5 Ultimate Tips To Create Your Basic Bank Account Today

Introduction to Banking: Navigating the Basics

Starting your financial journey with a bank account is an essential step towards managing your money and achieving your financial goals. A basic bank account serves as a foundation for your financial well-being, offering a secure and convenient way to handle your funds. In this guide, we’ll explore five key tips to help you create your own basic bank account, ensuring a smooth and informed process.

1. Research and Compare Banks

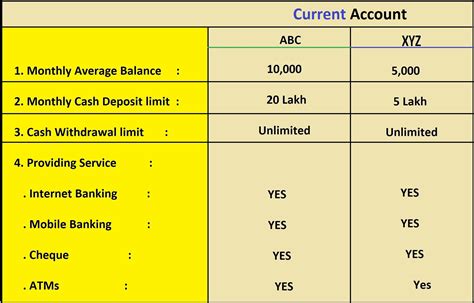

Before diving into the world of banking, it’s crucial to research and compare different financial institutions. Each bank offers unique features, fees, and services, so understanding their differences will help you make an informed decision. Consider factors such as account types, interest rates, fees, customer service, and digital banking options.

Account Types: Banks typically offer various account options, including checking accounts, savings accounts, and money market accounts. Research the differences between these accounts to determine which best suits your needs.

Interest Rates: If you’re interested in earning interest on your savings, compare the interest rates offered by different banks. Look for competitive rates that align with your financial goals.

Fees: Be mindful of any fees associated with the account, such as monthly maintenance fees, overdraft fees, or transaction fees. Choose a bank with fee structures that won’t eat into your savings.

Customer Service: Assess the bank’s customer service reputation. Look for banks with responsive and helpful customer support, as this can be invaluable when you need assistance.

Digital Banking Options: In today’s digital age, online and mobile banking capabilities are essential. Ensure the bank you choose offers user-friendly digital platforms for easy account management and access.

2. Determine Your Banking Needs

Understanding your specific banking needs is vital to selecting the right account. Consider your daily financial activities and habits to determine the features and services you require.

Transaction Frequency: Do you anticipate making frequent transactions, such as regular bill payments or transfers? Look for accounts with low or no transaction fees to avoid unnecessary charges.

Savings Goals: If you’re aiming to save money, consider accounts with higher interest rates or special savings features. Some banks offer incentives for maintaining a certain balance or achieving specific savings milestones.

Convenience: Think about your preferred method of banking. Do you prefer in-person interactions at a physical branch, or are you more comfortable with digital banking options? Choose a bank that aligns with your preferred banking style.

3. Gather the Required Documentation

To open a basic bank account, you’ll need to provide certain documents to verify your identity and residence. Having these documents ready will streamline the account opening process.

Government-Issued ID: A valid and up-to-date government-issued ID, such as a driver’s license or passport, is typically required. Ensure your ID is not expired and includes your current address.

Proof of Address: In addition to your ID, you’ll need to provide proof of your current address. This can be a utility bill, bank statement, or other official correspondence with your name and address.

Social Security Number: In some cases, you may need to provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for tax reporting purposes.

4. Choose the Right Account Type

Once you’ve researched and compared banks, it’s time to choose the account type that best suits your needs. Consider the following account options:

Checking Accounts: These accounts are ideal for everyday transactions, such as paying bills, making purchases, and receiving direct deposits. They often come with features like debit cards, online bill payment, and overdraft protection.

Savings Accounts: Savings accounts are designed for long-term savings goals. They typically offer higher interest rates than checking accounts but may have limitations on the number of transactions you can make each month.

Money Market Accounts: Money market accounts strike a balance between checking and savings accounts, offering higher interest rates and check-writing privileges. However, they may require a higher minimum balance and have transaction limits.

5. Open Your Account and Start Banking

With your research complete and the necessary documentation gathered, it’s time to open your basic bank account. You can typically do this online, over the phone, or in person at a bank branch.

Online Application: Many banks offer secure online applications, allowing you to open an account from the comfort of your home. Ensure you have all the required information and documentation ready before starting the application process.

In-Person Visit: If you prefer a more personal approach, visit a local bank branch. Bring your identification and proof of address, and be prepared to answer any questions the bank representative may have.

Account Funding: Once your account is approved, you’ll need to fund it to start using it. Consider setting up direct deposit for your paycheck or transferring funds from another account.

Conclusion: Your Financial Journey Begins

Creating your basic bank account is a significant step towards financial independence and security. By following these five tips, you can navigate the banking landscape with confidence and choose an account that aligns with your needs. Remember, a basic bank account is just the beginning—with careful planning and responsible money management, you can build a solid financial foundation for your future.

FAQ

What is the minimum age required to open a basic bank account?

+

The minimum age to open a basic bank account varies by country and financial institution. In many cases, individuals must be at least 18 years old to open an account independently. However, some banks offer joint accounts or custodial accounts for minors with a parent or guardian as a co-owner.

Can I open a basic bank account if I have bad credit?

+

Yes, having bad credit typically does not prevent you from opening a basic bank account. Basic bank accounts are designed to provide essential financial services to individuals regardless of their credit history. However, some banks may require additional identification or documentation for account approval.

Are there any alternatives to a basic bank account for those without a valid ID or proof of address?

+

In certain situations, individuals without a valid ID or proof of address can still access financial services through alternative options. Some banks and financial institutions offer accounts specifically for this purpose, such as refugee accounts or accounts for the homeless. These accounts may have specific requirements and limitations, so it’s important to research your options and contact financial institutions directly for more information.

How long does it typically take to open a basic bank account?

+

The time it takes to open a basic bank account can vary depending on the bank and the method of application. Online applications may be processed more quickly, with some banks offering instant approval. In-person applications may take a few days to process, especially if additional documentation or verification is required. It’s best to contact the bank directly for an estimated timeline.

What are some common fees associated with basic bank accounts?

+

Common fees associated with basic bank accounts may include monthly maintenance fees, overdraft fees, ATM fees, and transaction fees. It’s important to carefully review the fee schedule provided by the bank to understand the potential costs associated with the account. Some banks offer fee waivers or reduced fees for certain account activities or balance requirements.