Council Tax Band Costs Uk

Council tax is a crucial aspect of living in the United Kingdom, as it contributes to the funding of local services and infrastructure. Understanding the different council tax bands and their associated costs is essential for homeowners and renters alike. In this comprehensive guide, we will delve into the intricacies of council tax bands, how they are determined, and the costs associated with each.

What is Council Tax and How is it Calculated?

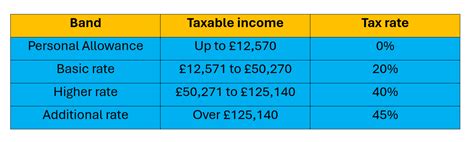

Council tax is a local taxation system in the UK, used to fund local government services. It is a property-based tax, meaning it is levied on residential properties based on their value and location. The tax is calculated using a combination of factors, including the property's valuation band, the number of occupants, and any applicable discounts or exemptions.

The valuation band of a property is determined by its open-market value as of 1st April 1991 in England, Wales, and Scotland, and 1st April 2003 in Northern Ireland. Properties are categorized into bands (A to H) based on their value, with band A representing the lowest value and band H the highest. The higher the band, the higher the council tax liability.

Council Tax Bands and Their Costs

The UK is divided into several council tax bands, each with its own set of properties and corresponding tax rates. The bands are as follows:

- Band A: This is the lowest band, typically reserved for properties with a low market value. Band A properties include smaller flats, bungalows, and houses.

- Band B: Properties in Band B are slightly more valuable than those in Band A. They often include larger semi-detached houses or properties with additional features.

- Band C: Band C encompasses a wide range of properties, including larger semi-detached houses, detached bungalows, and some terraced houses.

- Band D: Properties in Band D are generally more valuable and include larger detached houses, semi-detached properties with additional rooms, or substantial flats.

- Band E: Band E properties are typically larger and more expensive, often featuring substantial detached houses, converted properties, or luxury apartments.

- Band F: Band F is reserved for high-value properties, such as large detached houses with multiple bedrooms, grand terraced houses, or exclusive apartments.

- Band G: Properties in Band G are among the most valuable in the country, often including prestigious detached houses, large country estates, or high-end apartments.

- Band H: Band H is the highest council tax band and includes the most expensive properties in the UK. These properties are often grand mansions, exclusive country estates, or ultra-luxury apartments.

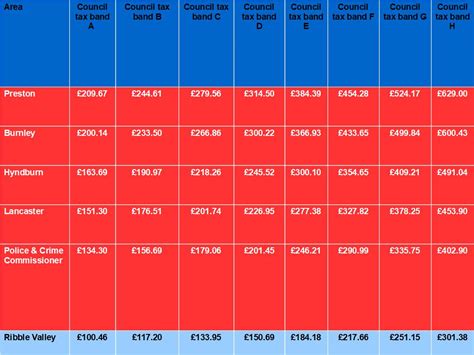

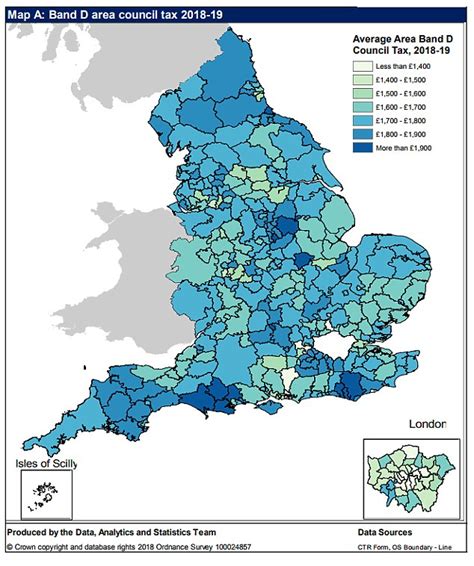

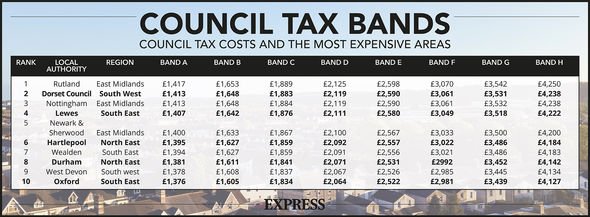

The cost of council tax varies depending on the band and the local authority. Each local authority sets its own council tax rates, which are calculated based on the property's valuation band and the local authority's budget requirements. As a result, council tax rates can differ significantly between regions and even between neighboring local authorities.

