Claiming Council Tax Benefit

If you're facing financial challenges and struggling to keep up with your council tax payments, you might be eligible for Council Tax Benefit. This benefit is designed to provide support and ease the burden for those on low incomes. In this comprehensive guide, we will walk you through the process of claiming Council Tax Benefit, step by step, ensuring you understand your rights and the support available.

Understanding Council Tax Benefit

Council Tax Benefit is a financial assistance program offered by local authorities in the United Kingdom. It aims to help individuals and households who are struggling to pay their council tax due to limited financial means. This benefit can significantly reduce the amount of council tax you owe, making it more manageable for those facing financial difficulties.

The benefit is means-tested, which means that your eligibility depends on your income, savings, and certain personal circumstances. It is essential to understand that the rules and criteria for Council Tax Benefit can vary across different local authorities, so it's crucial to check with your local council for specific details.

Who is Eligible for Council Tax Benefit?

Council Tax Benefit is typically available to individuals or households who meet the following criteria:

- Low income: Your income must be below a certain threshold, which can vary depending on your local authority and personal circumstances. This includes earnings from employment, self-employment, or any other sources of income.

- Limited savings: The amount of savings you have can also impact your eligibility. There is usually a limit on the amount of savings you can have while still qualifying for the benefit.

- Personal circumstances: Certain personal circumstances, such as being a student, having a disability, or being a single parent, can affect your eligibility and the amount of benefit you receive.

- Residency: You must be a resident of the property for which you are claiming Council Tax Benefit. Temporary residents or those staying in the property for a short period may not be eligible.

It's important to note that even if you don't meet all the criteria, you may still be entitled to some level of support. It's always recommended to check with your local council to understand your specific situation and the support available to you.

How to Claim Council Tax Benefit

Claiming Council Tax Benefit involves a few simple steps. Here's a step-by-step guide to help you through the process:

Step 1: Check Your Eligibility

Before applying, it's crucial to assess your eligibility. Visit the website of your local council or contact their customer service team to access the necessary forms and guidelines. They will provide you with information specific to your area, including income thresholds and any additional criteria you need to meet.

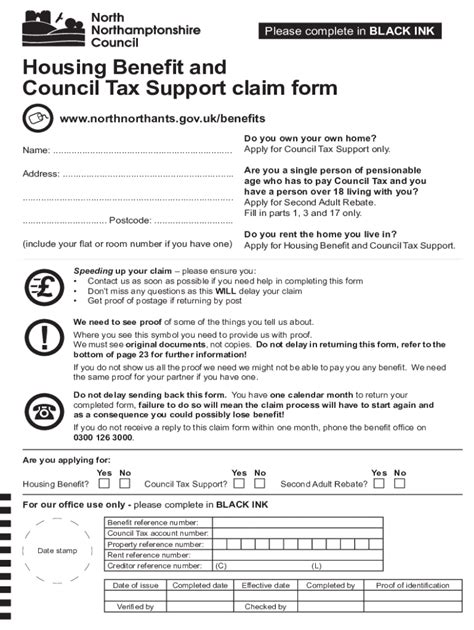

Step 2: Gather the Required Documentation

To apply for Council Tax Benefit, you will need to provide certain documents to support your application. Here's a list of common documents you may need:

- Proof of identity: This can include your passport, driving license, or national insurance card.

- Proof of address: A recent utility bill or bank statement with your current address.

- Income and savings evidence: Pay stubs, bank statements, or tax returns to demonstrate your financial situation.

- Benefit or pension information: If you receive any benefits or pensions, provide the necessary details.

- Council tax bill: A copy of your latest council tax bill will be required to process your application.

Make sure to have these documents readily available when applying to avoid any delays in processing your claim.

Step 3: Complete the Application Form

Once you have gathered the required documentation, it's time to complete the application form. You can usually find this form on your local council's website or request it from their customer service team. Take your time to fill out the form accurately, providing all the necessary information and supporting documents.

