Council Tax Discount Student

Council tax is a common charge levied on residential properties in the United Kingdom, and it plays a crucial role in funding local services and infrastructure. However, certain individuals, including students, are eligible for discounts or exemptions, making it important to understand the rules and regulations surrounding this topic.

In this comprehensive guide, we will delve into the world of council tax discounts for students, exploring the eligibility criteria, the application process, and the potential savings you can expect. By the end of this article, you'll have a clear understanding of how to navigate the council tax system as a student and make the most of the available benefits.

Understanding Council Tax

Council tax is a local tax imposed on properties by local authorities. It contributes to the funding of essential services such as police, fire services, local environmental health initiatives, and more. The amount of council tax you pay depends on various factors, including the value of your property and the number of occupants.

Students, being a unique demographic with specific financial considerations, often qualify for reduced council tax rates or even full exemptions. Let's explore the ins and outs of these student discounts.

Eligibility for Student Discounts

To be eligible for a council tax discount as a student, you must meet certain criteria. Here are the key requirements:

- Student Status: You must be a full-time student enrolled in a recognized educational institution. Part-time students may also be eligible in some cases.

- Residence: The property you occupy must be your primary residence, and you should not own any other property.

- Occupancy: The property should be occupied by at least one full-time student. If there are other adults living with you, their status and income may impact your eligibility.

- Age: In most cases, students under the age of 18 are not required to pay council tax. However, there might be variations based on local regulations.

It's important to note that the specific eligibility criteria can vary depending on your local authority and the country you reside in within the UK. Always check with your local council for the most accurate and up-to-date information.

Applying for a Student Discount

To apply for a council tax discount as a student, follow these steps:

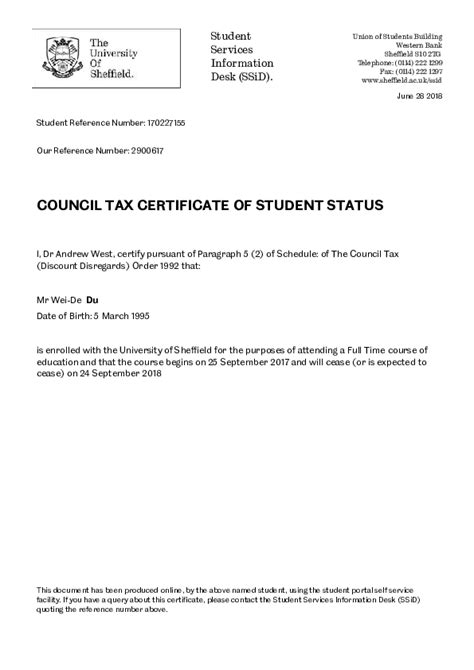

- Gather Documents: Collect the necessary documentation, including proof of student status (e.g., a student ID or enrollment certificate), proof of residence (e.g., a tenancy agreement or utility bill), and, if applicable, proof of income for other occupants.

- Contact Your Local Council: Reach out to your local council's council tax department. You can find their contact details on their official website or by searching for their contact information online.

- Submit an Application: Fill out the council tax discount application form provided by your local authority. This form typically requires details about your student status, the property, and the occupants.

- Provide Supporting Evidence: Attach the required documents to your application. Ensure that all information is accurate and up-to-date.

- Wait for Approval: The council will review your application and supporting evidence. They may contact you for further information or clarification. Once approved, you'll receive a notification and details about your new council tax rate.

🌟 Note: Some local councils may have online application systems, making the process more convenient. Check their website for online application options.

Types of Student Discounts

There are different types of council tax discounts available to students, depending on their circumstances. Here are the most common types:

Full Exemption

In some cases, students may be eligible for a full exemption from council tax. This means they won't have to pay any council tax for the property they occupy. Full exemptions are typically granted when the property is solely occupied by full-time students.

