Design The Ultimate Council Tax Band Strategy Now

Understanding Council Tax Bands

Council Tax is a vital source of revenue for local authorities in the United Kingdom, helping to fund essential services and infrastructure. One key aspect of this tax system is the council tax bands, which determine the amount individuals and households pay based on the value of their properties. Understanding how these bands work and developing a strategy to navigate them effectively can significantly impact your financial obligations and overall council tax liability.

This guide will delve into the intricacies of council tax bands, providing a comprehensive strategy to optimize your position within this system. By the end of this article, you’ll have a clear understanding of how to assess your current band, explore potential challenges and appeals, and ultimately, develop a plan to reduce your council tax burden.

Assessing Your Current Council Tax Band

The first step in formulating your council tax band strategy is to evaluate your current band. This involves understanding the criteria used to assign properties to specific bands and how your property was initially assessed.

Understanding the Banding System

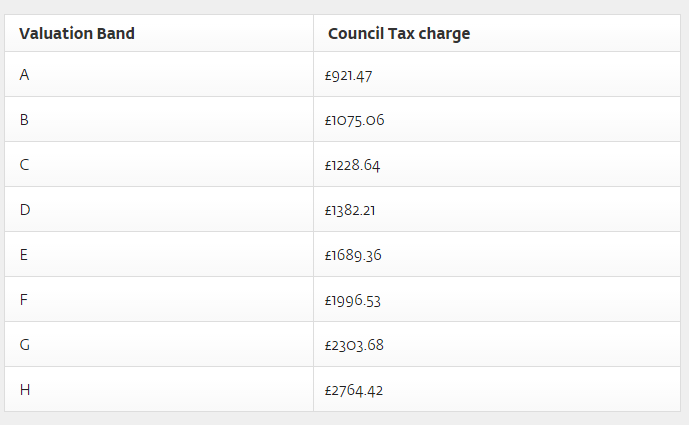

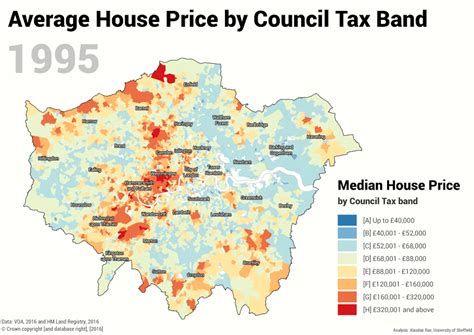

Council tax bands are divided into eight categories, ranging from A (the lowest band, for properties valued at up to £40,000) to H (the highest band, for properties valued at over £320,000). The valuation of your property, which is typically based on its open market value as of 1 April 1991, determines the band it falls into.

Assessing Your Property’s Value

To assess your property’s value and determine its council tax band, you can:

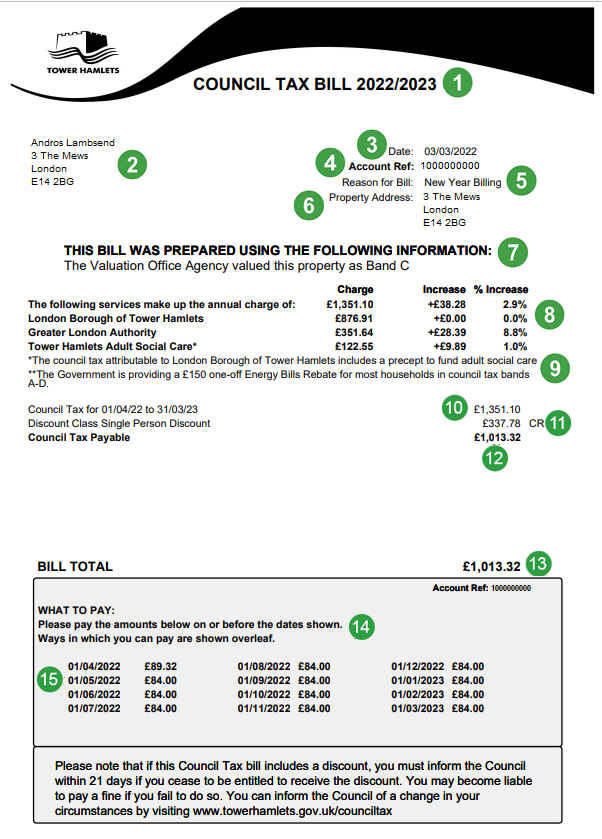

- Check your council tax bill: Your current bill should state the band your property is in.

- Use online tools: Many local authorities provide online tools or databases that allow you to check your property’s band based on its address.