If you have any questions or need assistance, don't hesitate to reach out to the council's customer service. They are there to guide you through the process and ensure your application is complete.

Step 4: Submit Your Application

After completing the application form, you can submit it to your local council. You can do this online, by post, or in person, depending on the council's preferred method. Ensure that you meet any deadlines and provide all the required information to avoid any delays in processing your claim.

Once your application is submitted, the council will assess your eligibility and calculate the amount of benefit you are entitled to. They will then inform you of their decision and the next steps.

Understanding the Benefit Calculation

The amount of Council Tax Benefit you receive depends on various factors, including your income, savings, and personal circumstances. The local authority will use a formula to calculate the benefit, taking into account your financial situation and the council tax band of your property.

The benefit is usually calculated as a percentage of your council tax liability. For example, if you are entitled to a 50% reduction, you will only need to pay half of your council tax bill. The remaining amount will be covered by the benefit.

It's important to note that the benefit calculation can be complex, and the rules may vary across different local authorities. If you have any questions or concerns about the calculation, don't hesitate to reach out to your local council for clarification.

Receiving Your Council Tax Benefit

Once your application has been approved, you will start receiving your Council Tax Benefit. The benefit is usually paid directly to your local council, who will then apply it towards your council tax bill. This means you will receive a reduced council tax bill, making it more affordable for you to pay.

The benefit is typically paid in arrears, which means you will receive it after you have paid your council tax. However, in some cases, the council may offer an advance payment to help with immediate financial needs. It's best to discuss this option with your local council if you require immediate assistance.

Review and Renewal

Council Tax Benefit is usually awarded for a specific period, typically a year. However, your circumstances may change during this time, affecting your eligibility. It's important to keep the council informed of any changes in your income, savings, or personal situation.

As your benefit award nears its end, you will need to renew your claim. The council will send you a renewal form, which you must complete and return to continue receiving the benefit. Make sure to respond promptly to avoid any disruptions in your benefit payments.

Appealing a Decision

If your application for Council Tax Benefit is denied or you disagree with the amount awarded, you have the right to appeal the decision. The process for appealing varies depending on your local authority, so it's essential to contact them directly for specific instructions.

Usually, you will need to provide additional evidence or information to support your appeal. It's recommended to seek advice from a citizen's advice bureau or a legal professional to ensure a strong case.

Conclusion

Claiming Council Tax Benefit can provide much-needed financial relief for those facing difficulties paying their council tax. By understanding the eligibility criteria, gathering the necessary documentation, and following the application process, you can access the support you deserve. Remember to keep the local council informed of any changes in your circumstances to ensure you receive the benefit you are entitled to.

Frequently Asked Questions

How often can I claim Council Tax Benefit?

+

You can claim Council Tax Benefit as often as your circumstances require. If your financial situation changes, you can reapply for the benefit. However, it’s important to notify the council of any changes to ensure accurate assessments.

Can I claim Council Tax Benefit if I own my home?

+

Yes, you can claim Council Tax Benefit regardless of whether you own or rent your home. The benefit is based on your income and savings, not your housing status.

Will claiming Council Tax Benefit affect my other benefits?

+

Claiming Council Tax Benefit should not impact your eligibility for other benefits. However, it’s always best to check with the relevant authorities to understand how different benefits interact.

Can I receive Council Tax Benefit if I live with a partner who has a higher income?

+

The eligibility for Council Tax Benefit takes into account the combined income of all residents in the household. If your partner’s income exceeds the threshold, it may affect your eligibility. However, it’s important to check with your local council for their specific rules.

What happens if I don’t pay my council tax even after receiving the benefit?

+

Failing to pay your council tax, even after receiving Council Tax Benefit, can result in legal consequences. The council may take enforcement action, including court proceedings, to recover the outstanding amount. It’s important to communicate with the council if you are facing difficulties paying.