Student Discount

If a property is occupied by a mix of students and non-students, a student discount may be applied. This discount reduces the overall council tax liability for the property. The discount percentage can vary, but it often ranges from 25% to 50%.

Second Adult Rebate

If you share a property with one or more non-students, you might be eligible for a second adult rebate. This rebate is designed to provide relief for households with low incomes. The amount of the rebate depends on your income and circumstances.

Calculating Your Savings

To estimate the potential savings you can achieve through a council tax discount, follow these steps:

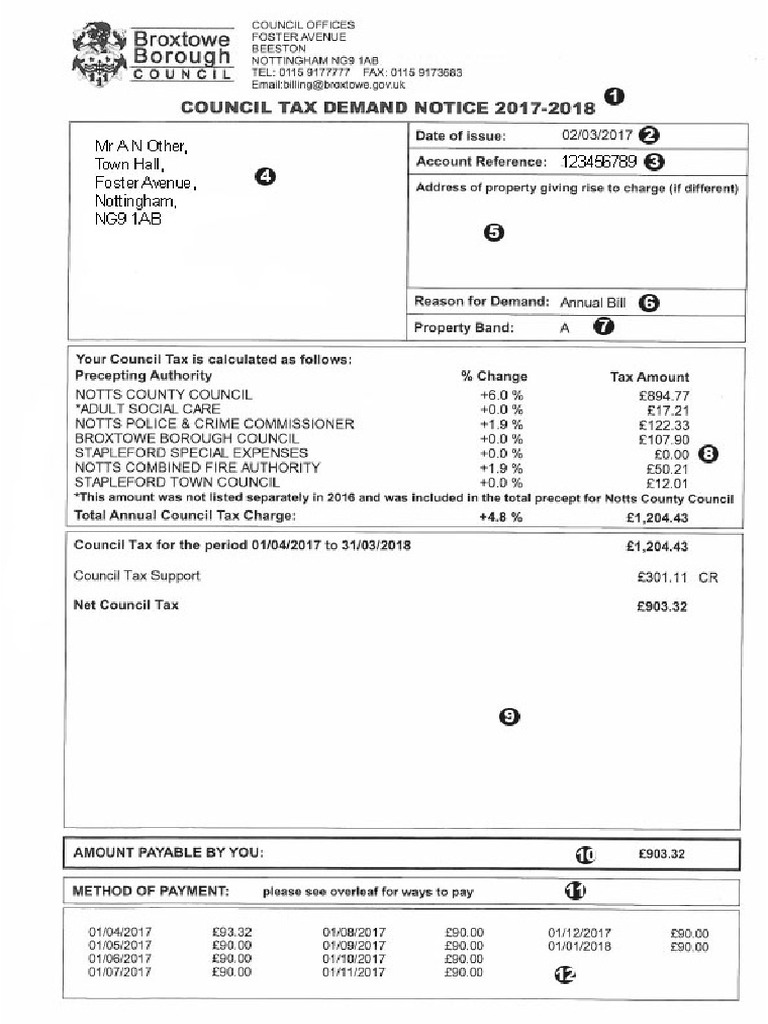

- Determine Your Current Council Tax Band: Find out the council tax band for your property. This information is available on your council tax bill or by contacting your local authority.

- Research Discount Rates: Look up the discount rates offered by your local council for students. These rates can vary, so it's essential to check the official sources.

- Calculate the Discounted Amount: Multiply your current council tax band by the applicable discount rate. This will give you an estimate of the discounted council tax amount.

- Compare Savings: Subtract the discounted amount from your current council tax liability to calculate your potential savings.

Remember, these calculations provide an estimate, and the actual savings may vary based on your specific circumstances and local regulations.

Renewing Your Discount

Council tax discounts for students are typically valid for the duration of your studies. However, it's important to renew your discount annually to ensure continuity. Here's what you need to do:

- Check Renewal Deadline: Your local council will provide information on the renewal deadline. Mark this date on your calendar to avoid missing it.

