Council Tax Birmingham Contact Number

Struggling to find the right contact number for Council Tax Birmingham? You've come to the right place! In this blog post, we'll guide you through the process of reaching out to the Birmingham City Council regarding your Council Tax queries. Whether you need to discuss payments, apply for discounts, or seek information about your account, we've got you covered. So, let's dive right in and explore the various ways to get in touch with the council efficiently.

Understanding Council Tax Birmingham

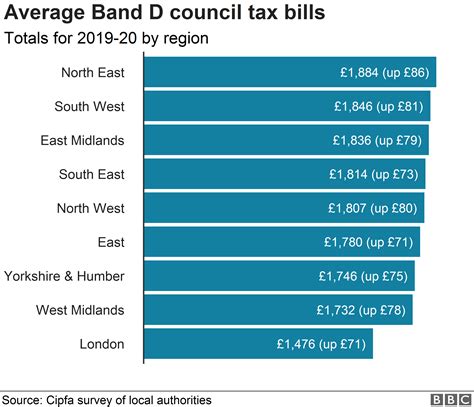

Council Tax is a local tax that residents in England, Scotland, and Wales pay to their local authority. It contributes to the funding of essential services provided by the council, such as waste collection, local police, fire services, and more. Birmingham, being the second-largest city in the UK, has a dedicated team to handle Council Tax-related matters.

Contacting Birmingham City Council for Council Tax Enquiries

When it comes to contacting Birmingham City Council regarding Council Tax, there are several convenient methods available. Let's explore each option:

1. Contact Centre

The Birmingham City Council operates a dedicated contact centre for Council Tax inquiries. You can reach them by calling the following number:

0121 303 9914

This contact centre is open from Monday to Friday, 8 am to 6 pm, and on Saturdays from 9 am to 12 pm. The team is well-equipped to handle a wide range of Council Tax-related queries, including:

- General inquiries about Council Tax

- Payment arrangements and options

- Discounts and exemptions

- Council Tax band queries

- Moving home or changing circumstances

When calling, ensure you have your Council Tax account details handy to speed up the process and receive accurate information.

2. Online Services

For those who prefer a more digital approach, Birmingham City Council offers a range of online services to manage your Council Tax account. You can access these services through their official website, www.birmingham.gov.uk.

Here's a breakdown of the online services available:

- View and Pay Your Council Tax Bill: You can view your current Council Tax bill, make payments, and set up direct debits online. This service is available 24/7, providing you with convenient access to manage your payments.

- Apply for Discounts and Exemptions: If you're eligible for a Council Tax discount or exemption, you can apply online. This includes discounts for single occupancy, students, or people with certain disabilities.

- Report a Change of Circumstances: Moving house, changes in occupancy, or other life events can impact your Council Tax liability. You can report these changes online, ensuring your account is up to date.

- Check Your Council Tax Band: If you have questions about your Council Tax band or believe there may be an error, you can use the online tool to check and compare your property's band.

3. Visiting In-Person

If you prefer a face-to-face interaction, you can visit the Birmingham City Council's Customer Service Centres. These centres are located across the city, offering a convenient way to discuss your Council Tax queries with a council representative.

Here are the details for the main Customer Service Centre:

Address: Birmingham City Council House,

Victoria Square,

Birmingham,

B1 1BB

Opening Hours:

Monday to Friday: 8:30 am to 5 pm

Saturday: 9 am to 12 pm

Please note that due to the ongoing COVID-19 situation, opening hours and services may be subject to change. It's recommended to check the Birmingham City Council website for the latest updates before visiting in person.

4. Writing a Letter

For more formal inquiries or to provide detailed information, you can write a letter to the Council Tax team. Here's the address for correspondence:

Birmingham City Council

Council Tax Team

PO Box 1

Birmingham

B4 6WN

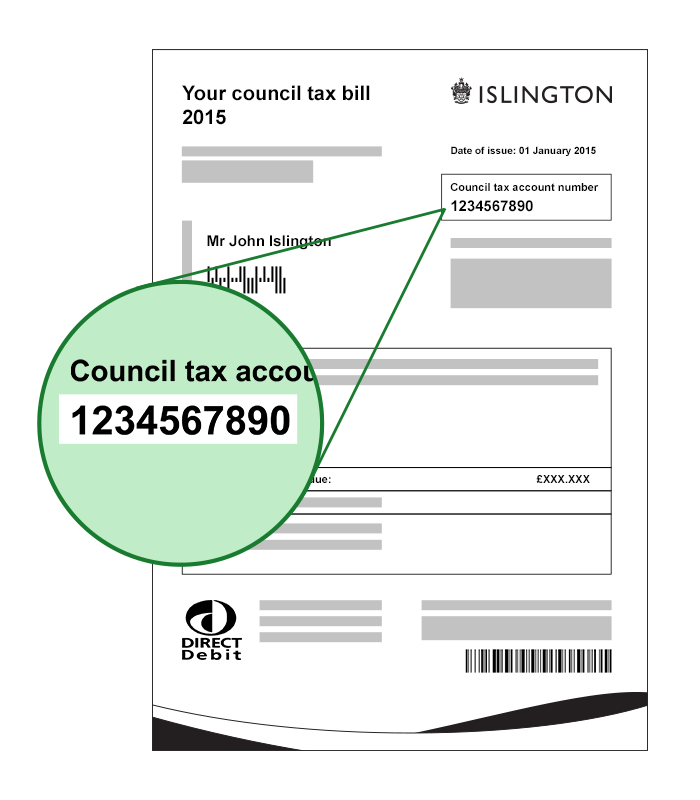

Ensure your letter includes your full name, address, and Council Tax account number for a swift response.

Additional Tips for Effective Communication

To ensure a smooth and efficient communication process, consider the following tips:

- Have your Council Tax account details, including account number and reference, readily available when contacting the council.

- Provide clear and concise information about your query or circumstances to help the council assist you effectively.

- If you're calling, try to call during off-peak hours to avoid long wait times. Early mornings or late afternoons might be less busy.

- Keep a record of your communications with the council, including dates, times, and any reference numbers provided.

Conclusion

Dealing with Council Tax inquiries doesn't have to be a daunting task. Birmingham City Council offers a range of convenient contact methods to assist residents with their Council Tax queries. Whether you choose to call, utilize online services, visit in person, or write a letter, the council is dedicated to providing efficient and helpful support. Remember to have your account details and relevant information ready to ensure a swift resolution to your Council Tax concerns.

How can I check my Council Tax band online?

+

You can check your Council Tax band online by visiting the Birmingham City Council website and using the Council Tax band checker tool. Simply enter your postcode and property details to view your band.

What if I’m struggling to pay my Council Tax?

+

If you’re facing financial difficulties and struggling to pay your Council Tax, it’s important to contact the council as soon as possible. They can provide guidance on payment plans, discounts, or exemptions that may be available to you.

Can I apply for a Council Tax reduction online?

+

Yes, you can apply for a Council Tax reduction online through the Birmingham City Council website. The online application process is straightforward and allows you to provide the necessary information to assess your eligibility for a reduction.

How do I report a change of address for Council Tax purposes?

+

To report a change of address for Council Tax, you can use the online service provided by Birmingham City Council. Simply log in to your account or create a new account, and follow the instructions to update your address details.

What should I do if I believe my Council Tax bill is incorrect?

+

If you believe your Council Tax bill is incorrect, it’s essential to contact the council promptly. You can call the Council Tax team or write a letter explaining the discrepancy and providing any supporting evidence. The council will investigate and resolve the issue accordingly.