6 Pro Tips To Pay Council Tax Birmingham Online Today

Discover the ultimate guide to paying your Council Tax in Birmingham online with these 6 pro tips. Learn how to navigate the process efficiently and effectively, ensuring a smooth and hassle-free experience. From understanding the different payment methods to exploring the benefits of direct debit, we've got you covered. Get ready to unlock the secrets to managing your Council Tax obligations with ease.

Understanding Council Tax in Birmingham

Council Tax is a vital contribution that residents of Birmingham make towards the local authority's services and facilities. It plays a crucial role in funding essential amenities such as waste collection, street lighting, and public transportation. By paying Council Tax, Birmingham residents ensure the continued maintenance and improvement of their community.

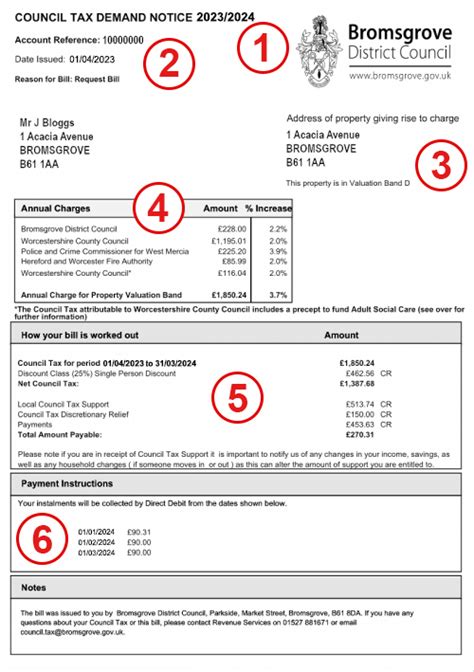

It's important to note that Council Tax is calculated based on the value of your property and the number of people living in it. The amount you pay is divided into different bands, with properties assessed and categorized accordingly. This system ensures fairness and helps distribute the financial burden evenly among residents.

Online Payment Options

Paying your Council Tax online offers a convenient and efficient way to manage your payments. Birmingham City Council provides a user-friendly online platform that allows residents to make secure transactions from the comfort of their homes. Here are the key online payment options available:

- Credit and Debit Cards: You can use major credit and debit cards, such as Visa, Mastercard, and Maestro, to make online payments. This method is quick and convenient, allowing you to settle your Council Tax bills with just a few clicks.

- Direct Debit: Setting up a Direct Debit is an excellent way to ensure your Council Tax payments are made on time and in full. With this option, you authorize the council to automatically deduct the amount from your bank account on a specific date each month. It's a hassle-free way to stay on top of your financial obligations.

- Online Banking: If you prefer using your online banking platform, you can make Council Tax payments directly from your account. Simply log in to your online banking service, select Birmingham City Council as the payee, and transfer the required amount. This method provides flexibility and control over your payments.

Step-by-Step Guide to Online Payment

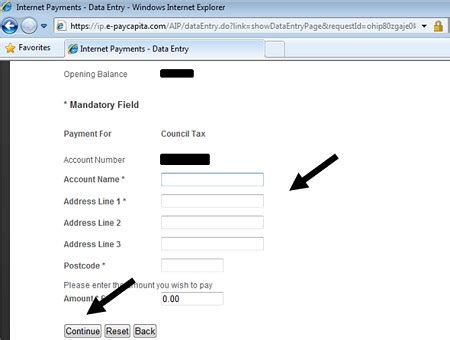

Follow these simple steps to pay your Council Tax online in Birmingham:

- Visit the Birmingham City Council Website: Go to the official Birmingham City Council website and navigate to the Council Tax payment section.

- Log In or Register: If you have an existing account, log in using your credentials. If not, create an account by providing your personal details and setting up a secure password.

- Select Payment Method: Choose your preferred payment option from the available choices, such as credit/debit card or Direct Debit.

- Enter Payment Details: Fill in the required information, including your card details or bank account information, depending on the payment method chosen.

- Review and Confirm: Carefully review the payment summary, ensuring all the details are correct. Double-check the amount, payment date, and any additional instructions before confirming the transaction.

- Receive Confirmation: Once the payment is processed, you will receive a confirmation message or email. Keep this for your records as proof of payment.

Benefits of Online Payment

Paying your Council Tax online offers several advantages that make it a preferred choice for many residents:

- Convenience: Online payment allows you to settle your Council Tax bills anytime, anywhere, without the need to visit a physical location. It saves you time and effort, especially during busy periods.

- Flexibility: With online payment, you have the flexibility to choose your preferred payment method and schedule. You can make one-time payments or set up recurring payments to ensure timely and hassle-free contributions.

