Design 8 Steps To Update Your Council Tax Bill Name Today

Transforming Your Council Tax Bill with an Updated Name

Council tax bills are an essential part of local government funding, but it's crucial to ensure that your bill is accurate and up-to-date, especially when it comes to your personal details. An outdated name on your council tax bill can lead to various administrative issues and potential financial implications. In this guide, we will walk you through a comprehensive step-by-step process to ensure your council tax bill reflects your current name accurately.

Step 1: Understand the Importance of an Updated Name

Having an accurate name on your council tax bill is not just a matter of administrative convenience. It's a legal requirement and ensures that you are correctly identified in the eyes of the law. Here are some key reasons why updating your name is essential:

- Legal Identification: Your name on the council tax bill is a crucial form of identification, especially when it comes to legal matters or disputes.

- Accuracy in Records: An updated name ensures that your council tax records are accurate, which is vital for future reference and potential audits.

- Avoidance of Penalties: In some cases, having an outdated name on your bill can lead to penalties or fines due to administrative errors.

- Easy Communication: A current name makes it easier for the council to communicate with you effectively, ensuring you receive important updates and information.

Step 2: Gather the Necessary Documentation

Before initiating the name update process, it's essential to have the required documentation ready. This will streamline the process and ensure a smoother transition.

- Proof of Identity: Provide valid identification documents such as a passport, driver's license, or national ID card.

- Proof of Address: Include a recent utility bill or bank statement that confirms your current address.

- Marriage/Divorce Certificate: If your name change is due to marriage or divorce, ensure you have the relevant certificate.

- Change of Name Deed: In some cases, a legal document, such as a change of name deed, may be required.

Step 3: Contact Your Local Council

The next step is to reach out to your local council's revenue department or the council tax office. This can be done via phone, email, or in person, depending on your preference and the council's communication channels.

- Phone: Call the council tax helpline and explain your situation to the customer service representative.

- Email: Send an email to the council tax department, attaching the necessary documents for reference.

- In-Person: Visit the council offices during their opening hours and speak to a representative directly.

Step 4: Provide the Required Information

When contacting the council, ensure you have the following details ready to provide:

- Your Full Name: Both your current and previous names, if applicable.

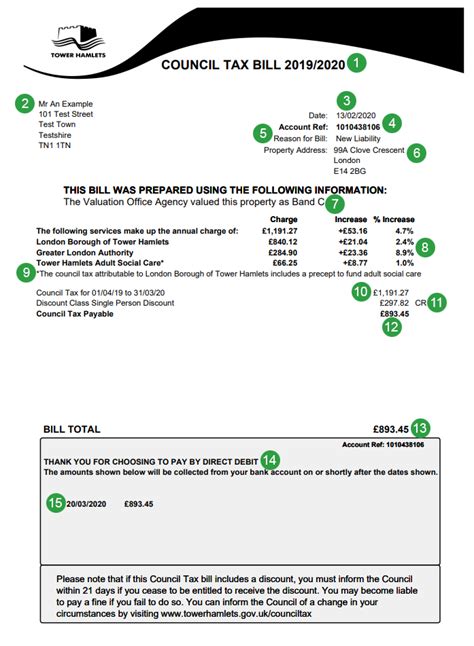

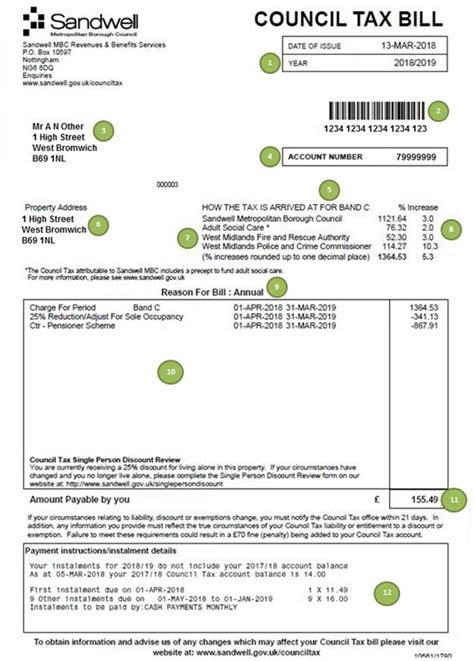

- Council Tax Account Number: This is usually found on your council tax bill or statement.

- Contact Details: Your current address, phone number, and email address.

- Reason for Name Change: Briefly explain the reason for your name change, whether it's due to marriage, divorce, or a legal deed.

Step 5: Complete the Necessary Forms

Depending on your local council's procedures, you may need to fill out specific forms to update your name. These forms are typically available online or can be requested from the council tax office.

- Online Forms: Many councils provide online platforms where you can submit your name change request and upload the required documents.

- Paper Forms: In some cases, you may need to print, complete, and return the forms by post or in person.

Step 6: Submit Your Request

Once you have gathered all the necessary information and completed the required forms, it's time to submit your name change request. Ensure that you keep a copy of all the documents for your records.

- Online Submission: If you are using an online platform, carefully follow the instructions to upload your documents and submit your request.

- Post or In-Person: If submitting by post or in person, ensure that you include all the required documents and clearly label the envelope or package.

Step 7: Await Confirmation

After submitting your request, it's important to be patient and allow the council time to process your application. They will review your documents and update their records accordingly.

- Processing Time: The time it takes to process your request may vary depending on the council's workload and procedures. It's best to enquire about the expected processing time when submitting your request.

- Communication: Keep an eye on your email or postal address for any updates or confirmation from the council.

Step 8: Verify the Changes

Once you receive confirmation from the council, it's essential to verify that the changes have been made accurately. This step ensures that your records are up-to-date and avoid any future issues.

- Check Your Next Bill: When you receive your next council tax bill, carefully review it to ensure that your name is correctly updated.

- Contact the Council: If you notice any discrepancies, don't hesitate to contact the council tax office and bring the issue to their attention.

Conclusion

Updating your name on your council tax bill is a straightforward process that ensures your personal details are accurate and up-to-date. By following these eight simple steps, you can easily navigate the name change process and maintain a positive relationship with your local council. Remember, accurate records not only avoid potential legal issues but also streamline communication and make your interactions with the council more efficient.

What happens if I don’t update my name on the council tax bill?

+

Failing to update your name can lead to administrative errors, potential fines, and legal complications. It’s essential to keep your records accurate to avoid any issues.

Can I change my name on the council tax bill if I’m a tenant?

+

Yes, tenants can also update their names on the council tax bill. However, you may need to provide additional documentation, such as a tenancy agreement, to prove your residence.

How long does it take for the council to process my name change request?

+

Processing times can vary depending on the council’s workload. It’s best to inquire about the expected timeframe when submitting your request.