Council Tax Benefit

Understanding Council Tax Benefit: A Guide to Financial Support for UK Residents

Council Tax Benefit is a crucial financial aid program offered by the UK government to assist eligible individuals and households in covering their council tax expenses. This benefit is designed to provide relief to those facing financial challenges, ensuring that they can meet their local taxation obligations without undue hardship.

Who Qualifies for Council Tax Benefit?

Eligibility for Council Tax Benefit is determined by a range of factors, including income, savings, and personal circumstances. Generally, individuals or households with low income, certain benefits, or specific life situations may qualify. It's important to note that the criteria can vary depending on your local authority and personal situation.

Here are some key groups that may be eligible for Council Tax Benefit:

- Unemployed individuals or those on low incomes

- Pensioners receiving Pension Credit

- People on certain benefits, such as Income Support or Universal Credit

- Those with a disability or caring responsibilities

- Students and some non-dependant residents

It's essential to check with your local council or the Gov.uk website for a comprehensive list of eligibility criteria and to understand the specific requirements in your area.

How to Apply for Council Tax Benefit

Applying for Council Tax Benefit is a straightforward process, but it's important to ensure you have the necessary information and documentation ready. Here's a step-by-step guide to help you through the application process:

-

Gather Your Information

Before you start your application, gather the following information:

- Your National Insurance number

- Details of your income and savings (e.g., payslips, bank statements)

- Details of any benefits you receive

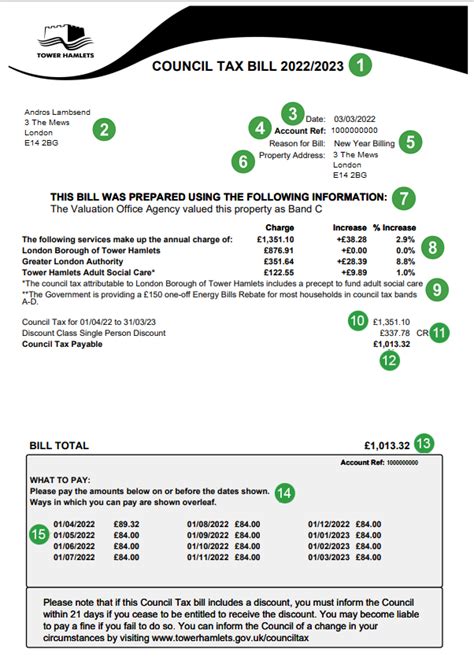

- Information about your council tax bill

-

Choose Your Application Method

You can apply for Council Tax Benefit in several ways:

- Online: Visit the Gov.uk website and follow the application instructions.

- By Phone: Contact your local council's benefits office and apply over the phone.

- In Person: Visit your local council's benefits office and apply in person.

-

Complete the Application Form

Whether you're applying online, by phone, or in person, you'll need to provide the information you gathered in step 1. Be as accurate and detailed as possible to ensure a smooth application process.

-

Submit Your Application

Once you've completed the application form, submit it to your local council. If you're applying online, you'll receive confirmation of your submission. If you're applying by phone or in person, ensure you receive confirmation of your application and the next steps.

-

Provide Additional Information (if required)

In some cases, the council may request additional information or documentation to support your application. Respond promptly to these requests to avoid delays in processing your application.

-

Wait for a Decision

After submitting your application, the council will assess your eligibility and notify you of their decision. This process can take several weeks, so be patient and keep an eye on your post or online account for updates.

Understanding Your Council Tax Benefit Award

If your application for Council Tax Benefit is successful, you'll receive an award letter detailing the amount of benefit you're entitled to and the period it covers. This benefit is typically paid directly to your local council to cover a portion or all of your council tax expenses.

The amount of Council Tax Benefit you receive depends on various factors, including your income, the number of people in your household, and the council tax band of your property. It's important to note that the benefit is means-tested, which means it's calculated based on your financial circumstances.

How to Use Your Council Tax Benefit

Council Tax Benefit is designed to help you cover your council tax expenses. Once you receive your award letter, you can use the benefit in the following ways:

-

Pay Your Council Tax

The benefit is usually paid directly to your local council, reducing the amount of council tax you need to pay. This means you may receive a reduced council tax bill or even have your council tax fully covered by the benefit.

-

Receive a Refund

If you've already paid some or all of your council tax for the period covered by your benefit award, you may be entitled to a refund. The council will inform you of any refund due and how to claim it.

-

Use it for Future Payments

If you haven't paid your council tax yet, the benefit can be used to cover future payments. This means you won't need to worry about making council tax payments out of your own pocket.

Notes

🌟 Note: Remember to keep your personal circumstances up to date with the council. Any changes in your income, benefits, or household composition may affect your Council Tax Benefit award. It's essential to notify the council of any changes to ensure you receive the correct amount of benefit.

🧑🔧 Note: If you're struggling to manage your council tax payments, don't hesitate to seek advice. Contact your local council's benefits office or a debt advice charity for guidance on managing your finances and accessing support.

Conclusion

Council Tax Benefit is a valuable financial support program for UK residents facing financial challenges. By understanding the eligibility criteria, application process, and how to use your benefit award, you can ensure you receive the support you're entitled to. Remember to keep your personal circumstances up to date with the council and seek advice if needed. With the right support, managing your council tax obligations can become more manageable.

FAQ

What is Council Tax Benefit, and who is eligible for it?

+

Council Tax Benefit is a financial aid program that helps eligible individuals and households cover their council tax expenses. Eligibility is based on income, savings, and personal circumstances. Low-income households, pensioners, and those on certain benefits may qualify.

How do I apply for Council Tax Benefit?

+You can apply for Council Tax Benefit online through the Gov.uk website, by phone, or in person at your local council’s benefits office. Ensure you have the necessary information and documentation ready before starting your application.

What happens after I submit my Council Tax Benefit application?

+After submitting your application, the council will assess your eligibility and notify you of their decision. This process can take several weeks. If your application is successful, you’ll receive an award letter detailing the amount of benefit you’re entitled to.

How is my Council Tax Benefit award calculated?

+Your Council Tax Benefit award is calculated based on your income, savings, and personal circumstances. The benefit is means-tested, which means it’s designed to provide support to those who need it most.

Can I use my Council Tax Benefit to pay for other expenses?

+No, Council Tax Benefit is specifically designed to help you cover your council tax expenses. It cannot be used for other types of payments or expenses.