Design The Ultimate Car Tax Strategy: 6 Uk Tips

Understanding Car Tax in the UK

The car tax system in the UK can be a complex affair, but with the right strategies, you can navigate it efficiently and potentially save a significant amount of money. This guide will walk you through the essential aspects of car tax, providing you with the knowledge to make informed decisions and devise an optimal tax strategy.

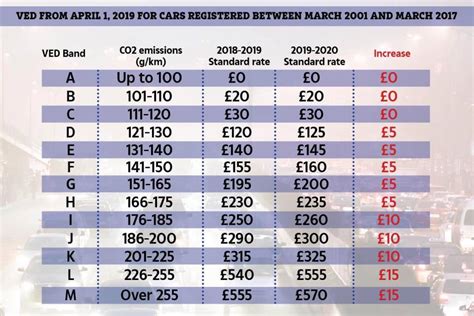

1. Vehicle Excise Duty (VED) and First Registration Fee

When purchasing a new or used car, you’ll encounter two primary taxes: the Vehicle Excise Duty (VED) and the First Registration Fee. The VED, often referred to as road tax, is an annual fee that varies based on the car’s carbon dioxide (CO2) emissions and fuel type. It’s important to understand the VED band your car falls into, as this will determine the tax rate you’ll pay.

The First Registration Fee, on the other hand, is a one-time payment made when registering a new or imported vehicle. This fee is calculated based on the car’s CO2 emissions and can be quite substantial, so it’s crucial to factor it into your overall tax strategy.

2. Opt for Low-Emission Vehicles

One of the most effective ways to reduce your car tax is by choosing a vehicle with low CO2 emissions. The UK government encourages the adoption of environmentally friendly cars by offering reduced VED rates for vehicles that produce fewer emissions. Electric and hybrid cars, in particular, often fall into the lowest VED bands, making them an attractive option for tax-conscious drivers.

3. Consider the Age of Your Vehicle

The age of your car can also impact the amount of tax you pay. Generally, newer vehicles with lower CO2 emissions are subject to lower VED rates. If you’re purchasing a used car, research the VED band it falls into and compare it with newer models to assess the potential tax savings.

4. Explore Tax-Efficient Financing Options

When financing a car, consider the tax implications of different options. Personal Contract Purchase (PCP) and Hire Purchase (HP) agreements often include the VED in the monthly payments, making them a convenient choice for those who prefer a fixed monthly outlay. However, be mindful of the total cost, as the included VED may be higher than the market rate.

5. Keep Up with Maintenance and Emissions Testing

To avoid additional taxes and penalties, it’s crucial to keep your car well-maintained and ensure it meets the required emissions standards. Regular servicing and emissions testing can help identify and rectify any issues that may impact your car’s tax classification.

6. Take Advantage of Exemptions and Discounts

Certain vehicles and drivers may be eligible for tax exemptions or discounts. For example, electric vehicles (EVs) are often exempt from VED, and disabled drivers may qualify for a discount or exemption through the Blue Badge scheme. Researching and understanding these exemptions can help you optimize your tax strategy.

Table: VED Bands and Rates

| VED Band | CO2 Emissions (g/km) | Fuel Type | First Year Rate | Standard Rate |

|---|---|---|---|---|

| A | 0-100 | Electric/Hybrid | £0 | £0 |

| B | 101-110 | Petrol/Diesel | £150 | £150 |

| C | 111-130 | Petrol/Diesel | £250 | £145 |

| ... | ... | ... | ... | ... |

| M | 255 and over | Petrol/Diesel | £2,135 | £520 |

Important Notes

- VED Rates: VED rates are subject to change, so it’s advisable to check the official government website for the most up-to-date information.

- Emissions Testing: Regular emissions testing is crucial to ensure your car remains compliant with environmental standards.

- Exemptions: Research and understand the various exemptions and discounts available to determine if you’re eligible for any tax benefits.

Conclusion

By familiarizing yourself with the UK’s car tax system and implementing the strategies outlined above, you can significantly reduce your tax burden. From choosing low-emission vehicles to exploring tax-efficient financing options, every decision counts when it comes to optimizing your car tax strategy. Remember to stay informed, keep your vehicle well-maintained, and take advantage of any applicable exemptions to ensure a smooth and cost-effective tax experience.

FAQ

What is the Vehicle Excise Duty (VED)?

+

VED, or Vehicle Excise Duty, is the annual tax paid by vehicle owners in the UK. It is based on the car’s CO2 emissions and fuel type.

Are there any exemptions for car tax in the UK?

+

Yes, certain vehicles and drivers may be eligible for exemptions or discounts. Electric vehicles are often exempt from VED, and disabled drivers can benefit from the Blue Badge scheme.

How often do I need to pay car tax in the UK?

+

Car tax is typically paid annually, but some financing options include the VED in the monthly payments.