Birmingham Council Tax Email

The Birmingham Council Tax email system is a convenient and efficient way for residents to communicate with the local authority regarding their council tax queries and concerns. This digital platform offers a user-friendly interface, ensuring a seamless experience for taxpayers to manage their accounts and stay updated on relevant information. In this blog post, we will explore the various aspects of the Birmingham Council Tax email service, providing valuable insights and guidance for taxpayers.

Understanding Birmingham Council Tax

Council tax is a crucial aspect of local government funding in the United Kingdom, and Birmingham, being the second-largest city in the country, has a well-established system for collecting and managing this tax. Understanding the basics of council tax is essential for residents to navigate the process effectively.

Council tax is a mandatory payment made by homeowners and tenants to the local authority, which contributes to the funding of various public services and amenities. These services include local policing, fire services, waste management, and the maintenance of public spaces, among others. It is a vital source of income for local governments, ensuring the smooth operation of essential services.

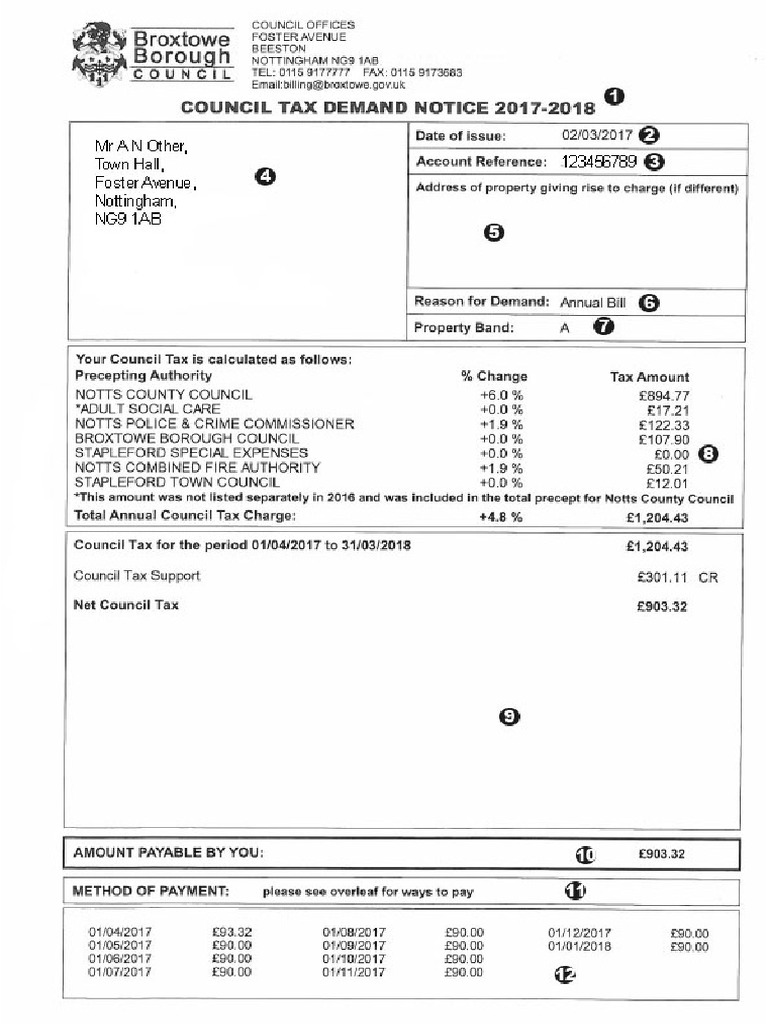

In Birmingham, the council tax system is designed to be fair and equitable, taking into account the value of properties and the financial circumstances of taxpayers. The tax is calculated based on the property's valuation band, with higher-value properties attracting a higher tax rate. However, there are various discounts and exemptions available to certain individuals and households, making the system more flexible and accommodating.

The Role of Birmingham Council Tax Email

The Birmingham Council Tax email service plays a pivotal role in facilitating communication between taxpayers and the local authority. It offers a convenient and accessible platform for residents to inquire about their council tax obligations, seek clarification on billing issues, and resolve any disputes or concerns they may have.

By utilizing the email system, taxpayers can avoid the hassle of long waiting times on the phone or the need to visit the council offices in person. Instead, they can send their queries or provide the necessary information via email, receiving prompt responses and updates from dedicated council tax advisors.

The email service is particularly beneficial for individuals who prefer a more private and discreet method of communication. It allows taxpayers to discuss sensitive financial matters or personal circumstances without the need for face-to-face interaction. This level of confidentiality can be reassuring for those who may feel uncomfortable discussing their financial situation openly.

How to Use the Birmingham Council Tax Email Service

Using the Birmingham Council Tax email service is straightforward and user-friendly. Here’s a step-by-step guide to help you navigate the process:

-

Access the Council's Website: Start by visiting the official website of Birmingham City Council. The website serves as a comprehensive hub for all council-related services, including council tax.

-

Locate the Contact Section: Navigate to the "Contact Us" or "Contact" section of the website. This section typically provides various contact options, including email, phone, and online forms.

-

Choose the Email Option: Select the email option from the available contact methods. You will be directed to a page where you can enter your details and compose your message.

-

Provide Necessary Information: Fill in the required fields with your personal details, such as your name, contact information, and council tax account number (if available). This information helps the council identify your account and provide accurate responses.

-

Compose Your Message: In the message box, clearly state the nature of your inquiry or concern. Be as specific as possible to ensure a prompt and relevant response. Provide any relevant documents or supporting information as attachments if necessary.

