and bank statements.

By strategically maximizing your deductions and credits, you can significantly increase your tax refund and improve your financial situation.

Step 5: Track Your Refund and Plan for the Future

After filing your tax return, it’s important to track your refund and plan for future tax seasons. Here’s how:

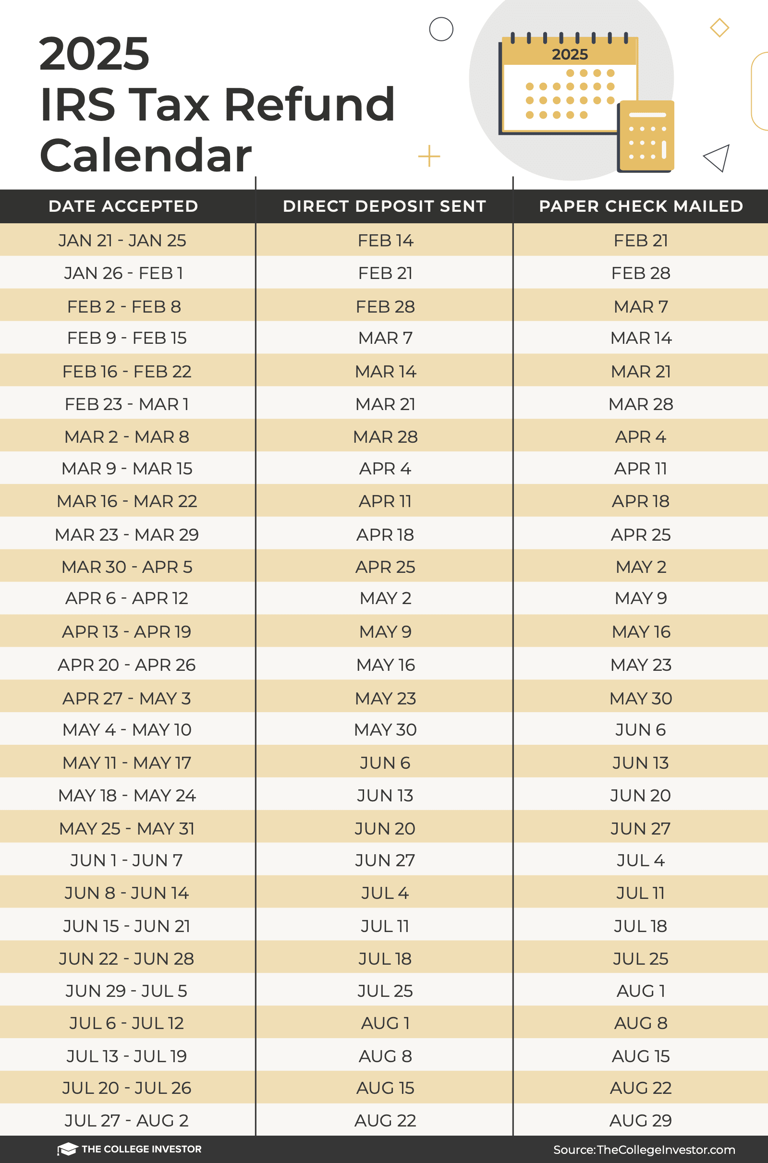

- Check Your Refund Status: Use the online tool provided by the IRS or your tax preparation software to track the status of your refund. This way, you can stay informed and anticipate its arrival.

- Consider Direct Deposit: Opt for direct deposit to receive your refund quickly and securely. Provide your bank account details during the filing process to ensure a smooth and efficient refund process.

- Review Your Return: Take the time to review your tax return after filing. This step allows you to identify areas for improvement and make necessary adjustments for future tax seasons.

- Save for Next Year: Consider setting aside a portion of your refund to cover next year’s tax obligations. This proactive approach can help you stay organized and ensure a smoother tax season.

- Plan for Long-Term Goals: Use your tax refund as a stepping stone towards achieving your financial goals. Whether it’s paying off debt, investing in your future, or saving for a specific goal, a well-planned refund can make a significant impact.

By staying organized and proactive, you can make the most of your tax refund and set yourself up for financial success in the long run.

Conclusion

Maximizing your tax refund through online filing is an empowering process that can improve your financial well-being. By following the steps outlined in this guide, you’ll be well-equipped to navigate the tax season with confidence and precision. Remember, gathering your documents, choosing the right tax preparation software, and maximizing your deductions and credits are key to a successful tax refund. Stay organized, track your refund, and plan for the future to make the most of this opportunity. With a strategic approach, you can turn your tax refund into a powerful tool for achieving your financial goals.

FAQ

What documents do I need to gather for filing my taxes online?

+

To file your taxes online, you’ll need income statements (W-2, 1099), expense records, investment statements, previous year’s tax returns, and personal information (Social Security number, bank details, etc.).

How do I choose the right tax preparation software for my needs?

+

Consider ease of use, accuracy, features, and support when selecting tax preparation software. Popular options include TurboTax, H&R Block Online, TaxAct, and FreeTaxUSA.

What are some strategies to maximize my tax refund?

+

Maximize your tax refund by itemizing deductions, taking advantage of tax credits, deducting business expenses, and considering medical and charitable contributions.

How can I track the status of my tax refund?

+

Use the IRS’s online tool or your tax preparation software’s refund tracker to check the status of your refund. This way, you can stay informed and anticipate its arrival.

What should I do with my tax refund to achieve my financial goals?

+

Consider using your tax refund to pay off debt, invest in your future, or save for a specific goal. Planning ahead can help you make the most of your refund and achieve financial success.