6 Ways To Design The Ultimate Deferred Payment Plan Today

Designing a deferred payment plan that is both beneficial for your business and attractive to customers can be a challenging task. However, with the right strategies and a well-thought-out approach, you can create an ultimate deferred payment plan that meets everyone's needs. In this blog post, we will explore six effective ways to design such a plan, offering valuable insights and practical tips.

1. Understand Your Target Market

Before diving into the design process, it is crucial to have a deep understanding of your target market. Conduct thorough market research to identify your ideal customers and their preferences. Consider factors such as their spending habits, financial capabilities, and the types of products or services they are likely to purchase on credit.

By understanding your target market, you can tailor your deferred payment plan to their specific needs and expectations. This personalized approach will make your plan more appealing and increase the chances of successful adoption.

2. Set Clear Eligibility Criteria

Establishing clear eligibility criteria is essential to ensure a fair and efficient deferred payment plan. Define the requirements that customers must meet to qualify for the plan. This may include factors such as creditworthiness, income stability, and a positive payment history.

Clear eligibility criteria help maintain the integrity of your plan and prevent potential abuses. It also allows you to assess the risk associated with each customer and make informed decisions regarding the terms and conditions of the deferred payment.

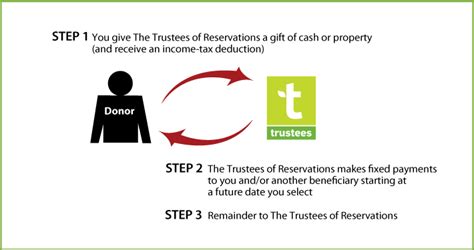

3. Offer Flexible Payment Options

One of the key aspects of designing an attractive deferred payment plan is offering flexible payment options. Provide your customers with a range of choices to suit their individual preferences and financial situations.

- Fixed Installments: Allow customers to pay a fixed amount at regular intervals, such as monthly or quarterly. This provides predictability and helps them budget effectively.

- Variable Installments: Offer the flexibility to adjust the payment amount based on the customer's financial situation. This option is particularly useful for those with fluctuating income.

- Early Repayment: Give customers the freedom to repay the entire amount before the agreed-upon deadline. This can be beneficial for those who want to save on interest or have unexpected financial windfalls.

By offering a variety of payment options, you cater to different customer needs and increase the likelihood of successful plan adoption.

4. Determine Interest Rates and Fees

When designing a deferred payment plan, it is crucial to determine the interest rates and any associated fees. These rates should be competitive and fair, taking into account the risk involved and the market standards.

Consider offering promotional interest rates or introductory offers to attract new customers. However, ensure that the long-term rates are transparent and communicated clearly to avoid any misunderstandings or negative experiences.

5. Implement Robust Payment Infrastructure

To ensure a smooth and secure payment process, it is essential to invest in robust payment infrastructure. This includes integrating secure payment gateways, implementing fraud detection systems, and providing multiple payment channels.

By offering convenient and reliable payment options, such as online payments, mobile wallets, or in-person transactions, you enhance the overall customer experience and build trust in your deferred payment plan.

6. Provide Clear Communication and Support

Effective communication is key to the success of any deferred payment plan. Ensure that your customers have access to clear and concise information about the terms and conditions, payment schedules, and any potential penalties or fees.

Offer multiple channels for customer support, such as a dedicated helpline, email support, or live chat. By providing timely and helpful assistance, you can address any concerns or queries promptly and build a positive relationship with your customers.

Additionally, consider sending regular payment reminders and providing educational resources to help customers manage their payments effectively.

Conclusion

Designing the ultimate deferred payment plan requires a combination of market understanding, flexibility, and clear communication. By following the six ways outlined in this blog post, you can create a plan that not only benefits your business but also meets the needs of your customers. Remember, a well-designed deferred payment plan can enhance customer loyalty, increase sales, and foster long-term relationships.

What are the benefits of offering a deferred payment plan?

+

Offering a deferred payment plan can attract more customers, increase sales, and improve customer loyalty. It provides flexibility and allows customers to make purchases they may not have been able to afford otherwise.

How can I ensure the security of deferred payments?

+

To ensure security, invest in robust payment infrastructure, implement fraud detection systems, and regularly update your security measures. Additionally, educate your customers about safe payment practices.

What should I consider when setting interest rates for deferred payments?

+

When setting interest rates, consider the risk involved, market standards, and your business goals. Offer competitive rates to attract customers while ensuring profitability. Regularly review and adjust rates as needed.

How can I handle late payments or defaults in a deferred payment plan?

+

Establish clear policies for late payments and defaults, including penalties and collection procedures. Communicate these policies to your customers and provide them with options to resolve any payment issues.

What are some common challenges in implementing a deferred payment plan?

+

Some common challenges include managing risk, ensuring customer understanding of terms, and dealing with late payments. Overcoming these challenges requires effective communication, robust infrastructure, and a well-defined risk management strategy.