Council Tax Benefits For Pensioners

Pensioners often face unique financial challenges, and understanding the available benefits can be crucial for a comfortable retirement. One such benefit is Council Tax Support (CTS), which provides financial assistance to eligible pensioners. In this comprehensive guide, we will explore the ins and outs of Council Tax Benefits for pensioners, covering eligibility criteria, application processes, and tips for maximizing these benefits.

Understanding Council Tax Support for Pensioners

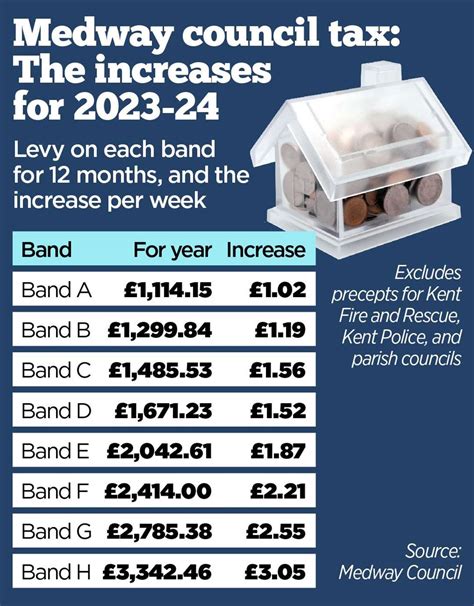

Council Tax Support, previously known as Council Tax Benefit, is a government-funded scheme designed to help low-income households, including pensioners, with their council tax bills. This support can significantly reduce the financial burden of council tax, ensuring that pensioners can afford essential services without compromising their living standards.

Eligibility Criteria

To be eligible for Council Tax Support as a pensioner, you must meet certain criteria:

- Age: You must be of pensionable age, which is typically 65 years or older. However, this age limit may vary depending on your local authority and the date you reached this age.

- Residency: You should be a resident in the property for which you are claiming the benefit. This means that you must live in the property as your main home.

- Income and Savings: Your income and savings play a crucial role in determining your eligibility. Generally, you must have a low income and limited savings to qualify for full or partial support. The specific income and savings thresholds may vary across different local authorities.

- Other Benefits: If you are already in receipt of certain benefits, such as Pension Credit, you may automatically qualify for Council Tax Support.

It's important to note that eligibility criteria can be complex and may vary based on individual circumstances. Therefore, it is advisable to check with your local council or seek advice from a benefits advisor to ensure you meet all the necessary requirements.

Applying for Council Tax Support

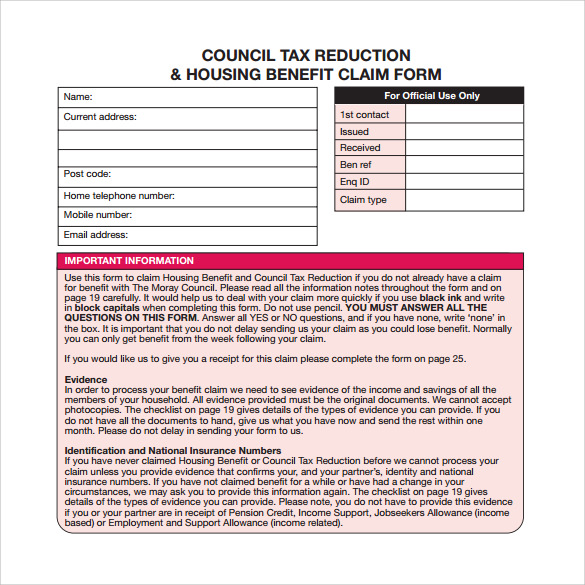

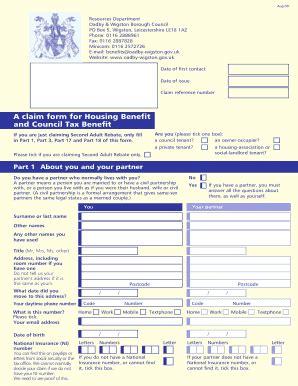

The application process for Council Tax Support is relatively straightforward, but it's essential to follow the correct steps to ensure a successful application:

- Check Your Eligibility: Before applying, verify your eligibility by reviewing the criteria outlined above. You can also use online eligibility checkers provided by some local authorities to get a quick assessment.

