7 Ways To Design The Ultimate Housing Benefit Income Strategy Today

When it comes to maximizing your housing benefits and optimizing your income, there are several strategic approaches you can take. In this article, we will explore seven effective ways to design an ultimate housing benefit income strategy, empowering you to make the most of your financial resources and achieve a comfortable living situation.

1. Understand Your Eligibility and Entitlements

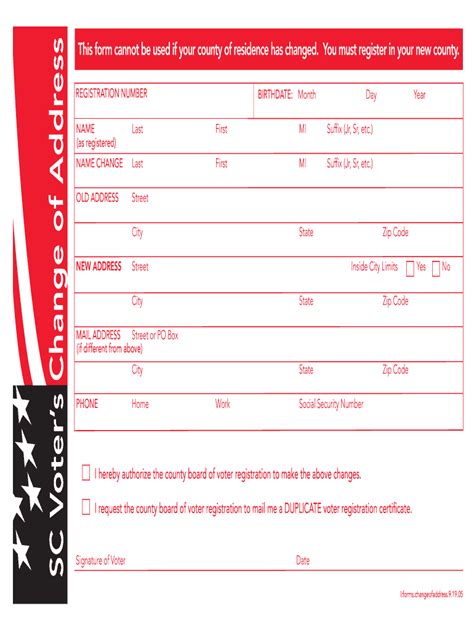

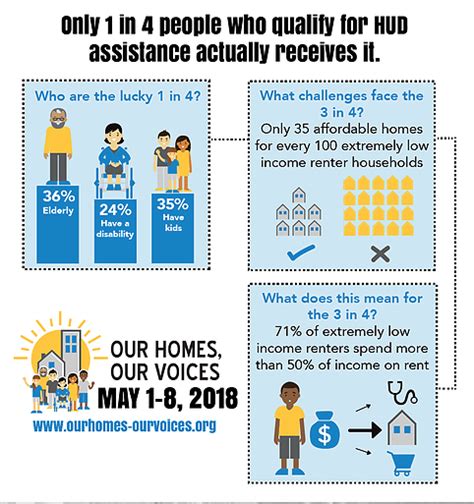

The first step in designing an effective housing benefit income strategy is to gain a comprehensive understanding of your eligibility for various housing assistance programs. Research and familiarize yourself with the criteria and requirements set by your local or national government. Explore options such as rental assistance, housing vouchers, or subsidized housing programs tailored to low-income individuals or families.

By knowing your eligibility, you can identify the programs that align with your specific circumstances and needs. Consider factors such as income level, family size, and any additional support you may require. Understanding your entitlements will enable you to make informed decisions and maximize the benefits available to you.

2. Explore Rental Assistance Programs

Rental assistance programs are designed to provide financial support to eligible individuals or families struggling to afford their rent. These programs typically offer a subsidy or voucher that covers a portion of the rental costs, making housing more affordable and accessible. Research and apply for rental assistance programs in your area to alleviate the financial burden of rent and stabilize your housing situation.

When exploring rental assistance options, consider the following:

- Income limits: Ensure your income falls within the eligibility criteria for the program.

- Application process: Familiarize yourself with the application requirements and gather the necessary documentation.

- Waiting lists: Some programs may have waiting lists, so plan accordingly and apply well in advance.

3. Take Advantage of Housing Vouchers

Housing vouchers, also known as Section 8 vouchers, are a powerful tool to help low-income households afford decent and safe housing. These vouchers cover a significant portion of the rental costs, allowing tenants to choose suitable housing options that meet their needs. By utilizing housing vouchers, you can access a wider range of rental properties and negotiate more favorable rental terms.

To make the most of housing vouchers, consider the following tips:

- Research eligible properties: Explore the list of approved rental units and find options that align with your preferences and budget.

- Negotiate with landlords: Leverage the voucher as a bargaining tool to negotiate lower rents or additional amenities.

- Understand voucher rules: Familiarize yourself with the rules and regulations associated with housing vouchers to ensure compliance.

4. Consider Subsidized Housing Options

Subsidized housing programs offer affordable rental options to low-income individuals and families. These programs typically involve partnerships between government agencies and private landlords, resulting in reduced rental rates. By opting for subsidized housing, you can secure stable and affordable housing while benefiting from potential additional support services.

When considering subsidized housing, keep the following in mind:

- Eligibility criteria: Ensure you meet the income and other requirements set by the program.

- Application process: Follow the application guidelines and provide the necessary documentation.

- Wait times: Subsidized housing programs often have waiting lists, so plan ahead and apply early.

5. Maximize Income through Employment and Benefits

Increasing your income is a crucial aspect of improving your financial stability and accessing better housing options. Explore employment opportunities that align with your skills and interests, aiming for stable and well-paying jobs. Additionally, familiarize yourself with the benefits and support programs available to low-income individuals, such as tax credits, child care assistance, or healthcare subsidies.

To maximize your income and benefits, consider the following strategies:

- Job search resources: Utilize online job boards, career centers, and networking events to find suitable employment opportunities.

- Skill development: Invest in education or training programs to enhance your skills and increase your earning potential.

- Benefits enrollment: Research and apply for relevant benefits programs to supplement your income and reduce financial strain.

6. Practice Effective Budgeting and Financial Management

Efficient budgeting and financial management are essential skills to ensure your housing benefit income strategy is successful. Create a comprehensive budget that outlines your income, expenses, and savings goals. Prioritize essential expenses such as rent, utilities, and groceries, while also setting aside funds for unexpected costs or emergencies.

To enhance your budgeting skills, follow these tips:

- Track expenses: Use budgeting apps or spreadsheets to monitor your spending and identify areas for improvement.

- Set financial goals: Define short-term and long-term financial goals, such as saving for a security deposit or building an emergency fund.

- Seek financial advice: Consult with financial advisors or counselors who can provide personalized guidance and support.

7. Explore Alternative Housing Arrangements

If traditional rental options are not feasible or affordable, consider exploring alternative housing arrangements. Shared housing, such as renting a room in a shared apartment or house, can significantly reduce living costs. Additionally, consider co-living spaces or intentional communities that offer affordable housing options along with a sense of community and shared resources.

When exploring alternative housing, keep the following in mind:

- Safety and comfort: Ensure the alternative housing arrangement meets your safety and comfort standards.

- Lease agreements: Understand the terms and conditions of the lease or agreement before committing.

- Community guidelines: Familiarize yourself with any community rules or expectations to ensure a harmonious living environment.

Conclusion

Designing an effective housing benefit income strategy requires a combination of research, planning, and proactive decision-making. By understanding your eligibility, exploring rental assistance programs, utilizing housing vouchers, considering subsidized housing options, maximizing income, practicing effective budgeting, and exploring alternative housing arrangements, you can create a stable and comfortable living situation. Remember, each step in this process contributes to your overall financial well-being and empowers you to make informed choices about your housing and income.

How long does it take to receive rental assistance or housing vouchers?

+

The wait time for rental assistance or housing vouchers can vary depending on the program and demand. It is recommended to apply as early as possible to increase your chances of receiving assistance within a reasonable timeframe.

Can I choose any rental property with a housing voucher?

+

While housing vouchers provide flexibility in choosing rental properties, there may be certain eligibility criteria and approval processes involved. It is important to research and understand the requirements of the voucher program to ensure a smooth rental process.

Are there any age restrictions for subsidized housing programs?

+

Age restrictions for subsidized housing programs may vary depending on the specific program and local regulations. It is advisable to check the eligibility criteria for each program to determine if there are any age-related requirements.