Design 7 Expert Strategies For Hmrc Business Tax Today

7 Expert Strategies for Dealing with HMRC Business Tax

Navigating the complexities of HMRC business tax can be a daunting task for any entrepreneur. Whether you're a seasoned business owner or just starting out, understanding the tax landscape and implementing effective strategies is crucial to ensure compliance and minimize financial burdens. In this comprehensive guide, we will explore seven expert strategies to help you tackle HMRC business tax with confidence.

1. Understand Your Tax Obligations

The first step towards effective tax management is understanding your specific tax obligations as a business owner. HMRC has different tax requirements for various business structures, such as sole proprietorships, partnerships, and limited companies. Familiarize yourself with the relevant taxes, including income tax, National Insurance contributions, corporation tax, VAT, and any other applicable taxes based on your business activities.

Take the time to read through HMRC's guidance notes and seek professional advice if needed. Understanding your tax obligations will help you plan and budget effectively, ensuring you meet your tax liabilities on time.

2. Keep Accurate Records

Maintaining accurate and organized financial records is essential for smooth tax management. Keep track of all income, expenses, and transactions related to your business. This includes sales invoices, purchase receipts, bank statements, payroll records, and any other relevant documentation.

Utilize accounting software or apps to streamline the record-keeping process. These tools can help you categorize transactions, generate financial reports, and even calculate tax liabilities. Accurate records not only simplify tax compliance but also provide valuable insights into your business's financial health.

3. Stay Informed About Tax Changes

HMRC's tax regulations and rates are subject to change, so it's crucial to stay updated on any modifications that may impact your business. Follow HMRC's official website, sign up for their newsletters, and subscribe to reputable tax blogs or news sources to receive timely updates.

Being aware of tax changes allows you to plan and adjust your financial strategies accordingly. It also helps you identify potential opportunities, such as new tax incentives or relief programs, that can benefit your business.

4. Utilize Tax-Efficient Strategies

Implementing tax-efficient strategies can help you minimize your tax liabilities legally and ethically. Here are a few approaches to consider:

- Claiming allowable expenses: Ensure you're claiming all eligible expenses related to your business operations. This can include office rent, utility costs, travel expenses, and professional fees.

- Utilizing tax reliefs: Take advantage of tax reliefs offered by HMRC, such as Research and Development (R&D) tax relief or the Annual Investment Allowance. These reliefs can significantly reduce your tax bill.

- Structuring your business: Consider the most tax-efficient business structure for your operations. For instance, a limited company may offer more tax advantages compared to a sole proprietorship.