- Submit a Renewal Application: Complete the renewal application form provided by your local authority. You may need to provide updated proof of student status and residence.

- Keep Records: Maintain a record of your previous applications and renewals. This will make the process smoother in subsequent years.

🚨 Note: Failing to renew your discount on time may result in a loss of benefits, so stay organized and keep track of important dates.

Challenging a Council Tax Decision

In some cases, you may disagree with a council tax decision made by your local authority. If you believe you have been incorrectly assessed or denied a discount, you have the right to appeal. Here's how to proceed:

- Review the Decision: Carefully read the council tax decision letter provided by your local authority. It should outline the reasons for the decision and any relevant information.

- Gather Evidence: Collect any additional evidence or documentation that supports your case. This could include proof of student status, residence, or income.

- Contact the Council: Reach out to your local council's council tax department and express your intention to appeal. They will guide you through the appeal process.

- Submit an Appeal: Follow the instructions provided by the council to submit your appeal. You may need to fill out an appeal form and provide supporting evidence.

- Wait for a Response: The council will review your appeal and provide a decision. They may request further information or schedule a hearing.

💡 Note: Appealing a council tax decision can be complex, so consider seeking advice from student support services or legal professionals if needed.

Council Tax and Shared Accommodation

If you're a student living in shared accommodation with other students, the council tax situation can be a bit more complex. Here are some key points to consider:

- Joint Liability: In shared accommodation, all occupants are typically jointly liable for the council tax. This means that if one person fails to pay, the others may be held responsible.

- Discounts and Exemptions: The availability of discounts and exemptions depends on the specific circumstances of the property and its occupants. It's essential to discuss this with your housemates and understand your collective responsibilities.

- Communication: Open and honest communication with your housemates is crucial. Ensure everyone is aware of their financial obligations and the potential impact of council tax on their budget.

Tips for Managing Council Tax as a Student

Here are some practical tips to help you navigate council tax as a student:

- Stay Informed: Keep yourself updated on council tax regulations and any changes that may impact your eligibility for discounts.

- Keep Records: Maintain a file with all your council tax-related documents, including application forms, renewal notices, and correspondence with the local authority.

- Set Reminders: Use calendar reminders or digital tools to stay on top of important dates, such as renewal deadlines and payment due dates.

- Budget Wisely: Factor council tax into your monthly budget. Even with discounts, it's an essential expense that should be planned for.

- Seek Support: If you encounter any difficulties or have questions, don't hesitate to reach out to student support services or financial advisors for guidance.

Conclusion

Council tax discounts for students can provide significant financial relief during your studies. By understanding the eligibility criteria, navigating the application process, and staying organized with renewals, you can make the most of these benefits. Remember, each local authority may have slightly different rules, so always refer to your council's official website or contact them directly for accurate information.

As a student, managing your finances can be a challenging task, but with the right knowledge and resources, you can ensure that council tax doesn't become an unnecessary burden. Stay informed, stay organized, and make the most of the student discounts available to you.

FAQ

What happens if I move during the academic year?

+

If you move to a new property during the academic year, you should inform both your previous and new local councils about your change of address. This ensures that your council tax liability is correctly assessed at each location.

Can I apply for a council tax discount if I’m a part-time student?

+

Eligibility for council tax discounts as a part-time student may vary depending on your local authority. Some councils offer discounts to part-time students, while others may require you to meet specific criteria, such as a certain number of hours studied per week.

How long does it take to receive a decision on my council tax discount application?

+

The processing time for council tax discount applications can vary. Some local councils may provide a decision within a few weeks, while others may take up to several months. It’s best to check with your local authority for an estimated timeline.

Can I backdate my council tax discount if I’ve been eligible for a while but didn’t apply earlier?

+

Backdating council tax discounts is generally not possible. However, it’s worth contacting your local council to inquire about their specific policies. In some cases, they may consider backdating under exceptional circumstances.