5 Ways To Perfectly Handle Penalty Charges Today

Introduction to Penalty Charges

Dealing with penalty charges can be a daunting task, but with the right approach and knowledge, you can navigate through the process effectively. Whether it’s late payment fees, overdraft charges, or any other financial penalties, understanding your rights and taking proactive steps is crucial. In this blog post, we will explore five practical ways to handle penalty charges and minimize their impact on your financial well-being. From negotiating with financial institutions to exploring dispute resolution options, we’ve got you covered. Let’s dive in and explore these strategies to help you tackle penalty charges head-on!

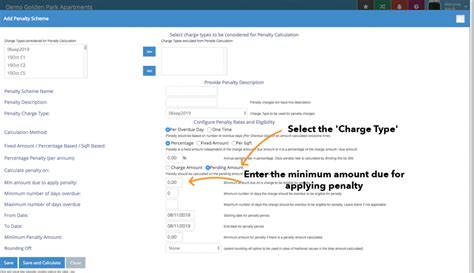

Way 1: Understand the Reason for the Penalty Charge

The first step in handling penalty charges is to understand the reason behind them. Financial institutions impose penalty charges for various reasons, such as late payments, missed payments, exceeding credit limits, or overdrafts. By identifying the specific reason for the charge, you can take appropriate action to address the issue and prevent future occurrences.

Tips for Understanding Penalty Charges:

- Review your account statements regularly: Check for any unusual activities, missed payments, or unauthorized transactions. Identifying these issues early on can help you take prompt action.

- Contact your financial institution: Reach out to your bank, credit card company, or lender to inquire about the penalty charge. They can provide detailed information about the reason and any applicable terms and conditions.

- Understand the terms and conditions: Familiarize yourself with the terms and conditions of your financial products. Many penalty charges are outlined in these agreements, so reading and comprehending them is essential.

- Keep track of payment due dates: Create a payment schedule and set reminders to ensure you make timely payments. Missing payment deadlines is a common reason for penalty charges.

Way 2: Negotiate and Communicate with Your Financial Institution

Communication is key when it comes to penalty charges. Financial institutions often understand that unforeseen circumstances can lead to missed payments or other issues. By reaching out and explaining your situation, you may be able to negotiate a resolution or alternative arrangement.

Strategies for Effective Negotiation:

- Be proactive: Don’t wait for the penalty charge to appear on your statement. Contact your financial institution as soon as you anticipate a potential issue. Early communication can demonstrate your responsibility and willingness to resolve the matter.

- Explain your circumstances: Provide a clear and honest explanation of the reasons behind the missed payment or overdraft. Financial institutions are more likely to be understanding if they perceive your situation as legitimate.

- Offer a solution: Propose a solution or repayment plan that aligns with your financial capabilities. Demonstrate your commitment to resolving the issue and making amends.

- Ask for alternatives: Inquire about alternative payment options or reduced penalty charges. Financial institutions may offer waivers, reduced fees, or extended payment plans to help you manage the situation.

- Stay calm and professional: Maintain a calm and respectful tone throughout the communication. Financial institutions are more likely to assist you if you approach the situation professionally.

Way 3: Explore Dispute Resolution Options

If you believe a penalty charge is unfair, inaccurate, or the result of an error, you have the right to dispute it. Financial institutions and regulatory bodies provide dispute resolution processes to address such situations.

Steps to Dispute a Penalty Charge:

- Review your rights: Familiarize yourself with the consumer protection laws and regulations in your jurisdiction. Understanding your rights is crucial for a successful dispute.

- Gather evidence: Collect any relevant documentation, such as account statements, transaction records, or correspondence that supports your claim. Evidence strengthens your case.

- Contact the financial institution: Reach out to the financial institution’s customer service or dispute resolution department. Explain the issue and provide supporting evidence.

- Follow the dispute process: Follow the steps outlined by the financial institution for disputing charges. This may involve completing a dispute form, providing additional information, or attending a mediation process.

- Seek assistance: If the dispute process becomes complex or you need further guidance, consider seeking help from consumer protection agencies or financial advisors. They can provide valuable insights and support.