Factors Affecting Council Tax Costs

Several factors can influence the cost of council tax for a particular property. These include:

- Property Value: As mentioned earlier, the higher the property's valuation band, the higher the council tax liability.

- Local Authority: Different local authorities have different council tax rates. Some areas may have higher rates to fund specific local services or infrastructure projects.

- Discounts and Exemptions: Certain individuals or households may be eligible for discounts or exemptions on their council tax. This includes discounts for single-occupancy properties, students, and people with certain disabilities.

- Occupancy: The number of people living in a property can also impact council tax costs. Some local authorities offer reduced rates for second homes or properties with multiple occupants.

- Changes in Property Value: If a property's value increases significantly, it may be re-evaluated and moved to a higher council tax band, resulting in higher tax liability.

Council Tax Band Changes and Appeals

Council tax bands can change over time due to various factors, such as changes in property values or local authority budget requirements. If a property's valuation band changes, the council tax liability will also be adjusted accordingly.

Homeowners or renters who believe their property has been incorrectly banded can appeal the decision. The process for appealing a council tax band varies depending on the local authority, but it typically involves providing evidence to support the claim that the property's valuation is inaccurate.

Reducing Council Tax Costs

There are several ways to potentially reduce council tax costs. Some of the most common methods include:

- Applying for Discounts: Check if you are eligible for any discounts or exemptions, such as the single-occupancy discount or the disabled band reduction.

- Council Tax Reduction: If you are on a low income or receiving certain benefits, you may be eligible for a council tax reduction. This can significantly reduce your council tax liability.

- Moving to a Lower Band Property: If you are considering buying or renting a new property, choosing one in a lower council tax band can result in lower annual costs.

- Checking for Errors: Regularly review your council tax bill to ensure there are no errors or discrepancies. If you spot any mistakes, contact your local authority to have them corrected.

Council Tax Payment Options and Penalties

Council tax can be paid in a variety of ways, including by direct debit, online banking, or at local authority offices. It is important to stay up to date with payments to avoid penalties and late payment charges.

If you fail to pay your council tax on time, the local authority may issue a reminder notice. If the debt remains unpaid, further enforcement action can be taken, including court proceedings and the potential for bailiffs to seize goods.

Conclusion

Understanding council tax bands and their associated costs is crucial for anyone living in the UK. By knowing your property's valuation band and the local authority's council tax rates, you can budget effectively and explore potential ways to reduce your council tax liability. Remember to stay informed about any changes to your band and take advantage of discounts or exemptions you may be eligible for.

What is the purpose of council tax?

+

Council tax is a local tax used to fund essential services provided by local authorities, such as waste collection, road maintenance, and social care.

How often do council tax bands change?

+

Council tax bands are typically reviewed every few years, but changes can occur more frequently in some areas due to changes in property values or local authority budgets.

Can I appeal my council tax band?

+

Yes, if you believe your property has been incorrectly banded, you can appeal the decision. The process varies by local authority, but it often involves providing evidence to support your claim.

Are there any discounts or exemptions for council tax?

+

Yes, there are several discounts and exemptions available, including the single-occupancy discount, disabled band reduction, and council tax reduction for low-income households.

What happens if I don’t pay my council tax on time?

+

Failure to pay council tax on time can result in late payment charges, reminder notices, and potential court proceedings. In extreme cases, bailiffs may be instructed to seize goods to cover the debt.