Carers Credit Form

The Carers Credit form is a vital document for those who provide care and support to others, ensuring their valuable contributions are recognized and rewarded. This form plays a crucial role in the UK's social security system, allowing carers to claim credits towards their state pension, even if they are not employed or self-employed. By completing and submitting this form, carers can protect their future financial security and gain access to essential benefits.

Understanding the Carers Credit Form

The Carers Credit form is specifically designed for individuals who dedicate their time and energy to caring for family members, friends, or loved ones who require support due to illness, disability, or old age. It is an official document provided by the Department for Work and Pensions (DWP) in the UK, enabling carers to claim credits for the periods they spend caring, thus contributing to their National Insurance record.

These credits are essential as they help carers build up their National Insurance record, which is a requirement for receiving a state pension. Without sufficient National Insurance credits, individuals may not be eligible for the full state pension, making the Carers Credit form a vital tool for ensuring financial stability in retirement.

Who Can Apply for Carers Credit?

Carers who meet the following criteria are eligible to apply for Carers Credit:

- They must be caring for someone for at least 20 hours a week.

- The person they are caring for must be eligible for certain benefits, such as Attendance Allowance or Personal Independence Payment.

- The carer should not be employed or self-employed during the period for which they are claiming Carers Credit.

- They should be aged 16 or over but below the State Pension age.

It's important to note that Carers Credit is not available for those who are already claiming certain benefits, such as Jobseeker's Allowance or Employment and Support Allowance. Additionally, carers who are receiving Carer's Allowance automatically get Carers Credit and do not need to apply separately.

How to Apply for Carers Credit

Applying for Carers Credit is a straightforward process, and the DWP provides a dedicated online application form. Here's a step-by-step guide to help you through the application process:

Step 1: Check Your Eligibility

Before applying, ensure you meet the eligibility criteria mentioned above. You can also use the Carers Credit eligibility checker on the government website to confirm your eligibility.

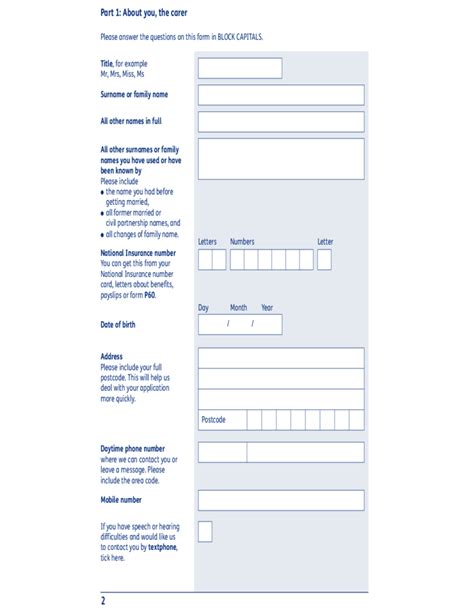

Step 2: Gather Necessary Information

Collect the following information before starting your application:

- Your National Insurance number and the National Insurance number of the person you care for.

- Details of the benefits the person you care for is receiving.

- Your contact information, including your address, phone number, and email.

Step 3: Access the Online Application Form

Visit the Carers Credit application page on the government website. Here, you'll find the online application form, which is user-friendly and easy to navigate.

Step 4: Complete the Application Form

Fill in the application form with the information you've gathered. Ensure you provide accurate and up-to-date details to avoid any delays in processing your application.

Step 5: Submit Your Application

Once you've completed the form, review it carefully to ensure all the information is correct. Then, submit your application. You'll receive a confirmation email or letter acknowledging your application.

Step 6: Wait for a Decision

After submitting your application, the DWP will assess your eligibility and make a decision. You'll be informed of the outcome via post or email. If your application is successful, you'll receive a letter confirming your Carers Credit and its impact on your National Insurance record.

Benefits of Carers Credit

Applying for Carers Credit offers several advantages, including:

- Building Your National Insurance Record: Carers Credit helps you build up your National Insurance record, ensuring you meet the requirements for a full state pension when you reach State Pension age.

- Financial Security in Retirement: By claiming Carers Credit, you can protect your future financial stability and avoid any gaps in your National Insurance record, which could impact your state pension entitlement.

- Recognition for Your Caring Role: Carers Credit acknowledges the valuable contribution of carers, ensuring they are not penalized for their selfless dedication to others.

Frequently Asked Questions (FAQ)

Here are some common questions and answers about the Carers Credit form:

Can I apply for Carers Credit if I am employed or self-employed?

+

No, you must not be employed or self-employed during the period for which you are claiming Carers Credit. Carers Credit is designed to support those who are not in paid employment while caring for someone.

Do I need to apply for Carers Credit every year?

+

No, once you have applied and been approved for Carers Credit, you do not need to reapply each year. However, you should inform the DWP if your circumstances change, such as if you start working or if the person you care for no longer receives the necessary benefits.

Can I claim Carers Credit retrospectively for past periods of care?

+

Yes, you can claim Carers Credit for past periods of care, but there are time limits. You can claim up to three years retrospectively if you meet the eligibility criteria for those periods. It's important to apply as soon as possible to avoid missing out on any credits.

What happens if I receive Carers Credit but later start working or claiming other benefits?

+

If your circumstances change and you start working or claiming other benefits, you should inform the DWP immediately. They will assess your situation and determine if you are still eligible for Carers Credit. Any overpaid credits may need to be repaid.

Conclusion

The Carers Credit form is a powerful tool for carers to secure their financial future and gain recognition for their selfless dedication. By applying for Carers Credit, individuals can ensure they meet the requirements for a full state pension and avoid any gaps in their National Insurance record. The online application process is simple and accessible, making it easy for carers to take control of their financial well-being. Remember, if you have any questions or need further assistance, you can always reach out to the DWP for guidance and support.