Birmingham City Council Tax Bands

Understanding Birmingham's city council tax bands is essential for residents and property owners alike. These tax bands determine the amount of council tax you are required to pay, which contributes to the funding of local services and infrastructure. In this blog post, we will delve into the different council tax bands in Birmingham, explore how they are calculated, and provide insights into the factors that influence these bands.

Council Tax Bands in Birmingham

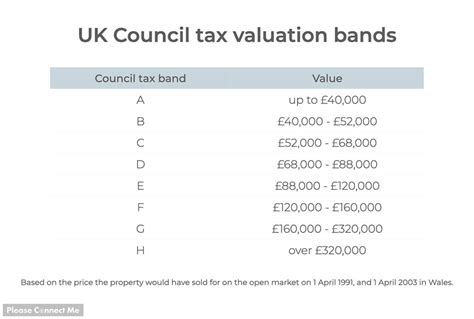

Birmingham, being the largest city in the United Kingdom outside of London, has a diverse range of properties, each falling into specific council tax bands. These bands are categorized alphabetically, from A to H, with each band representing a different property value range.

Here's an overview of the council tax bands in Birmingham, along with the approximate property values they correspond to:

| Council Tax Band | Property Value Range |

|---|---|

| Band A | Up to £40,000 |

| Band B | £40,001 - £52,000 |

| Band C | £52,001 - £68,000 |

| Band D | £68,001 - £88,000 |

| Band E | £88,001 - £120,000 |

| Band F | £120,001 - £160,000 |

| Band G | £160,001 - £320,000 |

| Band H | Over £320,000 |

It's important to note that these values are approximate and may vary slightly based on the specific location and characteristics of the property. The council tax bands are primarily determined by the property's value as of 1st April 1991, which is the date used as a reference for council tax assessments.

How Council Tax Bands are Calculated

The calculation of council tax bands involves a complex process that takes into account various factors. Here's a simplified breakdown of how the bands are determined:

- Property Valuation: The first step is to assess the value of the property as of 1st April 1991. This valuation is typically conducted by the local authority or a designated valuation officer.

- Valuation Bands: Once the property's value is determined, it is assigned to one of the council tax bands (A to H) based on its relative position within the local property market.

- Council Tax Rates: Each council tax band is associated with a specific rate, which is set by the local authority. This rate is applied to the property's valuation band to calculate the annual council tax liability.

- Discounts and Exemptions: Certain properties may be eligible for discounts or exemptions from council tax. For example, unoccupied properties or those occupied by students may qualify for reduced rates or temporary exemptions.

It's worth mentioning that council tax rates can vary between different local authorities, even within the same city. This is because each local authority has the autonomy to set its own council tax rates based on the services and infrastructure it provides.

Factors Influencing Council Tax Bands

Several factors come into play when determining the council tax bands for properties in Birmingham. Understanding these factors can help property owners and residents anticipate potential changes in their council tax liabilities.

- Property Value: The most significant factor is the property's value as of 1st April 1991. Properties with higher values are typically placed in higher council tax bands, resulting in a higher annual council tax bill.

- Location: The location of the property within Birmingham can also impact its council tax band. Properties in more desirable or affluent areas may be assigned to higher bands due to their higher market value.

- Property Characteristics: The size, type, and condition of the property can influence its council tax band. For instance, larger properties or those with unique features may be valued higher and placed in higher bands.

- Council Tax Reforms: Over time, local authorities may introduce reforms or changes to the council tax system. These reforms can impact the valuation process, band boundaries, or the rates applied to each band.

It's important for property owners and residents to stay informed about any changes or reforms to the council tax system in Birmingham. Local authorities often provide information and guidance on their websites, and it's advisable to consult these resources for the most up-to-date and accurate information.

Appealing Council Tax Bands

If you believe that your property has been incorrectly valued or placed in the wrong council tax band, you have the right to appeal. The appeals process involves providing evidence and justifications to support your case. Here's a general overview of the steps involved in appealing your council tax band:

- Check Your Valuation: Start by checking the valuation of your property as of 1st April 1991. You can obtain this information from your local authority or by searching online property databases.

- Compare with Similar Properties: Research the council tax bands of similar properties in your area. This can help you identify any discrepancies or potential errors in your property's valuation.

