Council Tax Amount

Understanding Council Tax Amounts: A Comprehensive Guide

Council Tax is a crucial aspect of local government funding in the United Kingdom, playing a vital role in providing essential services to communities. This guide aims to provide a comprehensive understanding of Council Tax amounts, including how they are calculated, the factors influencing them, and the steps individuals can take to manage their Council Tax obligations effectively.

What is Council Tax and How is it Calculated?

Council Tax is a local taxation system in the UK, levied by local authorities to fund various public services, such as education, social care, and local infrastructure. The amount of Council Tax due is based on the value of a property and the number of people living in it.

The calculation of Council Tax involves a complex process that takes into account various factors, including:

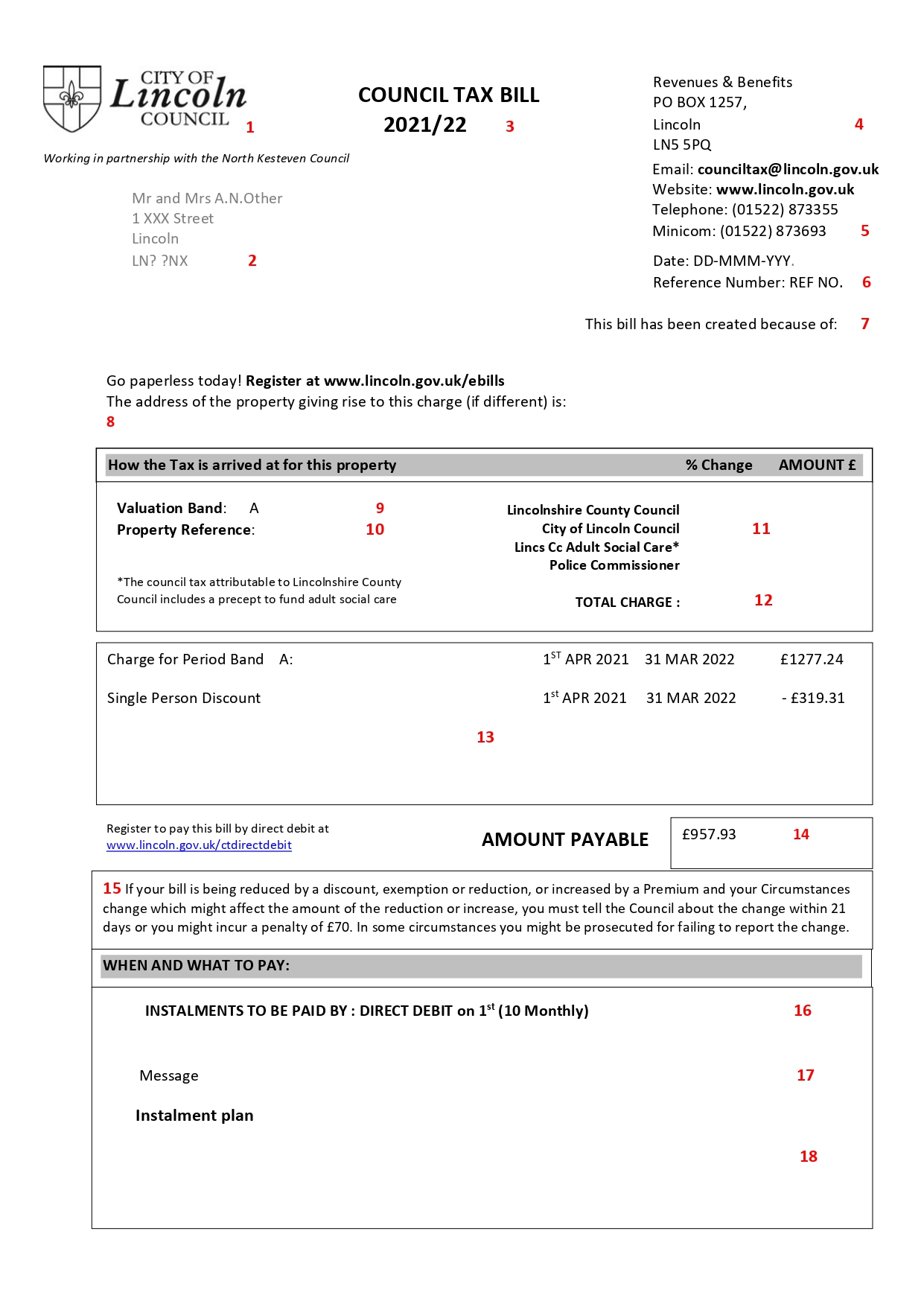

Property Value: The valuation of a property is a significant determinant of Council Tax. Properties are assigned to one of eight bands (A to H) based on their estimated value as of 1 April 1991 (in England and Scotland) or 1 April 2003 (in Wales). The higher the band, the higher the Council Tax.

