Council Tax Discount For Disabled

For individuals living with disabilities, managing financial obligations can present unique challenges. One such obligation is Council Tax, a system in place in England, Scotland, and Wales to fund local government services. Fortunately, there are provisions in place to provide support and discounts for disabled individuals, ensuring they receive the assistance they need. This guide will explore the various Council Tax discounts available for disabled individuals, the criteria for eligibility, and the application process.

Understanding Council Tax Discounts for Disabled Individuals

Council Tax is a vital source of funding for local authorities, covering essential services such as waste management, social care, and road maintenance. However, recognizing the potential financial strain on disabled individuals, the government has implemented specific discounts and exemptions to ease this burden.

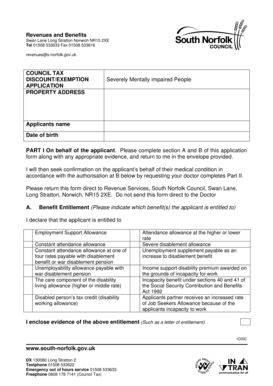

The primary discount scheme applicable to disabled individuals is the Council Tax Reduction (CTR) scheme, which replaces the previous Council Tax Benefit. CTR aims to ensure that those with limited means, including disabled individuals, do not face excessive financial hardship when paying their Council Tax.

In addition to CTR, there are other provisions in place to support disabled individuals. These include:

- Disabled Band Reductions: Properties occupied by severely disabled individuals may be eligible for a reduction in their Council Tax band, effectively lowering the tax liability.

- Disability-Related Occupant Discounts: In certain circumstances, a disabled person living in a property with non-disabled individuals may be entitled to a discount on their Council Tax bill.

- Disabled Facilities Grants: Local authorities may provide grants to cover the cost of adapting a home to meet the needs of a disabled occupant.

Eligibility Criteria for Council Tax Discounts

To qualify for Council Tax discounts for disabled individuals, certain criteria must be met. These criteria vary depending on the specific discount or exemption being applied for. Here are some key considerations:

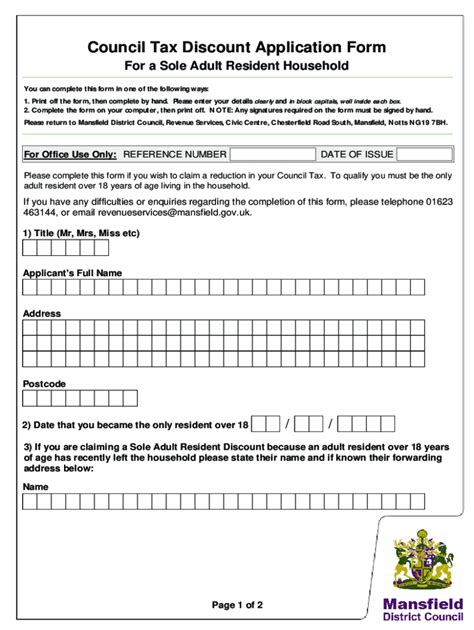

Council Tax Reduction (CTR)

- CTR is primarily based on an individual's income and capital. To be eligible, your income and savings must be below a certain threshold.

- You must also be responsible for paying Council Tax, either as the sole occupant or as part of a larger household.

- Certain benefits, such as Income Support or Jobseeker's Allowance, can automatically qualify you for CTR.

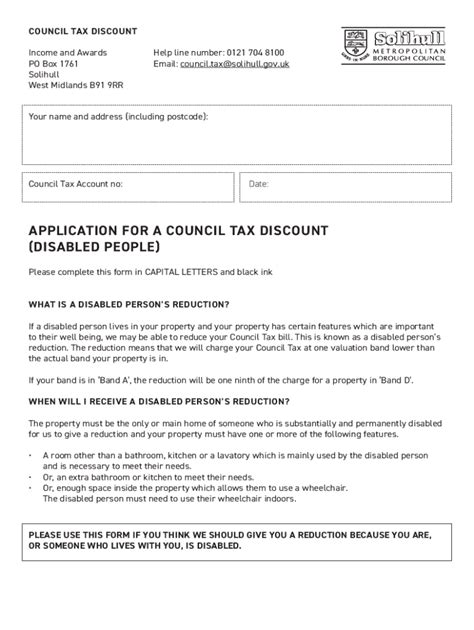

Disabled Band Reductions

- To qualify for a reduction in Council Tax band due to severe disability, the property must be the main residence of a severely disabled person.

- The property must have been specially adapted or constructed to meet the needs of the disabled occupant.

- The disabled person must be substantially and permanently disabled, as defined by the government's criteria.