-

Submit Your Email: Once you have drafted your message and attached any required documents, click on the "Send" or "Submit" button to send your email to the council tax team.

-

Wait for a Response: After submitting your email, you can expect a response from the council tax advisors within a reasonable timeframe. The response time may vary depending on the complexity of your inquiry and the volume of emails received by the council.

It is important to note that the Birmingham Council Tax email service is primarily intended for general inquiries and non-urgent matters. For more urgent or complex issues, it is recommended to contact the council tax team directly via phone or in-person appointments.

Common Council Tax Queries and How to Address Them

Taxpayers often have various questions and concerns regarding their council tax obligations. Here are some common queries and the steps you can take to address them effectively:

1. Checking Your Council Tax Balance

If you want to check your current council tax balance, you can do so by logging into your online council tax account. Most local authorities provide an online portal where taxpayers can access their account information, including their balance and payment history. Simply follow these steps:

-

Visit the council's website and locate the "My Account" or "Online Services" section.

-

Enter your login credentials (username and password) to access your account.

-

Once logged in, navigate to the "Council Tax" or "Balance" section to view your current balance.

If you have forgotten your login details or encounter any issues accessing your account, you can contact the council's customer service team for assistance.

2. Updating Personal Details

It is essential to keep your personal details up-to-date with the council to ensure accurate billing and correspondence. If you have recently moved, changed your name, or experienced any other significant changes, you should inform the council tax department. Here’s how you can update your personal details:

-

Visit the council's website and locate the "Change of Circumstances" or "Update Personal Details" section.

-

Follow the instructions provided on the website to submit your changes online. You may need to provide supporting documentation, such as a marriage certificate or proof of address.

-

Alternatively, you can contact the council tax team via email or phone to inform them of the changes and provide the necessary information.

3. Applying for Council Tax Discounts or Exemptions

Birmingham City Council offers various discounts and exemptions to eligible taxpayers. If you believe you qualify for any of these benefits, you can apply through the council’s website. Here’s a simplified process to apply for discounts or exemptions:

-

Visit the council's website and locate the "Council Tax Discounts and Exemptions" section.

-

Review the different types of discounts and exemptions available, such as single occupancy discount, disability reduction, or student exemption.

-

Choose the applicable discount or exemption and follow the online application process. You may need to provide supporting evidence, such as proof of student status or disability certificates.

-

Once your application is submitted, the council will assess your eligibility and inform you of the outcome.

4. Disputing Council Tax Bills

In the event that you disagree with your council tax bill or believe there has been an error, you have the right to dispute it. The council tax team is equipped to handle such disputes and resolve them fairly. Here’s a step-by-step guide to disputing your council tax bill:

-

Review your council tax bill carefully, noting any discrepancies or errors.

-

Contact the council tax team via email or phone to discuss the issue. Provide specific details about the dispute, such as the incorrect valuation band or any changes in your circumstances that may affect your tax liability.

-

The council tax advisors will investigate your claim and may request additional information or documentation to support your case.

-

Once the investigation is complete, the council will inform you of their decision and any necessary adjustments to your council tax bill.

Tips for Effective Communication via Email

To ensure a smooth and efficient communication process when using the Birmingham Council Tax email service, consider the following tips:

-

Be Clear and Concise: When drafting your email, aim to be clear and concise. Provide all the necessary details and relevant information to help the council tax advisors understand your query or concern. Avoid rambling or including unnecessary information that may distract from your main point.

-

Use a Professional Tone: Maintain a professional and respectful tone in your email communication. Remember that you are interacting with a government organization, so a polite and courteous approach is appreciated.

-

Attach Relevant Documents: If you have any supporting documents or evidence to substantiate your claim or inquiry, attach them to your email. This can include property deeds, tenancy agreements, or any other relevant paperwork.

-

Follow Up if Needed: If you have not received a response to your email within a reasonable timeframe, it is acceptable to send a polite follow-up email. However, be mindful of the council's response times and avoid sending excessive follow-up emails, as this may delay the process.

Conclusion

The Birmingham Council Tax email service offers a convenient and accessible platform for taxpayers to communicate with the local authority regarding their council tax queries and concerns. By following the steps outlined in this blog post, you can effectively utilize this service to address your council tax matters. Remember to provide clear and concise information, maintain a professional tone, and attach any relevant documents to ensure a prompt and accurate response from the council tax advisors. With the right approach, you can navigate the council tax system with ease and ensure a positive experience as a taxpayer in Birmingham.

FAQ

How often should I check my council tax balance online?

+

It is recommended to check your council tax balance online regularly, at least once a month. This allows you to stay updated on your payment status and identify any discrepancies or changes promptly.

Can I make council tax payments online?

+

Yes, most local authorities, including Birmingham City Council, offer online payment options for council tax. You can log into your online account and choose the payment method that suits you, such as direct debit or credit/debit card.

What happens if I fail to pay my council tax on time?

+

If you miss a council tax payment, the council may send you a reminder notice. If you continue to miss payments, you may face legal action, including court proceedings and the potential for enforcement measures, such as a court-ordered repayment plan or even the seizure of goods.

Are there any support services available for council tax payers in financial difficulty?

+

Yes, Birmingham City Council recognizes that some taxpayers may face financial challenges. They offer support services and advice to help individuals manage their council tax payments. You can contact the council’s financial support team to discuss your options and explore potential solutions.

Can I appeal a council tax valuation band if I believe it is incorrect?

+

Yes, you have the right to appeal a council tax valuation band if you believe it is incorrect. The process involves submitting an appeal to the Valuation Office Agency (VOA), which is responsible for determining property valuations for council tax purposes. You can find more information and guidance on the VOA’s website.