Number of Occupants: The number of people residing in a property also impacts the Council Tax amount. Properties with a higher number of occupants may be eligible for discounts or exemptions.

Local Authority Rates: Each local authority sets its own Council Tax rates, which can vary significantly across the country. These rates are based on the budget required to fund local services and are expressed as a percentage of the property’s band value.

Discounts and Exemptions: Certain individuals or properties may be eligible for discounts or exemptions, reducing the amount of Council Tax due. These can include discounts for single-occupancy properties, exemptions for full-time students, or reductions for people on low incomes or with certain disabilities.

Factors Influencing Council Tax Amounts

Several factors can influence the amount of Council Tax an individual or household is required to pay. These include:

Property Value Fluctuations: Changes in property values can lead to adjustments in Council Tax bands, resulting in higher or lower tax liabilities.

Local Authority Budget Changes: Local authorities may adjust their Council Tax rates annually to account for changes in the cost of providing local services. These changes can impact the overall tax burden on residents.

Occupancy Changes: The number of people living in a property can change over time due to various reasons, such as family members moving in or out, or changes in relationship status. These changes can impact the Council Tax liability, as discounts or exemptions may apply based on the number of occupants.

Discount or Exemption Eligibility: The criteria for discounts and exemptions can vary, and individuals may become eligible or ineligible for these benefits over time due to changes in their personal circumstances or local authority policies.

Managing Your Council Tax Obligations

Understanding your Council Tax obligations and taking steps to manage them effectively can help ensure you are not overpaying and that you are aware of any discounts or exemptions you may be entitled to. Here are some tips:

Check Your Band and Valuation: Regularly review your Council Tax band and property valuation to ensure they are accurate. If you believe your band is incorrect, you can challenge it through the local authority’s valuation process.

Apply for Discounts or Exemptions: If you believe you are eligible for a discount or exemption, contact your local authority to apply. Keep in mind that you may need to provide supporting documentation to prove your eligibility.

Consider Direct Debit Payments: Setting up a direct debit for your Council Tax payments can help you avoid late payment charges and ensure your payments are made on time.

Review Your Bill: Carefully review your Council Tax bill each year to understand the breakdown of charges and ensure there are no errors. If you have any questions or concerns, contact your local authority for clarification.

Seek Advice: If you are struggling to pay your Council Tax or have questions about your bill, seek advice from local advice centers or citizen advice bureaus. They can provide guidance on managing your Council Tax obligations and accessing any support you may be entitled to.

Conclusion

Council Tax is a complex but essential system that funds vital local services. By understanding how Council Tax is calculated, the factors that influence it, and the steps you can take to manage your obligations, you can ensure you are paying the correct amount and accessing any discounts or exemptions you may be entitled to. Regular review and engagement with your local authority can help you stay on top of your Council Tax obligations and contribute effectively to your community.

What happens if I don’t pay my Council Tax?

+

Failure to pay Council Tax can result in legal action, including court summons, debt recovery proceedings, and, in extreme cases, bailiff action. It is important to communicate with your local authority if you are struggling to pay, as they may be able to offer support or arrange a payment plan.

How can I challenge my Council Tax band?

+

If you believe your Council Tax band is incorrect, you can challenge it by contacting your local authority’s valuation office. They will guide you through the process, which may involve providing evidence to support your claim.

Are there any support programs for low-income households regarding Council Tax?

+

Yes, there are various support programs available for low-income households. These can include Council Tax Reduction schemes, which provide financial assistance based on income and circumstances. It is worth checking with your local authority to understand the specific support available in your area.

Can I pay my Council Tax in installments?

+

Many local authorities offer the option to pay Council Tax in installments. Contact your local authority to discuss payment plans and the available options. It is important to keep up with your agreed-upon payments to avoid additional charges.

Are there any online tools to help me estimate my Council Tax?

+

Yes, several online tools and calculators are available to help estimate your Council Tax based on your property’s band and local authority. These can provide a rough estimate, but it is important to consult your local authority for an accurate calculation.