Council Tax: 10+ Tips To Pay Over The Phone With Ease

Introduction: Navigating Council Tax Payments with Confidence

Council tax is an essential financial obligation for homeowners and renters alike. While there are various methods to settle this tax, making payments over the phone can be a convenient and efficient option. In this blog post, we will explore practical tips and guidelines to help you navigate the process of paying council tax over the phone smoothly and effortlessly. By following these suggestions, you can ensure a stress-free and timely payment experience.

Understanding Council Tax

Before diving into the payment process, let’s briefly understand what council tax entails. Council tax is a local tax levied by local authorities in the United Kingdom to fund various public services, including education, waste management, and social care. It is typically based on the value of your property and the number of occupants.

Benefits of Paying Council Tax Over the Phone

Paying council tax over the phone offers several advantages:

- Convenience: You can make payments from the comfort of your home or office without the need to visit a physical location.

- Flexibility: Phone payments often provide options for different payment methods, allowing you to choose the most suitable one for your financial situation.

- Real-time Updates: By paying over the phone, you can receive immediate confirmation and updates on your payment status.

- Personalized Assistance: Speaking directly with a council tax representative can provide personalized guidance and address any specific queries you may have.

Step-by-Step Guide: Paying Council Tax Over the Phone

Step 1: Gather Necessary Information

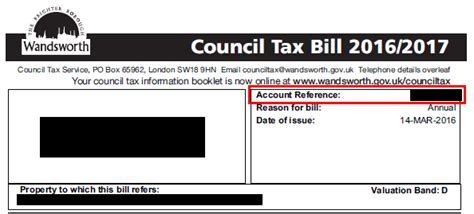

Before initiating the phone call, ensure you have the following details ready:

- Council Tax Account Number: This unique number identifies your council tax account and is essential for accurate processing.

- Payment Amount: Check the amount due on your council tax bill to avoid any discrepancies.

- Payment Method: Decide on the payment method you prefer, such as credit/debit card, direct debit, or other available options.

Step 2: Contact Your Local Council

Locate the contact details of your local council’s council tax department. You can find this information on your council tax bill or their official website. Note down the phone number and any specific instructions for contacting them.

Step 3: Initiate the Call

Dial the provided phone number and follow the automated instructions or wait to be connected to a council tax representative. Be prepared for potential wait times, especially during peak hours.

Step 4: Provide Account Details

When connected to a representative, provide your council tax account number and any other relevant details they may request. This ensures they can access your account information accurately.

Step 5: Choose Payment Method

Inform the representative of your preferred payment method. They will guide you through the process, explaining any necessary steps or requirements.

Step 6: Make the Payment

Follow the instructions provided by the representative to complete the payment. This may involve providing card details, setting up a direct debit, or confirming other payment-related information.

Step 7: Receive Confirmation

Once the payment is processed, request a confirmation reference number or receipt. This serves as proof of payment and can be useful for future reference.

Step 8: Keep Records

After the call, make a note of the payment details, including the date, amount, and confirmation reference. This helps you keep track of your council tax payments and provides evidence in case of any discrepancies.

Additional Tips for a Smooth Payment Experience

- Call During Off-Peak Hours: Avoid calling during busy periods to minimize wait times and ensure a more efficient process.

- Have Your Bill Handy: Keep your council tax bill nearby for easy reference and to verify the payment amount.

- Use a Quiet Environment: Choose a quiet location to make the call, ensuring you can hear the representative clearly and provide accurate information.

- Consider Online Payment Options: Explore alternative payment methods, such as online banking or mobile apps, which may offer additional convenience and flexibility.

Managing Council Tax Arrears

If you find yourself facing council tax arrears, it’s crucial to take proactive steps to resolve the situation. Here are some tips to manage council tax arrears effectively:

- Contact Your Local Council: Reach out to your local council’s council tax department to discuss your arrears and explore potential payment plans or arrangements.

