7 Tips To Design The Ultimate Online Council Tax Strategy Now

Introduction to Online Council Tax Strategies

Online council tax strategies have become increasingly popular as more and more people look for ways to save money and optimize their financial situation. With the right approach, you can design an effective strategy to minimize your council tax payments and make the most of your financial resources. In this blog post, we will explore seven essential tips to help you create the ultimate online council tax strategy, ensuring you stay compliant while reducing your financial burden.

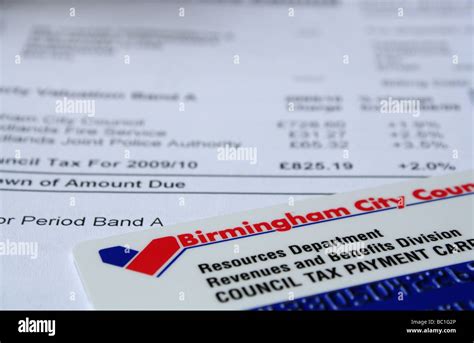

Understanding Council Tax

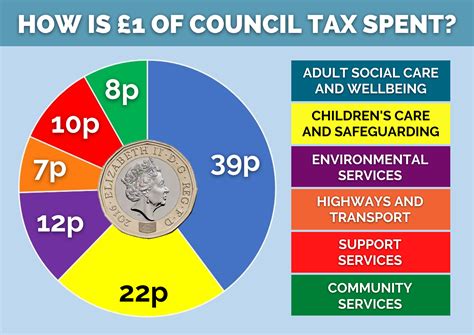

Before diving into the strategies, it’s crucial to have a solid understanding of what council tax is and how it works. Council tax is a local tax levied by local authorities in the United Kingdom to fund various public services, including local government administration, fire services, and environmental initiatives. It is typically paid by households and is based on the value of their property.

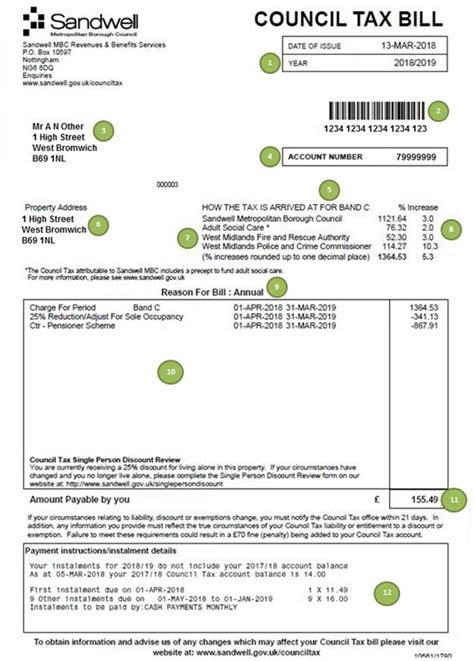

Council tax is usually calculated based on the property’s valuation band, which ranges from A to H, with band A being the lowest and band H being the highest. The tax rate increases with higher valuation bands, meaning properties in band H will pay more council tax than those in band A. It’s important to note that council tax is not a one-size-fits-all tax; the rates can vary significantly between different local authorities.

Tip 1: Research and Compare Local Authorities

One of the first steps in designing your online council tax strategy is to research and compare different local authorities. Each local authority has its own council tax rates and bands, so it’s essential to understand the variations and choose the one that aligns with your financial goals.

You can start by visiting the official websites of local authorities in your area or using online comparison tools that provide information on council tax rates and services offered. Look for authorities that offer lower tax rates or provide better value for money in terms of the services they deliver.

For example, some local authorities may have lower council tax rates but invest more in local amenities, such as parks, libraries, or community centers. On the other hand, others might have higher rates but offer more extensive services, including better waste management or improved transportation infrastructure.

Tip 2: Explore Council Tax Reduction Schemes

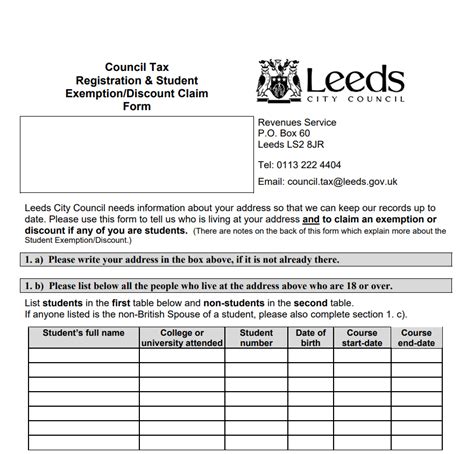

Many local authorities offer council tax reduction schemes to help eligible individuals and households reduce their tax burden. These schemes are designed to support those on low incomes, the unemployed, or people with certain disabilities. Understanding the eligibility criteria and applying for these schemes can significantly reduce your council tax payments.

To find out if you qualify for a council tax reduction, visit the official website of your local authority or contact their customer service team. They will guide you through the application process and provide information on the necessary documentation and evidence required.

Keep in mind that the eligibility criteria and reduction amounts can vary between local authorities, so it’s crucial to research and compare the options available to you. Some authorities may offer a flat-rate reduction, while others might provide a percentage-based reduction based on your income or circumstances.

Tip 3: Optimize Your Property Valuation

The valuation of your property plays a significant role in determining your council tax band and, consequently, the amount you pay. It’s essential to ensure that your property is correctly valued to avoid overpaying. Here are a few ways to optimize your property valuation:

Check Recent Sales: Keep an eye on recent property sales in your area. If similar properties have sold for significantly lower prices, it may indicate that your property is overvalued. You can use online property websites or contact local estate agents to gather this information.

