Council Tax C Band Cost

The Council Tax system in the United Kingdom is a vital component of local government funding, contributing to the provision of essential services and amenities within communities. One of the key aspects that determines the amount of Council Tax an individual or household pays is the property's valuation band. This band is assigned based on the property's value as of 1991, with properties in England, Scotland, and Wales falling into one of eight bands (A to H), and Northern Ireland using five bands (A to E). Among these bands, C is a common designation, so let's delve into the specifics of Council Tax Band C and explore the associated costs.

Understanding Council Tax Band C

Council Tax Band C encompasses properties that were valued between £95,001 and £128,000 in 1991. These properties are typically of a moderate size and often include semi-detached houses, terraced houses, and some smaller detached homes. It's important to note that the valuation bands are based on the property's value two decades ago, and modern property values may differ significantly.

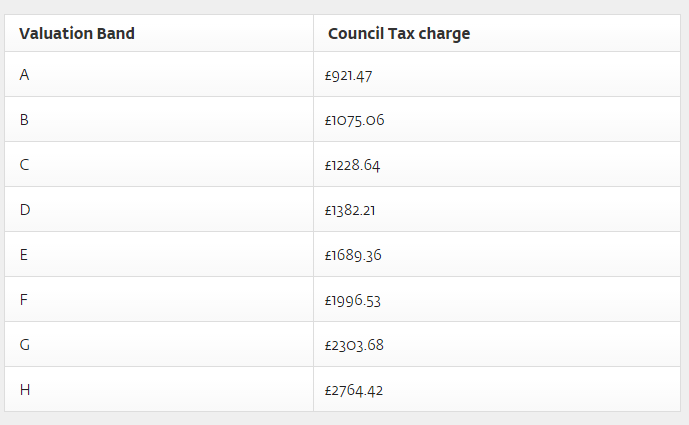

Council Tax Charges for Band C Properties

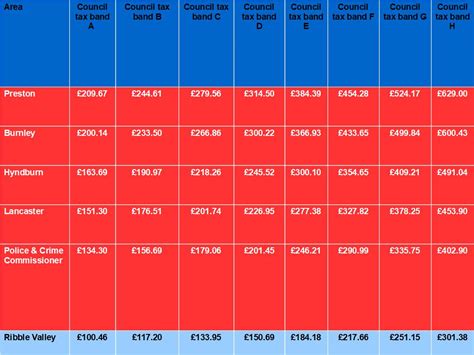

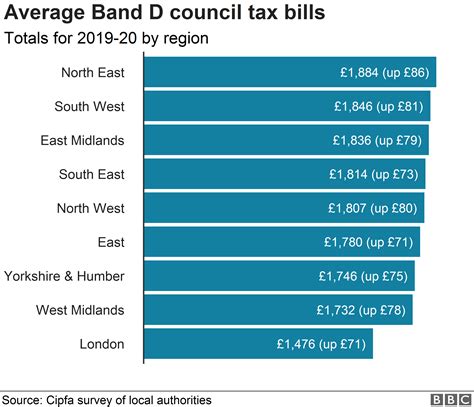

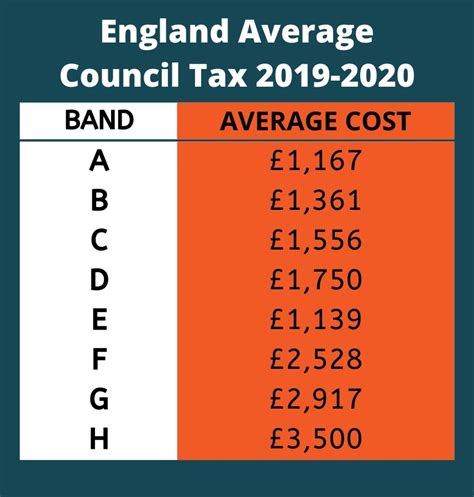

The Council Tax charges for Band C properties vary depending on the local authority and the services provided. Each local council sets its own Council Tax rates, which are determined by the budget required to fund local services such as education, social care, waste management, and environmental services.

As of the 2023/24 tax year, the average Council Tax for Band C properties in England is approximately £1,848. However, this figure is just an average, and the actual amount can differ significantly from one council to another. For instance, the highest Council Tax for Band C properties is found in Kensington and Chelsea, where it stands at £3,226.66, while the lowest is in Billingshurst, where it is just £1,005.33.

Factors Influencing Council Tax Band C Charges

- Local Authority: Each local council has the autonomy to set its own Council Tax rates. This means that properties in the same valuation band, such as Band C, can have significantly different Council Tax charges depending on the local authority.

- Services and Amenities: The level of services and amenities provided by a local council directly impacts the Council Tax rates. Councils with more extensive services, such as better-funded schools or extensive leisure facilities, may have higher Council Tax rates to support these initiatives.

- Property Value: While the Council Tax bands are based on the property's value in 1991, the current market value of a property can also influence the Council Tax charges. Some local authorities may consider the property's current value when determining the Council Tax rate, especially for properties that have undergone significant improvements or renovations.

