7 Pro Tips To Pay Council Tax Online Birmingham Today

Paying your council tax online is a convenient and efficient way to fulfill your civic duty as a resident of Birmingham. In this blog post, we will guide you through the process and provide some valuable tips to make it a seamless experience. Whether you're a busy professional or a student, these tips will help you stay on top of your council tax payments and avoid any unnecessary hassle.

Understanding Council Tax in Birmingham

Before we dive into the online payment process, let's quickly understand what council tax is and why it's important. Council tax is a local tax that funds various services provided by the local authority, such as waste collection, road maintenance, and social care. It is a legal requirement for all households in Birmingham to pay council tax, and failure to do so can result in penalties and legal action.

The amount of council tax you pay depends on several factors, including the value of your property, the number of occupants, and any applicable discounts or exemptions. Birmingham City Council offers a user-friendly online platform to manage your council tax payments, making it easier for residents to stay informed and up to date with their obligations.

Step-by-Step Guide: Paying Council Tax Online

-

Access the Birmingham City Council Website

Start by visiting the official website of Birmingham City Council. You can find it by searching for "Birmingham City Council" in your preferred search engine. Alternatively, you can directly navigate to https://www.birmingham.gov.uk.

-

Navigate to the Council Tax Section

Once you're on the homepage, look for the "Council Tax" section or use the search bar to find it quickly. This section will provide you with all the necessary information and tools to manage your council tax payments.

-

Log In to Your Account

If you already have a Birmingham City Council online account, log in using your credentials. If not, you can create one by following the simple registration process. Having an account will allow you to access your council tax information and make payments securely.

-

Locate Your Council Tax Bill

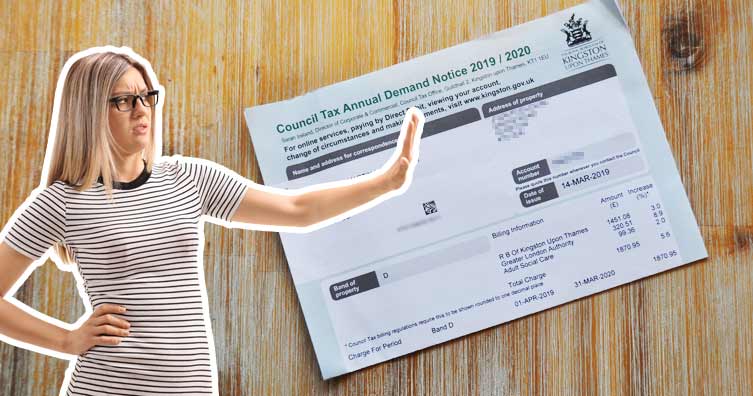

After logging in, navigate to your council tax bill. You can usually find it under the "My Account" or "My Services" section. Your bill will contain important details such as your council tax reference number, the amount due, and the payment deadlines.

-

Choose Your Payment Method

Birmingham City Council offers various payment methods to suit your preferences. You can opt for a one-time payment or set up a direct debit for regular payments. Consider your financial situation and choose the option that works best for you.

If you choose direct debit, you'll need to provide your bank account details. This method ensures that your payments are automatically deducted on the due date, saving you from any last-minute rushes.

-

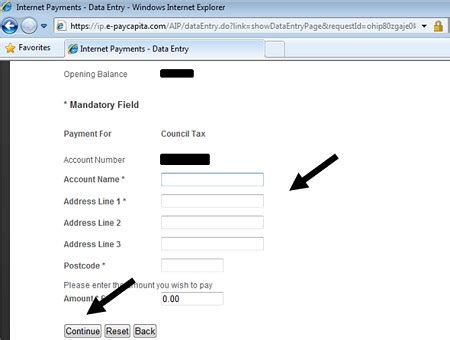

Complete the Payment Process

Follow the on-screen instructions to complete the payment. Double-check the amount, payment method, and any additional details before confirming the transaction. It's important to ensure accuracy to avoid any discrepancies.

Once you've submitted the payment, you should receive a confirmation email or message. Keep this for your records as proof of payment.