- Gather Evidence: Collect evidence to support your appeal, such as recent property sales in your area, expert valuations, or any relevant documentation that demonstrates the incorrect valuation.

- Submit an Appeal: Contact your local authority's valuation office or the Valuation Tribunal Service to initiate the appeal process. Provide them with the evidence you have gathered and explain your reasons for appealing.

- Wait for a Decision: The valuation office or tribunal will review your appeal and make a decision. They may request additional information or conduct further investigations before reaching a conclusion.

🛈 Note: The appeals process can be complex, and it's advisable to seek professional advice or assistance if you are unsure about any aspect of the process.

Council Tax Support and Discounts

For individuals or households facing financial difficulties, there are support schemes and discounts available to help reduce the burden of council tax payments. These schemes are designed to ensure that council tax remains affordable for those who need it most.

- Council Tax Support: Many local authorities offer council tax support schemes to eligible residents. These schemes provide financial assistance by reducing the amount of council tax individuals or households are required to pay. The eligibility criteria and support amounts vary between local authorities, so it's important to check with your local council for specific details.

- Discounts for Specific Circumstances: Certain circumstances may qualify you for council tax discounts. For example, if you are a single adult living alone in a property, you may be entitled to a 25% discount. Additionally, properties that are unoccupied or occupied by full-time students may also be eligible for temporary discounts or exemptions.

To find out more about the support and discount options available to you, contact your local authority's council tax team or visit their website. They will be able to provide you with the necessary information and guidance based on your specific circumstances.

Council Tax Payment Options

There are various payment options available for council tax, providing flexibility and convenience to residents. Understanding these options can help you choose the most suitable method for your circumstances.

- Direct Debit: Setting up a direct debit is a popular and convenient way to pay your council tax. You can choose to pay in full or spread the payments over 10 months. Direct debit ensures that your payments are automatically deducted from your bank account, making it a hassle-free option.

- Online Payments: Many local authorities offer online payment portals, allowing you to make secure payments using your debit or credit card. This option provides immediate confirmation of your payment and is available 24/7.

- Phone Payments: If you prefer to pay over the phone, you can contact your local authority's council tax team and make a payment using your debit or credit card details.

- Cash Payments: Some local authorities accept cash payments for council tax. You can visit designated payment locations, such as post offices or council offices, to make your payments in person.

- Cheque Payments: Cheque payments are also an option, although they may take longer to process. You can send your cheque along with the payment slip to the address provided by your local authority.

It's important to note that late or missed payments may result in penalties and additional charges. Therefore, it's advisable to choose a payment method that aligns with your financial situation and ensures timely payments.

Conclusion

Understanding Birmingham's council tax bands is crucial for residents and property owners to manage their financial obligations effectively. By familiarizing yourself with the different bands, the calculation process, and the factors that influence them, you can anticipate your council tax liabilities and take advantage of any available support or discounts. Remember to stay informed about any changes or reforms to the council tax system and reach out to your local authority for guidance and assistance whenever needed.

How often are council tax bands reviewed in Birmingham?

+

Council tax bands in Birmingham are typically reviewed and adjusted every few years to reflect changes in property values and market conditions. Local authorities have the authority to review and modify the bands to ensure fairness and accuracy.

Can I request a revaluation of my property’s council tax band?

+

Yes, if you believe that your property has been incorrectly valued or placed in the wrong council tax band, you can request a revaluation. Contact your local authority’s valuation office to initiate the revaluation process and provide any supporting evidence.

Are there any discounts available for multiple occupancy properties?

+

Yes, some local authorities offer discounts for multiple occupancy properties, such as shared houses or flats. These discounts are typically based on the number of occupants and the size of the property. Check with your local authority for specific eligibility criteria.

Can I pay my council tax in installments?

+

Yes, most local authorities allow residents to pay their council tax in installments. You can usually choose to pay in full or spread the payments over a set period, typically 10 months. Contact your local authority to set up a payment plan that suits your financial situation.

What happens if I fail to pay my council tax on time?

+

If you fail to pay your council tax on time, you may receive a reminder notice from your local authority. If the payment remains overdue, further action may be taken, including the issuance of a liability order, which can result in additional charges and potential enforcement measures.