Create 7 Instant Ways To Perfect Council Tax Discounts Today

When it comes to managing your finances, finding ways to save money is always a priority. One area where you might be eligible for a discount is your council tax. Council tax discounts can provide some much-needed relief on your household expenses, and the best part is that there are instant ways to apply for and secure these discounts. In this blog post, we will explore seven simple and effective methods to perfect your council tax discounts, helping you keep more money in your pocket.

1. Check Your Eligibility for Single Person Discount

If you live alone or are the only adult occupying your property, you could be entitled to a 25% discount on your council tax. This discount is known as the Single Person Discount and is available to those who meet specific criteria.

To apply for this discount, you need to contact your local council and provide the necessary information. They will assess your eligibility based on factors such as your residency status, ownership of the property, and whether you are the sole adult resident.

Make sure to gather the required documentation, such as proof of residency and any relevant supporting evidence, to support your application. By taking advantage of the Single Person Discount, you can instantly reduce your council tax liability and save a significant amount over the year.

2. Apply for Council Tax Support

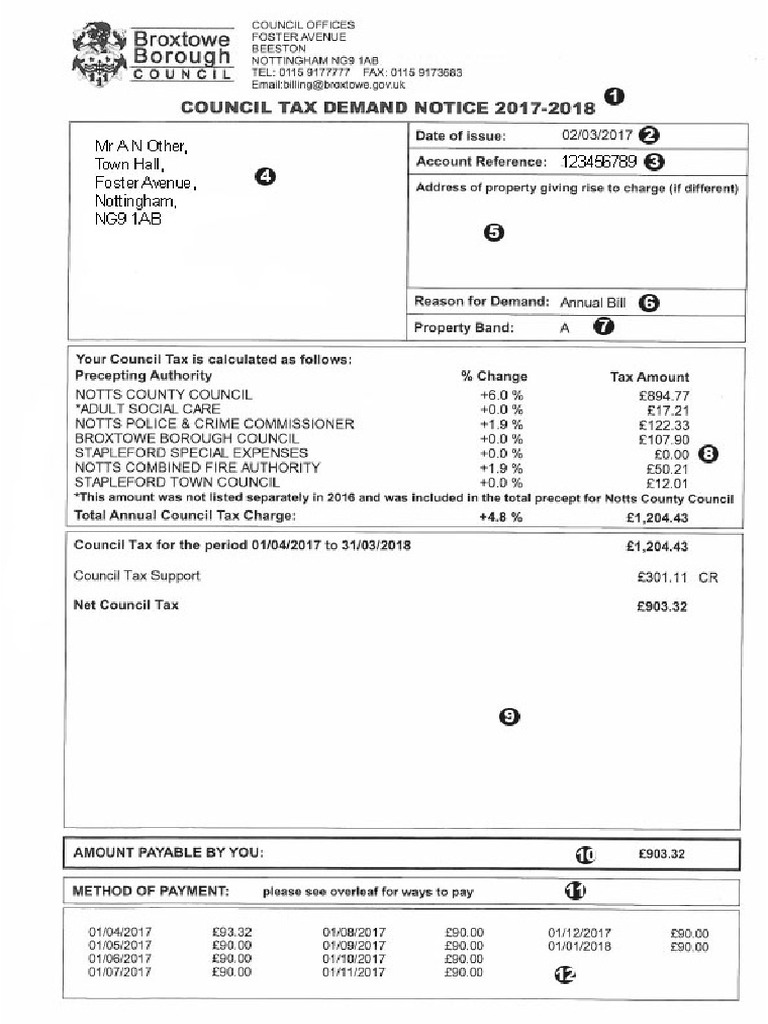

If you are on a low income or receive certain benefits, you may be eligible for Council Tax Support (formerly known as Council Tax Benefit). This support scheme is designed to help those who struggle to pay their council tax due to financial circumstances.

To apply for Council Tax Support, you need to contact your local council and provide details about your income, savings, and any benefits you receive. The council will assess your eligibility and calculate the amount of support you are entitled to. This support can significantly reduce your council tax bill, making it more manageable.

Keep in mind that the eligibility criteria and support amounts may vary depending on your local authority, so it's essential to reach out to your council for accurate information and guidance.

3. Explore Discounts for Specific Circumstances

In addition to the Single Person Discount and Council Tax Support, there are various other discounts available for specific circumstances. These discounts can provide significant savings and are worth investigating if you find yourself in any of the following situations:

- Disabled Residents: If you or someone in your household has a disability that requires specific adaptations to your home, you may be eligible for a council tax reduction. The discount amount can vary depending on the local authority and the severity of the disability.

