5 Ways To Get $200 For Opening A Bank Account: Essential Guide

Unlocking the Power of Banking: 5 Strategies to Secure $200 by Opening a New Account

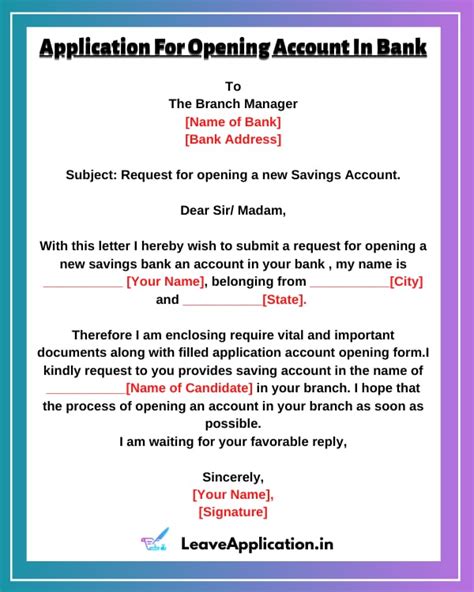

In today's financial landscape, opening a new bank account is not just about managing your money; it's an opportunity to boost your savings with attractive sign-up bonuses. With a bit of research and a strategic approach, you can easily pocket $200 or more when you choose the right bank and meet the account requirements. Let's dive into five effective ways to maximize your earnings and make the most of these banking incentives.

1. Direct Deposit Bonuses

Many banks offer direct deposit bonuses as an incentive to attract new customers. These bonuses typically range from $100 to $200 and are credited to your account once you've set up a qualifying direct deposit. To take advantage of this offer, you'll need to ensure your employer or benefits provider is capable of sending direct deposits to your new account. Some banks may require a minimum deposit amount or a certain number of deposits within a specified timeframe to qualify for the bonus. Be sure to read the fine print and understand the terms and conditions before committing to a new account.

2. Referral Programs

Referral programs are a win-win for both the referrer and the new customer. When you refer a friend or family member to open a new account, you both stand to gain. The new account holder receives a sign-up bonus, often in the range of $100 to $200, while you, the referrer, also receive a referral bonus, typically around $50. These programs are a great way to boost your savings and build your network. However, it's important to note that some banks have limitations on the number of referrals you can make or the frequency of referrals, so be sure to check the program's details before participating.

3. New Account Bonuses

New account bonuses are a common incentive offered by banks to attract new customers. These bonuses are typically awarded when you open a new checking or savings account and meet certain requirements, such as maintaining a minimum balance or completing a specified number of transactions within a set timeframe. Bonuses can range from $100 to $500, with $200 being a common incentive. To maximize your earnings, compare offers from different banks and choose the one that best aligns with your financial goals and habits. Be mindful of any fees or penalties that may apply if you fail to meet the bonus requirements.

4. Checking Account Promotions

Checking account promotions are a great way to earn a quick bonus for opening a new account. These promotions often require you to set up direct deposits, use your debit card a certain number of times, or make a specified number of bill payments within a set period. Bonuses for checking account promotions can range from $100 to $300, with $200 being a common incentive. To make the most of these promotions, ensure you understand the requirements and can meet them within the specified timeframe. Some banks may also offer additional perks, such as waived monthly fees or higher interest rates, so be sure to read the fine print.

5. Savings Account Bonuses

Savings account bonuses are a fantastic way to grow your savings while earning a substantial bonus. These bonuses are typically awarded when you open a new savings account and meet specific criteria, such as maintaining a minimum balance or making a certain number of deposits within a set period. Bonuses for savings accounts can range from $100 to $500, with $200 being a common incentive. To maximize your earnings, compare offers from different banks and choose the one that best suits your savings goals and financial situation. Be mindful of any fees or penalties that may apply if you fail to meet the bonus requirements.

Choosing the Right Bank

When it comes to selecting a bank for your new account, it's essential to consider your financial needs and preferences. Here are some factors to keep in mind:

- Interest Rates: Compare interest rates on checking and savings accounts to ensure you're getting the best return on your money.

- Fees: Look for banks with low or no monthly fees and avoid accounts with high minimum balance requirements or excessive fees for various transactions.

- Customer Service: Consider the bank's reputation for customer service and ensure they offer convenient access to support when you need it.

- Digital Banking: Evaluate the bank's online and mobile banking capabilities to ensure they meet your needs for accessibility and ease of use.

- ATM Network: Check the bank's ATM network to ensure you have convenient access to cash withdrawals without incurring fees.

Tips for Success

To increase your chances of success in earning these sign-up bonuses, consider the following tips:

- Read the Fine Print: Always read the terms and conditions carefully to understand the requirements and potential limitations of the bonus offer.

- Compare Offers: Research and compare different banks and their bonus offers to find the best fit for your financial goals.

- Plan Ahead: Anticipate any potential changes to your financial situation that may impact your ability to meet the bonus requirements, such as a change in employment or a major purchase.

- Maintain Good Credit: Some bonus offers may be tied to your credit score, so it's essential to maintain a good credit history.

- Stay Organized: Keep track of your progress towards meeting the bonus requirements and ensure you're on track to qualify for the incentive.

Conclusion

By leveraging direct deposit bonuses, referral programs, new account bonuses, checking account promotions, and savings account bonuses, you can easily earn $200 or more when opening a new bank account. With a bit of research and strategic planning, you can take advantage of these incentives to boost your savings and improve your financial well-being. Remember to choose a bank that aligns with your financial goals and preferences, and always read the fine print to ensure you understand the terms and conditions of the bonus offer. Happy banking and happy savings!

Frequently Asked Questions

How long does it take to receive the bonus after opening a new account?

+

The time it takes to receive your bonus can vary depending on the bank and the specific offer. Some bonuses are credited to your account immediately upon meeting the requirements, while others may take several weeks or even months. It’s important to read the fine print and understand the timeframe for receiving your bonus.

Are there any fees or penalties associated with these bonus offers?

+

Yes, some bonus offers may come with fees or penalties if you fail to meet the requirements. For example, you may need to maintain a minimum balance or complete a certain number of transactions within a specified timeframe. If you don’t meet these conditions, you may be charged a fee or lose the bonus entirely. Be sure to read the terms and conditions carefully to understand any potential fees or penalties.

Can I qualify for multiple bonuses from the same bank?

+

In most cases, banks will allow you to qualify for multiple bonuses, but there may be restrictions on the number of bonuses you can receive or the timeframe in which you can earn them. Some banks may also have limitations on the types of accounts you can open to qualify for bonuses. It’s best to check with the bank directly or read their terms and conditions to understand their specific policies.

Are there any alternative ways to earn bonuses besides opening a new account?

+

Yes, there are alternative ways to earn bonuses without opening a new account. Some banks offer bonuses for meeting certain spending thresholds with your debit or credit card, while others may provide incentives for referring friends or family members to their services. Additionally, some banks have loyalty programs that reward customers for their continued patronage.

Can I combine different bonus offers to maximize my earnings?

+

Combining different bonus offers can be an effective strategy to maximize your earnings. For example, you could open a new checking account with one bank to take advantage of their direct deposit bonus while also referring a friend to open a new account with a different bank to earn a referral bonus. However, it’s important to carefully read the terms and conditions of each offer to ensure there are no restrictions on combining bonuses.