- Seek Financial Advice: Consult a financial advisor or debt charity to receive professional guidance on managing your financial situation and council tax arrears.

- Set Up a Payment Plan: Work with your local council to establish a realistic payment plan that aligns with your financial capabilities.

- Avoid Ignoring Notices: Ignoring council tax arrears notices can lead to further penalties and legal consequences. Respond promptly to avoid unnecessary complications.

Staying Informed and Up-to-Date

To ensure a smooth council tax payment experience, it’s essential to stay informed about any changes or updates related to council tax payments. Here are some ways to stay informed:

- Visit Official Websites: Regularly check your local council’s official website for any announcements, updates, or changes to council tax payment processes.

- Sign Up for Email Alerts: Subscribe to email newsletters or alerts from your local council to receive timely notifications about council tax-related matters.

- Follow Social Media Channels: Engage with your local council’s social media accounts, such as Twitter or Facebook, to stay updated on council tax news and announcements.

- Attend Local Council Meetings: Participate in local council meetings or community events where council tax matters may be discussed, allowing you to stay informed and engaged.

Council Tax Exemptions and Discounts

Understanding council tax exemptions and discounts can help you save money on your council tax payments. Here are some key points to consider:

- Single Occupancy Discount: If you live alone, you may be eligible for a 25% discount on your council tax bill. Check with your local council to determine your eligibility.

- Disability Reduction: Individuals with certain disabilities or long-term illnesses may qualify for a reduction in their council tax bill. Contact your local council to inquire about the specific criteria and application process.

- Council Tax Support: Low-income households may be eligible for council tax support, which can reduce the amount of council tax they need to pay. Check with your local council to understand the eligibility criteria and application procedure.

- Second Home Discount: If you own a second home that is unoccupied, you may be entitled to a discount on the council tax. Consult your local council for more information on this exemption.

Table: Council Tax Payment Methods

| Payment Method | Description |

|---|---|

| Credit/Debit Card | Pay using your credit or debit card details over the phone. |

| Direct Debit | Set up a direct debit instruction to automatically deduct payments from your bank account. |

| Online Banking | Utilize your online banking platform to make council tax payments. |

| Mobile Apps | Some local councils offer dedicated mobile apps for convenient council tax payments. |

| Cheque | Send a cheque along with your council tax bill payment slip. |

Conclusion: Simplifying Council Tax Payments

Paying council tax over the phone can be a straightforward and convenient process when armed with the right information and tips. By following the step-by-step guide and implementing the additional suggestions provided, you can navigate council tax payments with ease and confidence. Remember to stay informed, explore available exemptions and discounts, and seek assistance if needed to ensure a stress-free council tax experience.

FAQ Section

What happens if I miss a council tax payment over the phone?

+

Missing a council tax payment can result in late payment fees and potential legal consequences. It’s important to make timely payments to avoid penalties. If you encounter any issues with your payment, contact your local council immediately to discuss potential solutions.

Can I pay council tax over the phone using a credit card?

+

Yes, most local councils accept credit card payments over the phone. However, it’s important to note that some councils may charge a small fee for using a credit card. Check with your local council to confirm their policy regarding credit card payments.

Are there any alternative payment methods for council tax?

+Yes, apart from paying over the phone, you can also make council tax payments online, through mobile apps, by post, or in person at designated payment locations. Explore the options provided by your local council to find the most convenient payment method for you.

How can I dispute a council tax bill over the phone?

+If you wish to dispute a council tax bill, it’s best to contact your local council’s council tax department directly. They will guide you through the process of appealing or disputing the bill. It’s important to provide supporting evidence and explain your reasons for the dispute.

Can I pay council tax in installments over the phone?

+Yes, many local councils offer the option to pay council tax in installments over the phone. This can be especially helpful if you prefer a more manageable payment plan. Contact your local council to inquire about their installment payment options and the necessary steps to set up such an arrangement.