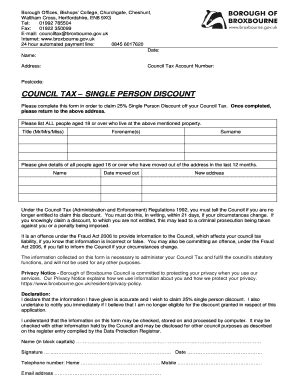

Disability-Related Occupant Discounts

- This discount applies when a disabled person lives with non-disabled individuals in a property that has been adapted to meet their needs.

- The disabled person must occupy the property as their sole or main residence.

- The adaptations made to the property must be specifically for the disabled occupant's use.

Applying for Council Tax Discounts

The application process for Council Tax discounts for disabled individuals varies depending on the specific discount or exemption. However, the general steps are as follows:

Council Tax Reduction (CTR)

- Contact your local council's benefits office to request a CTR application form.

- Complete the form, providing details of your income, capital, and household circumstances.

- Submit the form, along with any supporting documentation, to your local council.

- Your local council will assess your application and determine your eligibility for CTR.

Disabled Band Reductions

- Check with your local council if your property is eligible for a reduction in Council Tax band due to severe disability.

- If eligible, complete and submit the necessary application form, providing details of the disabled occupant and the adaptations made to the property.

- Your local council will assess your application and make a decision regarding the reduction.

Disability-Related Occupant Discounts

- Contact your local council to enquire about the availability of disability-related occupant discounts.

- If applicable, complete and submit the required application form, providing details of the disabled occupant and the adaptations made to the property.

- Your local council will review your application and determine your eligibility for the discount.

🌟 Note: It's important to note that the availability and criteria for these discounts may vary depending on your local council's policies. Always check with your local authority for specific details and guidance.

Additional Support and Resources

Navigating the world of Council Tax discounts for disabled individuals can be complex. Fortunately, there are various support services and resources available to assist you throughout the process.

Citizen's Advice

Citizen's Advice is a charitable organization providing free, independent advice on a wide range of topics, including Council Tax discounts. They offer guidance on eligibility criteria, application processes, and appeal procedures. You can access their services online, over the phone, or by visiting a local Citizen's Advice Bureau.

Local Council Support

Your local council's benefits office is an invaluable resource for Council Tax-related queries. They can provide personalized advice and support, ensuring you receive the discounts and exemptions you are entitled to. Don't hesitate to reach out to your local council for guidance and assistance.

Government Websites

The UK government's official website offers comprehensive information on Council Tax discounts for disabled individuals. You can find detailed guidelines, application forms, and frequently asked questions to help you navigate the process effectively.

Case Studies: Real-Life Examples of Council Tax Discounts

To better understand how Council Tax discounts work in practice, let's explore a few real-life case studies:

Case Study 1: Council Tax Reduction (CTR)

John, a single parent with a disabled child, was struggling to make ends meet on his low income. He applied for CTR, providing details of his income, savings, and household circumstances. After a thorough assessment, his local council granted him a 75% reduction in his Council Tax, providing much-needed financial relief.

Case Study 2: Disabled Band Reductions

Sarah, a severely disabled individual, had her home specially adapted to meet her needs. She applied for a reduction in her Council Tax band, submitting evidence of her disability and the adaptations made to her property. Her local council granted her a reduction, effectively lowering her Council Tax liability.

Case Study 3: Disability-Related Occupant Discounts

Michael, a disabled veteran, lived with his non-disabled spouse in a property adapted for his needs. He applied for a disability-related occupant discount, providing details of the adaptations and his occupancy. The local council approved the discount, reducing his Council Tax bill by 25%.

Frequently Asked Questions (FAQ)

What is the Council Tax Reduction (CTR) scheme, and who is eligible for it?

+The Council Tax Reduction (CTR) scheme is designed to help individuals on low incomes, including those with disabilities, by reducing their Council Tax liability. Eligibility is based on income, capital, and household circumstances. If your income and savings are below a certain threshold, you may qualify for CTR.

How do I apply for a disabled band reduction on my Council Tax bill?

+To apply for a disabled band reduction, you need to contact your local council and inquire about the specific application process. You will need to provide details of your disability, the adaptations made to your property, and evidence to support your claim. The local council will assess your application and determine your eligibility for the reduction.

Are there any other Council Tax discounts available for disabled individuals living with non-disabled occupants?

+Yes, disabled individuals living with non-disabled occupants may be eligible for a disability-related occupant discount. This discount applies when the property has been adapted to meet the needs of the disabled occupant. Contact your local council to inquire about the application process and criteria.

Conclusion

Council Tax discounts for disabled individuals play a crucial role in ensuring financial stability and accessibility. By understanding the various discounts available, such as Council Tax Reduction, disabled band reductions, and disability-related occupant discounts, individuals can take advantage of the support offered by the government and local authorities. Remember to reach out to organizations like Citizen’s Advice and your local council for personalized guidance and support throughout the application process. Together, we can ensure that disabled individuals receive the financial assistance they deserve.