Way 4: Improve Your Financial Management Practices

Preventing future penalty charges is essential for maintaining a healthy financial situation. By adopting better financial management practices, you can reduce the likelihood of incurring additional charges.

Tips for Improved Financial Management:

- Create a budget: Develop a comprehensive budget that outlines your income, expenses, and savings goals. A budget helps you allocate your finances effectively and avoid overspending.

- Automate payments: Set up automatic payments for recurring expenses, such as utility bills, insurance premiums, or loan repayments. Automation ensures timely payments and reduces the risk of missed deadlines.

- Build an emergency fund: Save a portion of your income to create an emergency fund. This fund can provide a financial cushion during unexpected expenses or financial setbacks, reducing the need for costly loans or overdrafts.

- Monitor your credit score: Regularly check your credit score and report. A good credit score can open doors to better financial opportunities and may even result in lower interest rates, reducing the impact of penalty charges.

- Seek financial advice: Consider consulting a financial advisor or planner who can provide personalized guidance based on your financial goals and situation. They can offer strategies to improve your financial management and reduce the likelihood of penalty charges.

Way 5: Stay Informed and Educate Yourself

Staying informed about your financial rights, responsibilities, and the latest changes in the financial industry is crucial. Education empowers you to make informed decisions and take control of your financial well-being.

Resources for Financial Education:

- Read financial literature: Explore books, articles, and blogs that cover personal finance, budgeting, and financial management. These resources provide valuable insights and practical tips.

- Attend financial workshops: Participate in financial literacy workshops or seminars offered by financial institutions, community organizations, or educational institutions. These events often provide practical guidance and networking opportunities.

- Follow reputable financial websites: Stay updated with the latest financial news and trends by following reputable financial websites and blogs. They offer valuable insights and analysis.

- Utilize online resources: Take advantage of online platforms and apps that provide financial education and budgeting tools. These resources can help you track your spending, create budgets, and make informed financial decisions.

- Seek professional advice: Consider seeking advice from certified financial planners or accountants who can provide personalized guidance based on your specific financial situation.

Conclusion

Handling penalty charges requires a proactive and informed approach. By understanding the reasons behind the charges, negotiating with financial institutions, exploring dispute resolution options, improving your financial management practices, and staying educated, you can effectively navigate through penalty charges and minimize their impact. Remember, taking control of your finances and staying vigilant is key to maintaining a healthy financial future. Stay informed, stay organized, and don’t hesitate to seek help when needed. With the right strategies and mindset, you can overcome penalty charges and work towards financial stability and security.

FAQ

How long do I have to dispute a penalty charge?

+

The time frame for disputing a penalty charge varies depending on the financial institution and the nature of the charge. It’s essential to act promptly and follow the institution’s dispute process guidelines. In some cases, you may have a limited window to dispute the charge, so it’s best to initiate the process as soon as possible.

Can I negotiate penalty charges if I have a good payment history?

+

Absolutely! Financial institutions often consider your payment history and overall relationship with them when negotiating penalty charges. If you have a positive payment history and a good standing with the institution, they may be more willing to work with you to find a mutually beneficial solution.

What happens if I ignore a penalty charge notice?

+

Ignoring a penalty charge notice can lead to further consequences. The financial institution may continue to assess late fees or additional charges, and your account could be subject to collection actions. It’s best to address the issue promptly to avoid further complications and potential damage to your credit score.

Are there any organizations that can help with financial education and budgeting?

+

Yes, there are several organizations dedicated to providing financial education and budgeting assistance. Some well-known organizations include the National Foundation for Credit Counseling (NFCC), the Financial Planning Association (FPA), and the Jumpstart Coalition for Personal Financial Literacy. These organizations offer resources, workshops, and counseling services to help individuals improve their financial management skills.

Can I get a penalty charge waived if I have a valid reason for the late payment?

+

In certain circumstances, financial institutions may waive penalty charges if you have a valid and documented reason for the late payment. Medical emergencies, natural disasters, or other unforeseen circumstances may be considered valid reasons. However, it’s essential to provide supporting documentation and communicate with the institution promptly to increase your chances of a waiver.