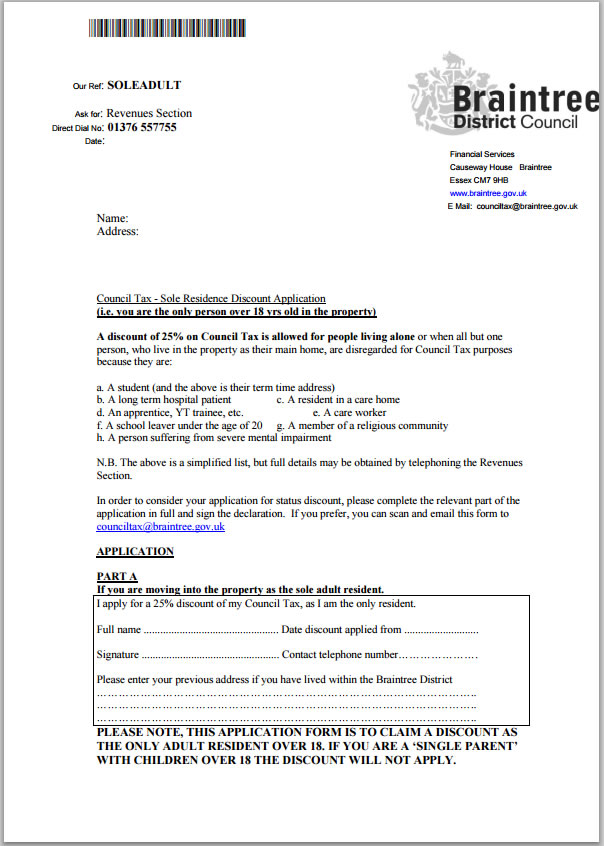

- Discounts and Exemptions: Certain individuals or households may be eligible for discounts or exemptions on their Council Tax. For example, students, people with disabilities, or those on low incomes may qualify for reduced Council Tax rates or complete exemptions. These discounts can significantly impact the overall cost for Band C properties.

Example Council Tax Charges for Band C Properties

To illustrate the variation in Council Tax charges for Band C properties, here are some examples from different local authorities in England:

| Local Authority | Council Tax Charge for Band C |

|---|---|

| Kensington and Chelsea | £3,226.66 |

| Westminster | £2,742.50 |

| Cambridge | £2,144.00 |

| Birmingham | £1,750.56 |

| Leeds | £1,684.64 |

| Manchester | £1,620.48 |

| Bristol | £1,584.61 |

| Norwich | £1,523.36 |

Paying Council Tax for Band C Properties

Homeowners and tenants of Band C properties can pay their Council Tax in various ways, depending on their preferences and the policies of their local authority. Common payment methods include:

- Direct Debit: Many local councils offer the option to set up a Direct Debit, allowing individuals to pay their Council Tax in monthly installments. This method is convenient and ensures that payments are made on time, avoiding any potential penalties.

- Online Payments: Online payment portals provided by local councils enable residents to make secure payments using their debit or credit cards. This method is efficient and can be done from the comfort of one's home.

- Phone Payments: Some local authorities also offer the option to make Council Tax payments over the phone, providing an additional layer of convenience for residents.

- Post-Dated Cheques: For those who prefer traditional methods, post-dated cheques can be an option. This involves providing a series of cheques, each dated for a specific payment date, to cover the full Council Tax liability for the year.

Challenging Council Tax Band C Valuations

If you believe that your property has been incorrectly valued and should not fall into Band C, you have the right to challenge the valuation. This process is known as making a "Council Tax appeal." To initiate an appeal, you should contact your local council's valuation office and request a review of your property's valuation band.

During the appeal process, it's essential to provide evidence to support your claim. This can include recent sales data for similar properties in your area, as well as details of any structural issues or renovations that may have affected your property's value. If your appeal is successful, you could see a reduction in your Council Tax charges, potentially saving you a significant amount of money.

Conclusion

Council Tax Band C encompasses a wide range of properties, and the associated costs can vary significantly depending on the local authority and the services provided. Understanding the factors that influence Council Tax charges is essential for homeowners and tenants to manage their financial obligations effectively. By staying informed about Council Tax rates and exploring potential discounts or exemptions, individuals can ensure they are paying a fair and reasonable amount for the local services they receive.

What is the purpose of Council Tax bands?

+

Council Tax bands are used to determine the amount of Council Tax a property owner or tenant needs to pay. They are based on the value of the property as of 1991, with properties falling into one of eight bands (A to H) in England, Scotland, and Wales, and five bands (A to E) in Northern Ireland.

How often are Council Tax bands reviewed?

+

Council Tax bands are typically reviewed every few years to ensure they remain accurate and reflect any changes in property values. However, the frequency of reviews can vary depending on the local authority.

Can I appeal my Council Tax band if I believe it is incorrect?

+

Yes, if you believe your Council Tax band is incorrect, you have the right to appeal. You can contact your local council’s valuation office to request a review of your property’s valuation band.

Are there any discounts or exemptions available for Council Tax?

+

Yes, certain individuals or households may be eligible for discounts or exemptions on their Council Tax. This includes students, people with disabilities, and those on low incomes. It’s important to check with your local council to see if you qualify for any reductions.

How can I pay my Council Tax if I fall into Band C?

+

There are several payment options available for Council Tax, including Direct Debit, online payments, phone payments, and post-dated cheques. You can choose the method that best suits your preferences and the policies of your local authority.