- Consult the Valuation Office Agency (VOA): If you’re unsure about your property’s valuation or band, you can contact the VOA, which is responsible for assessing and maintaining the banding system.

Evaluating Your Property’s Banding

Once you’ve determined your property’s current band, it’s essential to evaluate whether this band accurately reflects your property’s value and whether there are any grounds for challenging it.

Factors to Consider

When assessing your property’s banding, consider the following factors:

- Property Value: Compare your property’s value to similar properties in your area. If your property is significantly undervalued compared to others, this could be a valid reason for challenging your band.

- Recent Sales: Research recent sales of similar properties in your area. If properties with similar characteristics have sold for significantly less than your property’s valuation, this could indicate an inaccurate assessment.

- Property Condition: Take into account any significant changes or improvements to your property since the 1991 valuation. These could include extensions, renovations, or upgrades that may have increased your property’s value and, consequently, its council tax band.

- Local Market Trends: Stay informed about the property market in your area. If property values have been declining, this could potentially impact your property’s valuation and, consequently, its council tax band.

Challenging Your Council Tax Band

If you believe your property is in the wrong council tax band, you have the right to challenge this assessment. This process, known as a council tax band appeal, can be a complex and time-consuming endeavor, but it could result in significant savings if successful.

The Appeal Process

To initiate a council tax band appeal, follow these steps:

- Gather Evidence: Collect as much evidence as possible to support your case. This could include recent property sales data, details of any improvements or changes to your property, and any other relevant information that demonstrates your property’s true value.

- Contact the VOA: The first step is to contact the VOA, which is responsible for handling council tax band appeals. Provide them with your evidence and explain why you believe your property is in the wrong band.

- Wait for a Decision: The VOA will review your case and make a decision. They may request additional information or conduct a physical inspection of your property.

- Receive the Decision: Once the VOA has made its decision, you will be notified of the outcome. If your appeal is successful, your property’s band will be adjusted, and you may be entitled to a refund for any overpaid council tax.

Strategies for Reducing Your Council Tax Burden

While challenging your council tax band can be an effective strategy, there are also other approaches you can take to reduce your overall council tax liability.

Apply for Discounts and Exemptions

Certain individuals and households may be eligible for discounts or exemptions from council tax. These can significantly reduce your financial burden. Some common discounts and exemptions include:

- Single Person Discount: If you’re the only adult living in your property, you may be entitled to a 25% discount on your council tax.

- Disregarded Occupiers: If certain individuals, such as full-time students or young people under specific circumstances, live in your property, they may be disregarded for council tax purposes, reducing the number of adults counted for billing.

- Council Tax Reduction: If you’re on a low income or receive certain benefits, you may be eligible for a council tax reduction, which can significantly reduce your bill.

Explore Alternative Billing Arrangements

If you’re struggling to keep up with your council tax payments, consider discussing alternative billing arrangements with your local authority. They may be able to offer flexible payment plans or arrange for payments to be made directly from your benefits or pension.

Make Energy Efficiency Improvements

Improving the energy efficiency of your home can not only reduce your energy bills but also potentially lower your council tax band. Properties with higher energy efficiency ratings are often valued lower for council tax purposes. Consider investing in energy-efficient appliances, insulation, or other energy-saving measures.

Conclusion: Taking Control of Your Council Tax

Understanding the council tax banding system and developing a comprehensive strategy is essential to managing your financial obligations effectively. By assessing your current band, evaluating your property’s value, and exploring potential challenges and appeals, you can ensure that you’re paying the correct amount of council tax. Additionally, by applying for discounts and exemptions and exploring alternative billing arrangements, you can further reduce your financial burden. Remember, taking control of your council tax situation can lead to significant savings and a more secure financial future.

FAQ

What is the council tax banding system, and how does it work?

+

The council tax banding system is a way to determine the amount of council tax a property owner or resident must pay. Properties are divided into eight bands (A to H) based on their value as of 1 April 1991. The higher the property’s value, the higher the band and the greater the council tax liability.

How can I find out which council tax band my property falls into?

+

You can typically find your property’s council tax band on your council tax bill. If you don’t have a bill, you can check your local authority’s website or contact the Valuation Office Agency (VOA) to request this information.

Can I challenge my property’s council tax band if I believe it’s incorrect?

+

Yes, you have the right to appeal your council tax band if you believe it’s inaccurate. You’ll need to gather evidence to support your case and contact the VOA to initiate the appeal process.

What are some common discounts and exemptions available for council tax?

+

Common discounts and exemptions include the Single Person Discount (25% off for properties with only one adult), Disregarded Occupiers (certain individuals, like students, are not counted for billing), and Council Tax Reduction (for those on low incomes or receiving certain benefits).