Council Tax Support Fund

The Council Tax Support Fund is a vital initiative aimed at providing financial assistance to individuals and households struggling to meet their council tax obligations. This support system plays a crucial role in ensuring that those facing financial challenges can still access essential local services without undue burden. In this blog post, we will delve into the intricacies of the Council Tax Support Fund, exploring its purpose, eligibility criteria, application process, and the impact it has on the lives of those it supports.

Understanding the Council Tax Support Fund

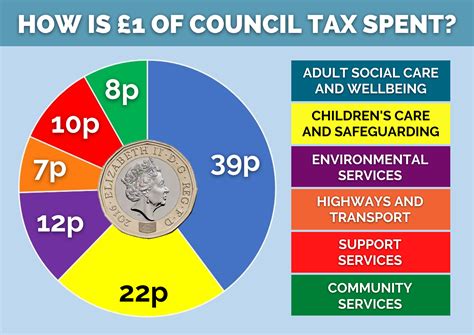

The Council Tax Support Fund is a government-funded program designed to offer financial relief to eligible individuals and households who are struggling to pay their council tax. Council tax is a local tax levied by local authorities to fund various public services, including waste collection, social care, and local infrastructure. However, for some individuals and families, especially those on low incomes or facing financial difficulties, the council tax can become a significant financial burden.

The primary objective of the Council Tax Support Fund is to ensure that everyone has equal access to these essential local services, regardless of their financial situation. By providing financial support, the fund aims to alleviate the strain on households, allowing them to focus on their well-being and overall financial stability.

Eligibility Criteria

Determining eligibility for the Council Tax Support Fund involves assessing an individual's or household's financial circumstances. Here are some key factors that are typically considered:

- Income: The fund primarily targets individuals and households with low incomes. The exact income threshold may vary depending on the local authority and the specific criteria set by the government.

- Employment Status: Those who are unemployed, on low wages, or in receipt of certain benefits may be eligible for support. Full-time students and individuals on certain types of training programs may also qualify.

- Council Tax Bill: The fund is intended to assist with council tax payments. Therefore, applicants must have a valid council tax bill and be responsible for paying it.

- Residence: Eligibility is often restricted to individuals who are legally resident in the UK and have a valid council tax account with a local authority.

It's important to note that eligibility criteria can vary between different local authorities, so it's advisable to check with your local council for specific requirements.

Application Process

Applying for Council Tax Support typically involves the following steps:

- Contact Your Local Authority: Start by reaching out to your local council's benefits or revenue department. They will provide you with the necessary application forms and guidance.

- Gather Required Documentation: Prepare the required documents, which may include proof of identity, residence, income, and council tax bill.

- Complete the Application Form: Fill out the application form accurately and provide all the necessary details. Be sure to include any relevant supporting evidence.

- Submit Your Application: Submit your completed application form and supporting documents to your local authority. You can usually do this in person, by post, or online, depending on the council's preferred method.

- Assessment and Decision: The local authority will assess your application based on the provided information and make a decision regarding your eligibility for support. They will inform you of the outcome and the next steps.

💡 Note: It's essential to apply for Council Tax Support as early as possible, preferably before you fall into arrears. This ensures a smoother process and reduces the risk of facing enforcement action for non-payment.

Impact and Benefits

The Council Tax Support Fund has a significant positive impact on the lives of those it supports. Here are some key benefits:

- Financial Relief: The fund provides much-needed financial assistance, reducing the burden of council tax payments for eligible individuals and households. This can help alleviate financial stress and improve overall well-being.

- Access to Essential Services: By supporting those in need, the fund ensures that everyone has equal access to vital local services, such as waste collection, social care, and community facilities. This promotes social equality and a better quality of life.

- Prevention of Arrears: Early intervention through the Council Tax Support Fund can prevent individuals from falling into arrears, which could lead to legal action and further financial difficulties.

- Stability and Peace of Mind: Knowing that there is support available can provide a sense of stability and peace of mind for those facing financial challenges. It allows individuals to focus on their livelihoods and long-term financial planning.

Case Study: A Success Story

Let's consider a hypothetical case study to illustrate the impact of the Council Tax Support Fund. Meet Sarah, a single mother of two young children. She recently lost her job and is now facing financial difficulties. With the help of the Council Tax Support Fund, Sarah was able to receive financial assistance to cover a significant portion of her council tax payments.

This support not only relieved the immediate financial strain but also allowed Sarah to focus on her job search and upskilling. With the fund's assistance, she could continue accessing essential local services, such as waste collection and community centers, which were crucial for her family's well-being. The Council Tax Support Fund played a vital role in providing Sarah and her family with the stability and support they needed during a challenging time.

Conclusion

The Council Tax Support Fund serves as a vital safety net for individuals and households facing financial challenges. By offering financial assistance, the fund ensures that everyone can access essential local services without being burdened by excessive council tax payments. The impact of this support extends beyond financial relief, promoting social equality and overall well-being within communities.

If you or someone you know is struggling to meet their council tax obligations, don't hesitate to explore the Council Tax Support Fund. It could be the key to unlocking a brighter and more stable future.

What is the Council Tax Support Fund?

+

The Council Tax Support Fund is a government-funded program that provides financial assistance to individuals and households struggling to pay their council tax. It aims to ensure equal access to essential local services for all residents.

Who is eligible for the Council Tax Support Fund?

+

Eligibility criteria may vary, but generally, the fund targets individuals and households with low incomes, those on certain benefits, or facing financial difficulties. It’s best to check with your local authority for specific requirements.

How do I apply for Council Tax Support?

+

Contact your local council’s benefits or revenue department to obtain an application form. Gather the required documents, complete the form, and submit it to your local authority. They will assess your application and inform you of the outcome.

Can I apply for Council Tax Support if I’m already in arrears?

+

While it’s possible to apply for support even if you’re already in arrears, it’s advisable to apply as early as possible. Early intervention can prevent further financial difficulties and legal action for non-payment.

What are the benefits of the Council Tax Support Fund?

+

The fund provides financial relief, ensures access to essential local services, prevents arrears, and offers stability and peace of mind to individuals facing financial challenges.