- Gather Required Documents: To support your application, you may need to provide various documents, including proof of identity, income, and residency. Make sure you have all the necessary paperwork ready.

- Contact Your Local Council: Reach out to your local council's benefits department. They can provide you with the appropriate application form and guide you through the process. You can usually find their contact details on their website or by searching online.

- Complete the Application Form: Carefully fill out the application form, ensuring all the information is accurate and up-to-date. Provide as much detail as possible to support your claim.

- Submit Your Application: Submit your completed application form along with the required supporting documents. You can usually do this online, by post, or in person at your local council office.

- Wait for a Decision: Once your application is submitted, the local council will assess your eligibility and make a decision. They will notify you of the outcome, which may include the amount of support you are entitled to.

🌟 Note: It's crucial to apply for Council Tax Support as soon as possible, as the process can take some time. Don't wait until you receive your council tax bill to start the application process.

Maximizing Your Council Tax Benefits

To make the most of your Council Tax Support, consider the following tips:

- Understand the Rules: Familiarize yourself with the rules and regulations governing Council Tax Support in your area. This knowledge will help you navigate the process more effectively and ensure you receive the full benefits you are entitled to.

- Keep Your Information Up-to-Date: Inform your local council about any changes in your circumstances, such as a change in income, savings, or residency. This ensures that your benefit amount remains accurate and reflects your current situation.

- Explore Additional Benefits: Council Tax Support is just one of the many benefits available to pensioners. Consider researching other benefits, such as Pension Credit, Winter Fuel Payment, and Attendance Allowance, which can further enhance your financial security.

- Seek Professional Advice: If you are unsure about your eligibility or have complex financial circumstances, it's a good idea to seek advice from a benefits advisor or a financial professional. They can provide personalized guidance and help you maximize your benefits.

Council Tax Support for Specific Circumstances

Council Tax Support can be particularly beneficial for pensioners facing specific circumstances. Here are a few scenarios where Council Tax Support can make a significant difference:

Living Alone

If you are a single pensioner living alone, you may be entitled to a 25% discount on your council tax bill. This discount is known as the Single Person Discount and can provide much-needed financial relief.

Living with a Disabled Person

If you live with a disabled person, you may be eligible for a Disability Reduction on your council tax bill. This reduction can vary depending on the local authority, but it typically ranges from 25% to 50%.

Low-Income Households

Council Tax Support is designed to assist low-income households, including pensioners. If your income and savings fall below the specified thresholds, you may qualify for full or partial support, ensuring you can afford your council tax payments.

Conclusion

Council Tax Support is a valuable benefit for pensioners, offering financial relief and ensuring they can afford essential services. By understanding the eligibility criteria, navigating the application process, and exploring additional benefits, pensioners can maximize their Council Tax Support and secure a more comfortable retirement. Remember, staying informed and seeking professional advice when needed can make a significant difference in accessing the support you deserve.

What is the difference between Council Tax Support and Council Tax Benefit?

+

Council Tax Support is the current name for the scheme, while Council Tax Benefit was the previous name. The scheme provides financial assistance to low-income households, including pensioners, to help them pay their council tax bills.

Can I apply for Council Tax Support if I am not of pensionable age?

+

No, Council Tax Support is primarily designed for pensioners of pensionable age. However, there may be other benefits or support available for individuals who are not of pensionable age. It’s advisable to check with your local council or a benefits advisor for more information.

How often do I need to renew my Council Tax Support claim?

+

The renewal process may vary depending on your local authority and individual circumstances. Typically, you will need to renew your claim annually or whenever there is a significant change in your circumstances. It’s important to stay informed and keep your local council updated to ensure continuous support.