Appeal Against an Incorrect Valuation: If you believe your property has been incorrectly valued, you have the right to appeal. Contact your local authority’s valuation office and explain your concerns. They will review your case and may adjust your valuation band if necessary.

Consider Property Improvements: Making improvements to your property, such as adding an extension or renovating certain areas, can impact its valuation. Ensure that you inform your local authority about these improvements to avoid any discrepancies in your council tax calculations.

Tip 4: Pay Your Council Tax on Time

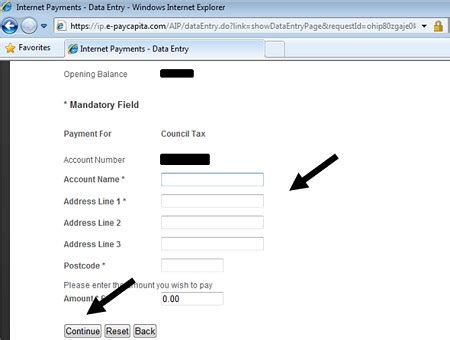

Prompt payment of your council tax is crucial to avoid late payment penalties and additional charges. Most local authorities offer various payment options, including direct debit, online payments, or payment by phone. Choose the method that suits you best and ensure you meet the deadlines to avoid any financial penalties.

If you are struggling to pay your council tax on time, it’s important to contact your local authority as soon as possible. They may be able to offer flexible payment plans or provide guidance on accessing financial support to help you manage your payments.

Tip 5: Utilize Online Tools and Resources

The internet is a powerful tool when it comes to managing your council tax affairs. There are numerous online resources and tools available to help you stay organized, calculate your tax liability, and explore potential savings. Here are a few online resources to consider:

Council Tax Calculators: Online council tax calculators can provide an estimate of your council tax based on your property’s valuation band and the local authority’s rates. These calculators are a great way to get an initial idea of your tax liability.

Comparison Websites: Comparison websites can help you compare council tax rates and services offered by different local authorities. These platforms often provide valuable insights and allow you to make informed decisions about which authority suits your needs best.

Online Payment Portals: Most local authorities have online payment portals where you can manage your council tax account, view your balance, and make payments conveniently. These portals often offer additional features, such as setting up direct debits or viewing your payment history.

Tip 6: Stay Informed About Council Tax Changes

Council tax rates and regulations can change from year to year, so it’s important to stay informed about any updates or modifications. Local authorities are required to publish their council tax rates and any proposed changes on their official websites. Make it a habit to check these websites regularly or subscribe to their newsletters to receive updates directly.

By staying informed, you can anticipate any changes in your council tax liability and plan your financial strategy accordingly. This also allows you to take advantage of any new initiatives or schemes introduced by your local authority that may benefit you.

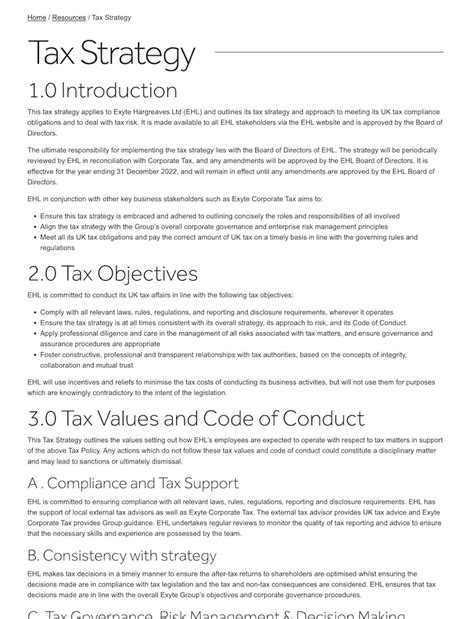

Tip 7: Consider Professional Advice

If you find yourself in a complex financial situation or have specific circumstances that impact your council tax liability, it may be beneficial to seek professional advice. Tax advisors or financial consultants can provide expert guidance tailored to your individual needs.

A professional advisor can help you navigate the intricacies of council tax, identify potential savings, and ensure you are claiming all the benefits and reductions you are entitled to. They can also assist with appealing against incorrect valuations or challenging unfair council tax bands.

Conclusion

Designing an effective online council tax strategy requires a combination of research, comparison, and optimization. By understanding the council tax system, exploring reduction schemes, optimizing your property valuation, and staying informed about changes, you can significantly reduce your financial burden. Remember to pay your council tax on time, utilize online tools, and consider professional advice when needed. With these tips in mind, you can create a well-rounded strategy to manage your council tax obligations effectively.

FAQ

How often do council tax rates change?

+

Council tax rates can change annually, typically in April. Local authorities set their rates based on their financial needs and the services they provide. It’s important to stay updated on any changes to your local authority’s rates.

Can I appeal against my council tax band?

+

Yes, you have the right to appeal against your council tax band if you believe it is incorrect. Contact your local authority’s valuation office and provide evidence to support your case. They will review your appeal and make a decision.

Are there any exemptions or discounts available for council tax?

+

Yes, there are various exemptions and discounts available for council tax. These include discounts for single occupants, students, people with disabilities, and those on certain benefits. Check with your local authority to see if you qualify for any of these exemptions.

Can I pay my council tax in installments?

+

Most local authorities offer the option to pay your council tax in installments. Contact your local authority to discuss payment plans and find out the available options. They may require you to set up a direct debit or make regular payments by other means.

What happens if I don’t pay my council tax on time?

+

If you fail to pay your council tax on time, you may incur late payment penalties and additional charges. Your local authority may also take legal action to recover the outstanding amount. It’s important to communicate with your local authority if you are facing financial difficulties and explore payment options.