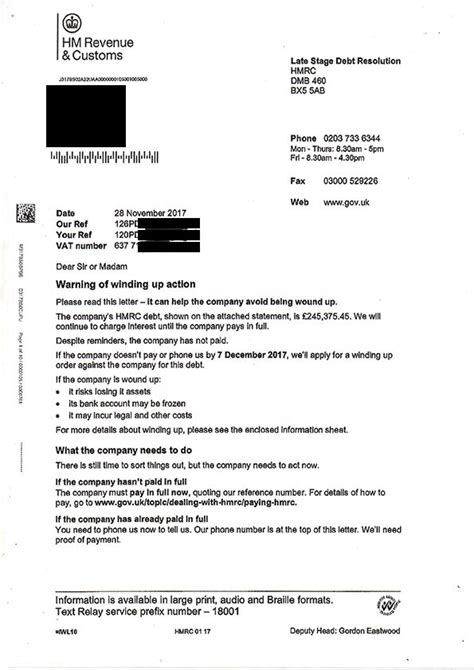

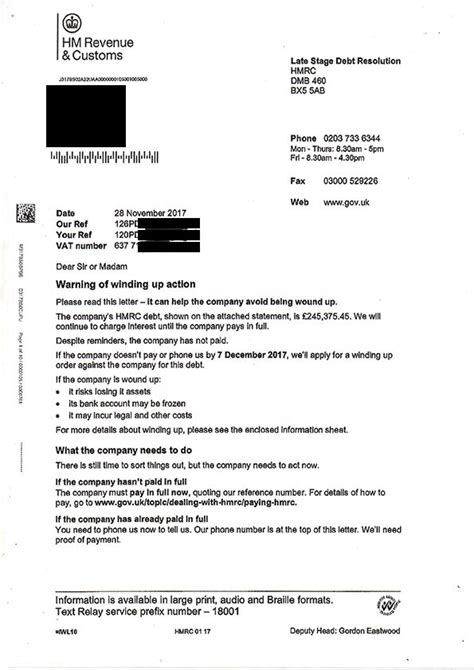

5. Plan for VAT Registration

If your business exceeds the VAT registration threshold, you'll need to register for VAT with HMRC. Planning for VAT registration is crucial to ensure compliance and avoid penalties. Here's what you need to know:

- Registration threshold: Familiarize yourself with the current VAT registration threshold, which is the annual turnover limit at which your business must register for VAT. As of 2023, the threshold is £85,000.

- VAT accounting methods: Choose the VAT accounting method that suits your business best, such as the standard, flat-rate, or cash accounting schemes.

- VAT returns: Understand the process of submitting VAT returns and the associated deadlines. Late submissions can result in penalties.

6. Seek Professional Tax Advice

While it's essential to educate yourself about HMRC business tax, seeking professional tax advice can provide valuable insights and peace of mind. Consider working with a qualified accountant or tax advisor who specializes in business tax.

A tax professional can help you navigate the complexities of tax laws, optimize your tax position, and ensure compliance. They can also assist with tax planning, identifying tax-efficient strategies, and representing you in case of an HMRC inquiry or audit.

7. Stay Organized and Plan Ahead

Effective tax management requires organization and forward planning. Set up a dedicated system for tracking tax-related tasks and deadlines. Use a tax calendar or a project management tool to stay on top of important dates, such as tax payment deadlines, VAT return submissions, and self-assessment filing deadlines.

Additionally, plan your tax payments in advance to avoid last-minute surprises. Set aside funds specifically for tax liabilities to ensure you have the necessary funds available when payments are due.

💡 Note: HMRC offers a Time to Pay service, which allows you to set up a payment plan if you're unable to pay your tax liabilities in full by the due date.

Conclusion

Dealing with HMRC business tax doesn't have to be overwhelming. By understanding your tax obligations, keeping accurate records, staying informed about tax changes, and implementing tax-efficient strategies, you can navigate the tax landscape with confidence. Remember to seek professional advice when needed and stay organized to ensure a smooth and compliant tax experience.

Frequently Asked Questions

What is the current VAT registration threshold in the UK?

+

As of 2023, the VAT registration threshold in the UK is £85,000. This means that if your business’s annual turnover exceeds £85,000, you must register for VAT with HMRC.

Can I choose a different VAT accounting method after registering for VAT?

+

Yes, you can change your VAT accounting method if it better suits your business needs. However, you’ll need to notify HMRC and provide a valid reason for the change. The most common methods include the standard, flat-rate, and cash accounting schemes.

What happens if I miss a tax payment deadline or VAT return submission?

+

Missing a tax payment deadline or VAT return submission can result in penalties and interest charges. HMRC may also impose a late filing penalty for late VAT returns. It’s crucial to stay organized and plan ahead to avoid these penalties.

Are there any tax reliefs or incentives for small businesses?

+

Yes, HMRC offers various tax reliefs and incentives to support small businesses. These include the Annual Investment Allowance, Research and Development (R&D) tax relief, and the Employment Allowance. It’s worth exploring these options to minimize your tax liabilities.

Can I appeal an HMRC decision or penalty?

+

Yes, you have the right to appeal HMRC’s decisions or penalties. You can do so by following HMRC’s official appeals process, which typically involves submitting a written notice of appeal within 30 days of receiving the decision or penalty notice. It’s advisable to seek professional advice when appealing an HMRC decision.