- Security: Birmingham City Council employs secure online payment systems, ensuring the protection of your personal and financial information. Rest assured that your transactions are safe and encrypted.

- Real-time Updates: When paying online, you receive instant confirmation and updates on your payment status. This transparency helps you stay informed and manage your Council Tax obligations effectively.

Tips for a Smooth Online Payment Experience

To ensure a seamless online payment process, consider the following tips:

- Have Your Council Tax Reference Number Ready: Your Council Tax reference number is a unique identifier for your account. Keep it handy to expedite the payment process and avoid any delays.

- Check Payment Limits: Be aware of any payment limits or restrictions imposed by Birmingham City Council. Some payment methods may have maximum transaction amounts, so plan your payments accordingly.

- Use a Secure Internet Connection: Ensure you are connected to a secure and reliable internet network when making online payments. This helps protect your personal and financial information from potential security threats.

- Keep Records: After completing your online payment, save the confirmation email or take a screenshot as a record. This documentation serves as proof of payment and can be useful for future reference or in case of any disputes.

Exploring Direct Debit

Direct Debit is a popular and convenient payment method for Council Tax in Birmingham. By setting up a Direct Debit, you authorize Birmingham City Council to automatically deduct your Council Tax payments from your bank account on a regular basis. This option offers several benefits, including:

- Automatic Payments: With Direct Debit, you no longer need to worry about remembering payment deadlines. The council will automatically deduct the amount on the agreed date, ensuring timely payments without any hassle.

- Flexibility and Control: You have the flexibility to choose the payment date that suits your financial situation. Additionally, you can update your Direct Debit instructions or cancel the arrangement if needed, providing you with control over your payments.

- Protection and Security: Direct Debit is a secure payment method, offering protection against unauthorized transactions. The Direct Debit Guarantee ensures that you can cancel any payments that were processed incorrectly or fraudulently.

Managing Your Council Tax Account

To stay on top of your Council Tax obligations and ensure a smooth payment process, consider the following tips for managing your account:

- Set Up Email or Text Alerts: Birmingham City Council offers the option to receive email or text alerts for upcoming payment deadlines. By enabling these notifications, you can stay informed and avoid late payment charges.

- Review Your Bill Regularly: Take the time to review your Council Tax bill thoroughly. Check for any errors or discrepancies, ensuring that the amount and payment schedule align with your expectations. If you have any concerns, contact the council for clarification.

- Explore Payment Plans: If you're facing financial difficulties, Birmingham City Council may offer payment plans to help you manage your Council Tax payments. Reach out to their customer service team to discuss your options and find a suitable arrangement.

Additional Resources

For further assistance and information, you can explore the following resources:

- Birmingham City Council Website: Visit the official Birmingham City Council website for detailed information on Council Tax, payment options, and frequently asked questions. The website provides comprehensive guides and resources to help you navigate the process.

- Customer Service Contact: If you have specific queries or require personalized assistance, don't hesitate to contact Birmingham City Council's customer service team. They are available to provide guidance and support, ensuring a positive and efficient experience.

Conclusion

Paying your Council Tax online in Birmingham is a convenient and efficient way to fulfill your financial obligations. By following the step-by-step guide and utilizing the various online payment options, you can streamline the process and ensure timely payments. Remember to explore the benefits of Direct Debit and stay proactive in managing your Council Tax account. With these pro tips, you can confidently navigate the online payment system and contribute to the development and maintenance of your local community.

How often do I need to pay Council Tax in Birmingham?

+

Council Tax payments in Birmingham are typically made annually. However, you can choose to pay in installments or set up a Direct Debit for monthly payments. It’s important to ensure that you meet the payment deadlines to avoid any penalties or additional charges.

Can I pay my Council Tax using a mobile app?

+

Yes, Birmingham City Council offers a mobile app that allows you to make Council Tax payments conveniently. Simply download the app, log in with your credentials, and follow the instructions to complete the payment process.

What happens if I miss a Council Tax payment?

+

If you miss a Council Tax payment, you may receive a reminder notice from Birmingham City Council. It’s important to respond promptly and make the payment to avoid further action, such as legal proceedings or additional charges.

Are there any discounts available for Council Tax in Birmingham?

+

Yes, Birmingham City Council offers various discounts and exemptions for Council Tax. These include discounts for single-person households, students, and individuals receiving certain benefits. It’s advisable to check the eligibility criteria and apply for any applicable discounts.

Can I pay my Council Tax in person at a local office?

+

While online payment is the most convenient option, you can also pay your Council Tax in person at designated local offices. Birmingham City Council provides information on the locations and opening hours of these offices, allowing you to make payments in cash or by card.