-

Keep Track of Your Payments

Regularly check your council tax account to stay updated on your payment status. This will help you keep track of any upcoming deadlines and ensure that you don't miss any payments. You can also set up email or text notifications to receive reminders.

7 Pro Tips for a Smooth Online Payment Experience

-

Create a Secure Online Account

Having a dedicated online account with Birmingham City Council is essential. Ensure that you use a strong password and enable two-factor authentication for added security. This will protect your personal information and payment details.

-

Set Up Direct Debit for Convenience

Consider setting up a direct debit to automate your council tax payments. This way, you won't have to worry about missing deadlines or remembering to make payments manually. It's a hassle-free way to stay on top of your financial obligations.

-

Keep Your Contact Information Updated

It's crucial to keep your contact details, especially your email address and phone number, up to date with Birmingham City Council. This ensures that you receive important notifications and reminders regarding your council tax payments.

-

Understand Your Bill

Take the time to understand your council tax bill thoroughly. Familiarize yourself with the breakdown of the charges, any applicable discounts, and the payment deadlines. This knowledge will help you budget effectively and avoid any surprises.

-

Explore Payment Plan Options

If you're facing financial difficulties, Birmingham City Council may offer payment plans to help you manage your council tax payments. Reach out to their customer support team to discuss your options and find a suitable arrangement.

-

Utilize Online Payment Assistance

Birmingham City Council provides online resources and guides to assist you with the payment process. Take advantage of these tools to ensure a smooth and error-free experience. You can also find helpful FAQs and contact information for further assistance.

-

Stay Informed About Changes

Keep yourself informed about any changes or updates to council tax policies and payment procedures. Birmingham City Council may occasionally introduce new initiatives or make adjustments to the system. Staying updated will help you adapt and continue making timely payments.

Important Notes

![]() Note: Always ensure that you are on the official Birmingham City Council website when making online payments. Be cautious of any phishing attempts or fraudulent websites. Look for the secure padlock icon in your browser's address bar to verify the website's authenticity.

Note: Always ensure that you are on the official Birmingham City Council website when making online payments. Be cautious of any phishing attempts or fraudulent websites. Look for the secure padlock icon in your browser's address bar to verify the website's authenticity.

![]() Note: Keep your council tax reference number handy. This unique identifier is essential for making payments and accessing your account information.

Note: Keep your council tax reference number handy. This unique identifier is essential for making payments and accessing your account information.

![]() Note: If you encounter any issues or have specific questions, don't hesitate to contact Birmingham City Council's customer support team. They are there to assist you and provide guidance.

Note: If you encounter any issues or have specific questions, don't hesitate to contact Birmingham City Council's customer support team. They are there to assist you and provide guidance.

Conclusion

Paying your council tax online in Birmingham is a straightforward process when you follow the right steps. By creating an online account, understanding your bill, and utilizing the available payment options, you can efficiently manage your council tax payments. Remember to stay organized, keep your contact information updated, and seek assistance when needed. With these tips, you can ensure a smooth and stress-free experience while contributing to the local services and infrastructure in Birmingham.

Frequently Asked Questions

What happens if I miss a council tax payment deadline?

+Missing a council tax payment deadline can result in penalties and additional charges. Birmingham City Council may send you a reminder, but it’s important to pay on time to avoid any further complications.

Can I pay my council tax in installments?

+Yes, Birmingham City Council offers the option to pay your council tax in installments. You can choose the number of installments and the frequency that suits your financial situation. Contact their customer support for more details.

Are there any discounts available for council tax payments?

+Yes, Birmingham City Council provides various discounts and exemptions for council tax payments. These may include discounts for single occupants, students, or people with certain disabilities. Check their website for eligibility criteria and application processes.

How can I update my contact information with Birmingham City Council?

+To update your contact information, log in to your online account and navigate to the “My Details” or “Personal Information” section. Here, you can edit your contact details and ensure that Birmingham City Council has the most up-to-date information.

What should I do if I have a query or need further assistance?

+If you have any queries or require further assistance, you can contact Birmingham City Council’s customer support team. They can be reached via phone, email, or live chat. Their contact details are available on their website.