- Second Homes: If you own a second home or a holiday home, you might be able to claim a discount or exemption on the council tax for that property. The rules and rates can vary, so it's essential to check with your local council.

- Empty Properties: If your property has been empty for a certain period, you may be eligible for a discount or exemption on the council tax. The length of time and the discount amount can vary, so consult your local council for accurate information.

- Student Discounts: Students living away from home may be entitled to a discount on their council tax. The discount percentage can vary, and it's crucial to inform your local council about your student status to ensure you receive the correct rate.

By exploring these specific discounts, you can maximize your savings and make your council tax more affordable.

4. Utilize Online Tools and Calculators

Many local councils provide online tools and calculators to help residents estimate their council tax liability and explore potential discounts. These tools can be incredibly useful in understanding your financial situation and identifying any available savings.

By inputting your personal details, such as income, benefits, and household composition, these calculators can provide an estimate of your council tax bill and highlight any discounts or reductions you may be eligible for.

Take advantage of these online resources to gain a better understanding of your council tax obligations and make informed decisions about applying for discounts.

5. Consider Discounts for People with Low Incomes

If you have a low income, you may be eligible for discounts or reductions on your council tax. These discounts are designed to support individuals and households who face financial challenges.

To apply for these discounts, you will need to provide evidence of your income, such as payslips, benefit statements, or tax credits. The council will assess your financial situation and determine the appropriate discount percentage.

It's important to note that the eligibility criteria and discount amounts can vary depending on your local authority and the specific circumstances of your household. Reach out to your local council for guidance and to understand the options available to you.

6. Check for Discounts on Second Properties

If you own multiple properties, you may be able to claim discounts on your second homes. These discounts can provide significant savings and are worth exploring if you find yourself in this situation.

The rules and rates for second property discounts can vary depending on your local council, so it's crucial to check with them for accurate information. In some cases, you may be eligible for a 50% discount on the council tax for your second home, while other councils may offer different rates or exemptions.

By claiming the appropriate discount, you can reduce the financial burden of owning multiple properties and manage your council tax obligations more effectively.

7. Stay Informed and Keep Records

To ensure you receive all the council tax discounts you are entitled to, it's essential to stay informed about any changes or updates to the system. Keep yourself updated on any new policies, eligibility criteria, or application processes introduced by your local council.

Additionally, maintain accurate records of your income, benefits, and any relevant documentation. This will make it easier to provide the necessary information when applying for discounts and support your case if any issues arise.

By staying informed and organized, you can navigate the council tax system more effectively and maximize your savings.

Conclusion

Perfecting your council tax discounts is an essential step towards managing your finances and reducing your household expenses. By exploring the seven instant ways outlined in this blog post, you can take control of your council tax obligations and potentially save a significant amount of money.

Remember to check your eligibility for the Single Person Discount, apply for Council Tax Support if you are on a low income, and investigate discounts for specific circumstances. Utilize online tools and calculators to estimate your council tax liability and explore savings. Stay informed about any changes to the system and keep accurate records to support your applications.

By taking these steps, you can make the most of the council tax discounts available to you and ensure a more manageable financial situation. With a little effort and research, you can instantly improve your financial well-being and enjoy the benefits of reduced council tax bills.

Frequently Asked Questions

What is the Single Person Discount, and how can I apply for it?

+

The Single Person Discount is a 25% reduction on your council tax if you are the only adult living in your property. To apply, contact your local council and provide proof of residency and your sole occupancy status.

Am I eligible for Council Tax Support if I receive benefits?

+

Yes, if you receive certain benefits and have a low income, you may be eligible for Council Tax Support. Contact your local council to assess your eligibility and calculate the amount of support you are entitled to.

Are there any discounts available for disabled residents?

+

Yes, if you or someone in your household has a disability that requires adaptations to your home, you may be eligible for a council tax reduction. The discount amount can vary, so check with your local council for specific details.

Can I claim a discount on my second home or holiday property?

+

Yes, you may be able to claim a discount or exemption on your second home or holiday property. The rules and rates can vary, so it’s essential to check with your local council for accurate information.

How can I estimate my council tax liability and explore potential discounts?

+

Many local councils provide online tools and calculators to estimate your council tax liability and identify potential discounts. Input your personal details to receive an estimate and explore your savings options.