Apply For Council Tax Reduction

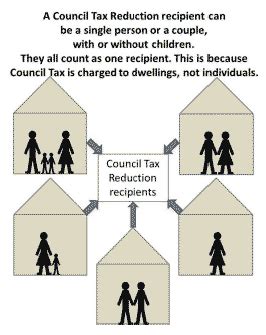

Council Tax Reduction (CTR) is a financial support scheme offered by local councils in the United Kingdom to help eligible individuals and households with their council tax payments. If you're struggling to meet your council tax obligations, applying for CTR can provide much-needed relief. Here's a comprehensive guide on how to apply for Council Tax Reduction.

Eligibility Criteria

Before applying, it's crucial to understand the eligibility criteria for Council Tax Reduction. Generally, you may be eligible if you meet the following conditions:

- You are a resident of the United Kingdom.

- You are responsible for paying council tax.

- Your income and savings fall within the specified limits set by your local council.

- You are not a full-time student (unless certain conditions are met).

- You are not in receipt of certain benefits, such as Universal Credit with housing costs included.

It's important to note that eligibility criteria can vary slightly between different local councils. Therefore, it's essential to check with your local council's website or contact them directly to obtain accurate and up-to-date information regarding eligibility.

Application Process

The application process for Council Tax Reduction typically involves the following steps:

-

Gather Required Documentation

Before starting your application, ensure you have the necessary documentation ready. This may include:

- Proof of identity (e.g., passport, driving license)

- Proof of address (e.g., recent utility bill, council tax bill)

- Bank statements or other income-related documents

- Details of any benefits you receive

- Information about your household members and their income/benefits

-

Contact Your Local Council

Get in touch with your local council's benefits or council tax department. You can find their contact details on their website or by searching for their official contact information.

-

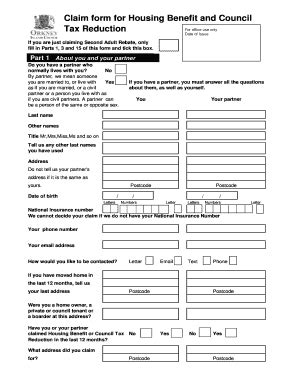

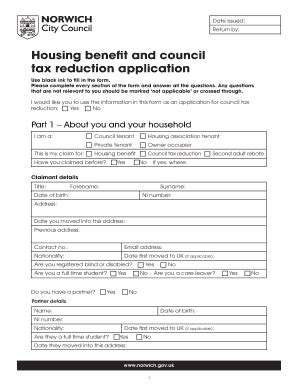

Request an Application Form

Inform the council that you wish to apply for Council Tax Reduction. They will provide you with the necessary application form, which may be available online or in person.

-

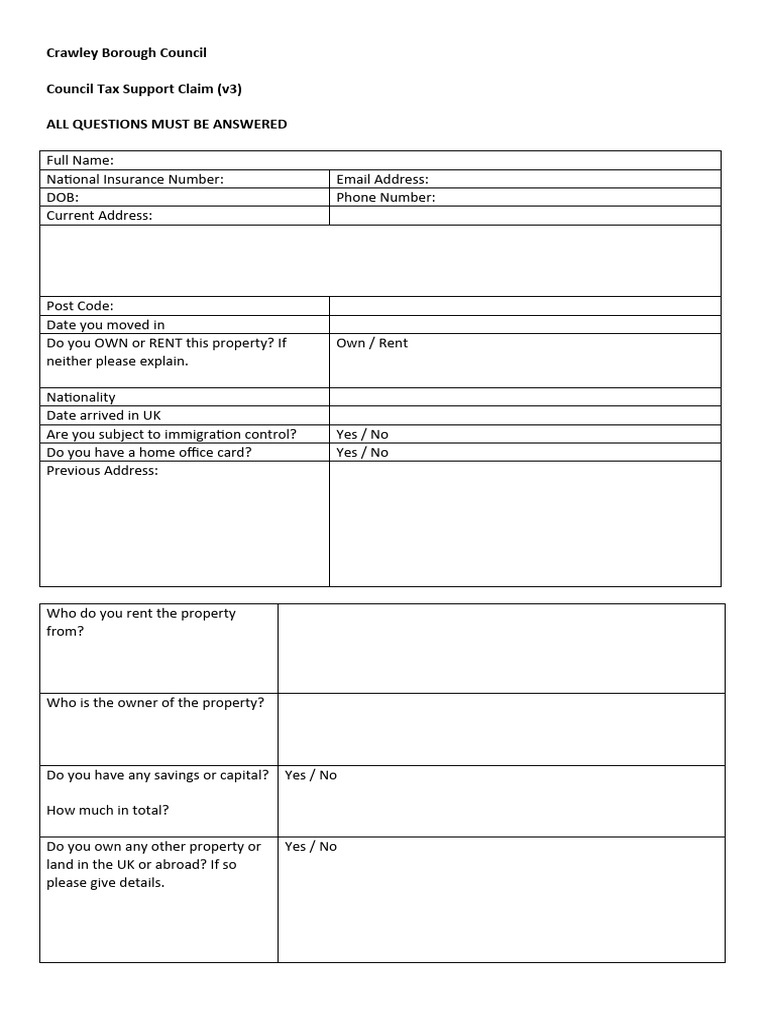

Complete the Application Form

Fill out the application form accurately and provide all the required information. Be sure to include details about your income, savings, and any benefits you receive.

