Basic Bank Account

Opening a basic bank account is a simple and essential step towards financial independence and security. In today's digital age, having access to banking services is more important than ever, especially for those who may face challenges or restrictions when it comes to traditional banking options. This guide will walk you through the process of opening a basic bank account, highlighting the benefits, requirements, and steps involved.

What is a Basic Bank Account?

A basic bank account, also known as a starter or foundational account, is a type of banking service designed to cater to individuals who may have limited access to traditional banking due to various reasons, such as a lack of credit history, poor credit score, or financial difficulties. These accounts offer a secure and convenient way to manage your money, make transactions, and access essential financial services.

Unlike standard bank accounts, basic accounts often come with fewer features and may have certain restrictions. However, they provide a great starting point for building a positive banking relationship and improving your financial situation.

Benefits of a Basic Bank Account

- Financial Inclusion: Basic bank accounts promote financial inclusion by providing access to banking services for individuals who may not qualify for traditional accounts. This includes the ability to receive payments, pay bills, and make purchases online.

- Budgeting and Money Management: These accounts offer a structured way to manage your finances. You can easily track your income and expenses, set up direct debits for regular payments, and plan your budget effectively.

- Security and Convenience: With a basic bank account, you can protect your money and make secure transactions. Online banking features allow you to access your account anytime, anywhere, providing convenience and peace of mind.

- Building Credit History: By maintaining a positive account balance and making timely payments, you can gradually build a positive credit history. This can improve your financial reputation and increase your chances of accessing better banking services in the future.

Eligibility and Requirements

Basic bank accounts are typically designed for individuals who may have difficulty opening a standard account. Here are some common eligibility criteria:

- Age: Most banks require you to be at least 18 years old to open an account independently. However, some banks may offer joint accounts for minors with a parent or guardian.

- Residency: You will need to provide proof of residency, such as a utility bill or lease agreement, to verify your address.

- Identification: Valid identification documents, such as a passport, driver's license, or national ID card, are required to open an account.

- Credit History: While basic accounts are designed for those with limited or poor credit, some banks may still conduct a credit check. However, the requirements are often more flexible compared to standard accounts.

Step-by-Step Guide to Opening a Basic Bank Account

- Research Banks: Start by researching different banks and their basic account offerings. Compare features, fees, and eligibility criteria to find the best option for your needs.

- Gather Documents: Prepare the necessary documents, such as identification, proof of residency, and any other required paperwork. Having these ready will streamline the application process.

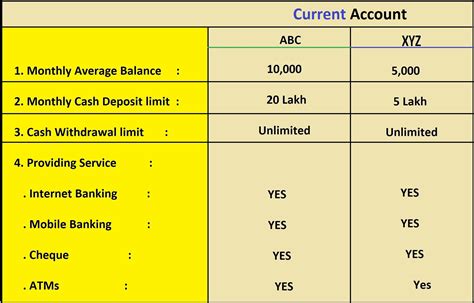

- Choose an Account Type: Decide on the type of basic account that suits your needs. Some banks offer different variations, such as current accounts, savings accounts, or both.

- Apply Online or In-Person: Most banks allow you to apply for a basic account online through their website. Alternatively, you can visit a local branch and speak with a banking representative.

- Provide Information: During the application process, you will be asked to provide personal details, such as your name, address, and contact information. Ensure the information is accurate and up-to-date.

- Set Up Security Measures: Choose a unique and secure password for your online banking. You may also be required to set up additional security measures, such as a PIN or biometric authentication.

- Verify Your Identity: Depending on the bank's procedures, you may need to verify your identity through video call or in-person visit. This step ensures the security of your account.

- Fund Your Account: Once your account is approved, you can fund it by transferring money from another account or making a cash deposit at an ATM or branch.

- Activate Your Card: If your account comes with a debit card, you will need to activate it by following the instructions provided by the bank. This usually involves calling a designated number and providing your personal details.

- Explore Account Features: Take the time to familiarize yourself with the features and benefits of your basic bank account. This includes understanding transaction limits, overdraft options, and any associated fees.

Tips for Managing Your Basic Bank Account

- Set Up Direct Debits: Automate your regular payments, such as rent, utilities, and subscriptions, by setting up direct debits. This ensures timely payments and helps you avoid late fees.

- Monitor Your Balance: Regularly check your account balance and transaction history to stay on top of your finances. This will help you identify any unusual activities and manage your budget effectively.

- Avoid Overdraft Fees: Basic accounts may have limited overdraft facilities or none at all. Keep track of your spending to avoid incurring overdraft fees or penalties.

- Consider a Joint Account: If you're opening an account with a partner or family member, consider a joint account. This allows for shared financial management and can be a great way to build trust and financial responsibility.

Common Questions and Concerns

Here are some frequently asked questions about basic bank accounts:

-

Can I upgrade my basic account to a standard account later on?

Answer: Yes, most banks allow you to upgrade your account once you meet certain criteria, such as maintaining a positive account balance or improving your credit score. -

Are there any monthly fees associated with basic accounts?

Answer: Some basic accounts may have monthly fees, while others offer fee-free options. It's important to review the terms and conditions before opening an account. -

Can I access my account through mobile banking?

Answer: Many basic accounts provide mobile banking apps, allowing you to manage your account on the go. Check with your chosen bank to ensure mobile access. -

What happens if I need to close my basic account?

Answer: You can close your account by contacting the bank and following their closure procedures. Ensure you settle any outstanding balances or fees before closing.

Conclusion

Opening a basic bank account is a crucial step towards financial empowerment and stability. By following the steps outlined in this guide, you can navigate the process with ease and enjoy the benefits of having a secure and accessible banking service. Remember to choose an account that aligns with your needs and take advantage of the features and resources provided by your chosen bank. With a basic bank account, you can take control of your finances and work towards a brighter financial future.

What is the difference between a basic bank account and a standard account?

+

Basic bank accounts offer a simplified set of features and may have restrictions on overdrafts or credit facilities. Standard accounts, on the other hand, provide a full range of banking services, including overdrafts, credit cards, and more.

Can I open a joint basic bank account with my spouse or partner?

+

Yes, many banks allow joint basic accounts, which can be a great way to manage shared finances and build financial responsibility together.

Are there any age restrictions for opening a basic bank account?

+

Most banks require individuals to be at least 18 years old to open an account independently. However, some banks offer joint accounts for minors with a parent or guardian.