Council Tax Cost Band E

Council Tax is a system of taxation used in England, Scotland, and Wales to fund local government services. It is a significant financial obligation for homeowners and renters alike, and understanding the different cost bands is crucial for managing your finances effectively. In this blog post, we will delve into the specifics of Council Tax, focusing on Cost Band E, and provide you with the information you need to navigate this essential aspect of property ownership.

What is Council Tax and How Does it Work?

Council Tax is a property-based tax, which means it is levied on the occupants of a property rather than the property itself. It is designed to fund local services such as education, social care, waste management, and more. The tax is calculated based on the value of your home and the number of people living in it.

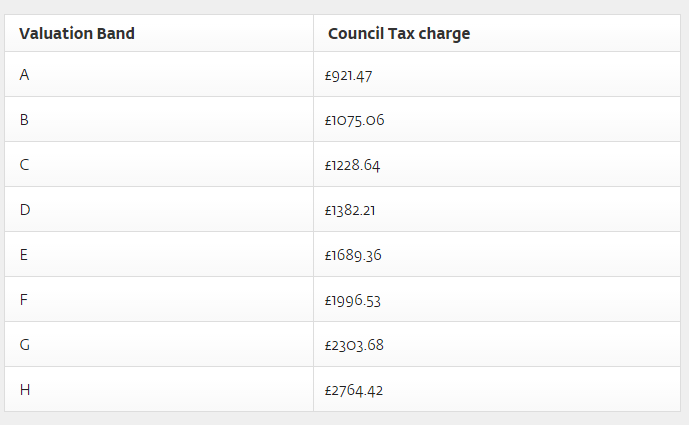

The Council Tax system is divided into different valuation bands, which are determined by the value of your property as of 1st April 1991 (or 1st April 2003 in Wales). These bands range from A (the lowest) to H (the highest), with each band corresponding to a specific range of property values. The band your property falls into directly impacts the amount of Council Tax you will pay.

Understanding Cost Band E

Cost Band E is one of the higher valuation bands in the Council Tax system. Properties in this band are typically more valuable than those in Bands A, B, C, and D. Here's what you need to know about Band E:

- Property Value: In England and Scotland, Band E covers properties valued between £32,001 and £40,000 as of 1st April 1991. In Wales, the valuation range for Band E is £40,001 to £52,000 as of 1st April 2003.

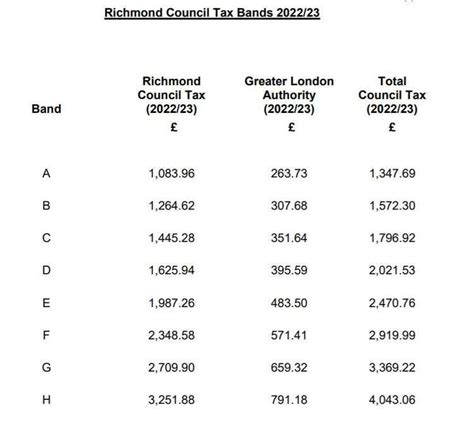

- Council Tax Amount: The Council Tax bill for properties in Band E can vary depending on the local authority and the services provided. On average, you can expect to pay a higher amount compared to lower bands. However, it's essential to check with your local council for accurate and up-to-date information.

- Exemptions and Discounts: Like other bands, Band E may have certain exemptions and discounts available. For example, if you live alone or are a full-time student, you might be eligible for a discount. Additionally, if your property is empty or unfurnished, you could qualify for an exemption or a reduced rate.

Factors Affecting Council Tax

Several factors can influence the Council Tax you pay, regardless of your valuation band. These include:

- Local Authority: Each local authority sets its own Council Tax rates, so the amount you pay can vary significantly from one area to another. It's important to research the rates in your specific region.

- Property Type: The type of property you own can also impact your Council Tax bill. For instance, flats or apartments might have different rates compared to detached houses.

- Occupancy: The number of people living in your property affects the Council Tax calculation. If you have more occupants, you may be eligible for a higher discount or exemption.

- Changes in Property Value: If the value of your property changes significantly, it could impact your valuation band and, consequently, your Council Tax bill. Regularly reviewing your property's value is essential to ensure you are paying the correct amount.

Managing Your Council Tax

Here are some tips to help you manage your Council Tax payments effectively:

- Stay informed about the Council Tax rates in your area and any changes that may affect your bill.

- Check your valuation band regularly to ensure it accurately reflects your property's value.

- Review your Council Tax bill annually and compare it with previous years to identify any significant differences.

- If you believe your valuation band is incorrect, you can appeal to the Valuation Office Agency (VOA) in England and Wales or the Scottish Assessors Association in Scotland.

- Take advantage of any available discounts or exemptions, such as the Single Person Discount or the Disabled Band Reduction.

- Consider setting up a direct debit with your local council to make timely payments and avoid late fees.

Council Tax Support and Assistance

If you are struggling to pay your Council Tax, there are support options available:

- Contact your local council to inquire about Council Tax Reduction schemes, which can provide financial assistance based on your income and circumstances.

- Explore other benefits and support programs, such as Housing Benefit or Universal Credit, which may help cover your Council Tax expenses.

- Seek advice from charities or organizations specializing in debt and financial management.

Remember, staying informed and taking proactive steps to manage your Council Tax obligations is crucial for maintaining a healthy financial situation.

FAQs

How often do Council Tax rates change?

+

Council Tax rates are typically reviewed and adjusted annually by local authorities. It's important to stay updated on any changes that may impact your bill.

Can I appeal my Council Tax valuation band?

+

Yes, if you believe your property's valuation band is incorrect, you can appeal to the relevant valuation office. The process involves providing evidence to support your claim.

Are there any discounts available for Council Tax?

+

Yes, several discounts and exemptions are available, such as the Single Person Discount, Disabled Band Reduction, and discounts for students or empty properties. Check with your local council for specific details.

🌐 Note: This blog post provides a general overview of Council Tax and Cost Band E. For accurate and up-to-date information, always refer to your local council's website or contact them directly.

Understanding your Council Tax obligations is an essential part of responsible property ownership. By staying informed and managing your payments effectively, you can ensure a smoother financial journey.