-

Submit Supporting Documents

Along with the completed application form, you will need to submit the supporting documents mentioned earlier. Ensure that all documents are up-to-date and clearly legible.

-

Return the Application

Return the completed application form and supporting documents to your local council. You can do this by post, email, or in person, depending on the council's preferred method.

Assessment and Decision

Once your application is received, the local council will assess your eligibility and calculate the potential reduction in your council tax. This process may take some time, so be patient.

The council will consider various factors, including your income, savings, household size, and any applicable discounts or exemptions. They will use a complex formula to determine the amount of reduction you may be entitled to.

After the assessment, you will receive a decision letter from the council. This letter will inform you whether you have been successful in your application and the amount of Council Tax Reduction you are eligible for.

Notes

🌟 Note: It's crucial to keep your council informed of any changes in your circumstances, such as a change in income or household composition. Failure to do so may result in overpayments or incorrect benefits.

📝 Note: Some councils may require you to provide additional information or attend an interview as part of the assessment process. Be prepared to cooperate and provide any necessary documentation.

💰 Note: Council Tax Reduction is means-tested, which means your income and savings will be taken into account. It's important to provide accurate and up-to-date financial information to ensure a fair assessment.

Appealing a Decision

If you disagree with the council's decision, you have the right to appeal. The appeal process may vary depending on your local council, but typically involves the following steps:

-

Request a Review

Contact the council and request a review of your application. Explain the reasons why you believe the decision is incorrect or unfair.

-

Provide Additional Information

If necessary, provide any new or additional information that may support your appeal. This could include evidence of changed circumstances or errors in the council's calculations.

-

Wait for the Review Decision

The council will review your case and provide a decision. They may uphold the original decision, modify it, or grant your appeal in full.

-

Consider Further Action

If you are still dissatisfied with the review decision, you may have the option to take your case to an independent tribunal or seek legal advice.

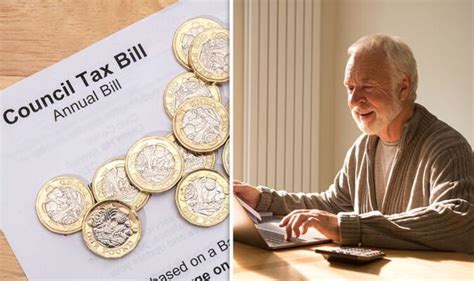

Receiving Your Council Tax Reduction

If your application for Council Tax Reduction is successful, the council will notify you of the amount you are entitled to and the method of payment. Common payment methods include:

- A reduction in your council tax bill

- A refund for overpaid council tax

- A direct payment to your bank account

It's important to keep track of your council tax payments and ensure that you receive the correct reduction amount. If there are any discrepancies, contact your local council promptly.

Conclusion

Applying for Council Tax Reduction can provide much-needed financial support for those struggling to meet their council tax obligations. By understanding the eligibility criteria, following the application process, and providing accurate information, you can increase your chances of receiving the support you need. Remember to keep your council informed of any changes in your circumstances and appeal if you believe the decision is unfair. With the right approach, Council Tax Reduction can make a significant difference in managing your financial responsibilities.

FAQ

What is the income limit for Council Tax Reduction?

+The income limit for Council Tax Reduction varies depending on your local council and household composition. It is typically calculated based on your income and savings, with certain allowances for dependent children or other eligible individuals.

Can I apply for Council Tax Reduction if I am a full-time student?

+In most cases, full-time students are not eligible for Council Tax Reduction. However, there are certain exceptions, such as if you are a student with a disability or if you are a care leaver. It’s best to check with your local council for specific guidelines.

How long does the Council Tax Reduction application process usually take?

+The application process can vary in duration, but it typically takes several weeks to a few months. The time frame depends on the complexity of your case, the volume of applications received by the council, and the efficiency of their processing systems.

Can I apply for Council Tax Reduction if I already receive other benefits?

+Yes, you can apply for Council Tax Reduction even if you receive other benefits. However, the amount of Council Tax Reduction you receive may be affected by the benefits you already receive. It’s important to declare all benefits and income sources accurately on your application.

What happens if I don’t pay my council tax after receiving Council Tax Reduction?

+If you fail to pay your council tax after receiving Council Tax Reduction, the council may take legal action against you. This could result in a court order, debt collection, or even bailiff enforcement. It’s important to keep up with your council tax payments, even with the reduction, to avoid further complications.