Design Your Hmrc Account: The Ultimate Guide

Setting up your HMRC account is an essential step for any business or individual dealing with tax and national insurance matters in the UK. With the right tools and knowledge, you can make the process seamless and efficient. This guide will walk you through the process of designing your HMRC account, covering everything from registration to managing your tax affairs online.

Registering for an HMRC Online Account

The first step towards an effective HMRC account is registration. Here's a step-by-step guide to help you get started:

-

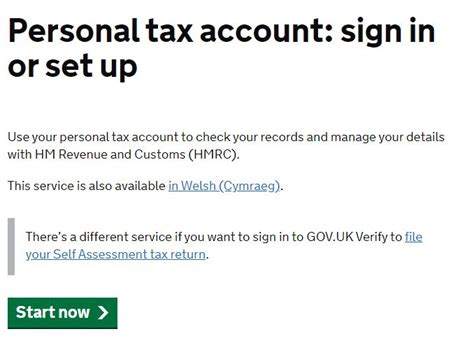

Access the HMRC Website: Visit the HM Revenue and Customs (HMRC) website using a web browser. This is the official government website for tax and national insurance matters.

-

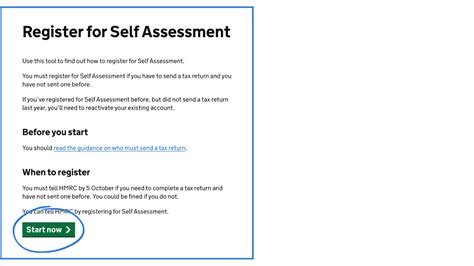

Navigate to the Registration Page: On the HMRC website, look for the "Services" or "Accounts" section. Click on the link that says "Register for an HMRC online account" or a similar option.

-

Choose Your Account Type: Depending on your needs, you may need to select an account type. Common options include:

- Personal Tax Account

- Business Tax Account

- Trust and Estate Account

- Corporation Tax Account

-

Enter Your Details: You'll be prompted to enter personal information, such as your name, date of birth, National Insurance number, and contact details. Ensure the information is accurate and up-to-date.

-

Verify Your Identity: HMRC may require you to verify your identity through a secure code sent to your mobile phone or email. Follow the instructions provided to complete this step.

-

Create Your Account: Once your identity is verified, you can create your HMRC online account by setting a strong password. Choose a password that's easy for you to remember but difficult for others to guess.

💡 Note: Keep your login details secure and never share your password with anyone. HMRC will never ask for your password or personal information through email or over the phone.

Managing Your HMRC Account

Once you've successfully registered, it's time to explore the features and benefits of your HMRC online account. Here's what you can do:

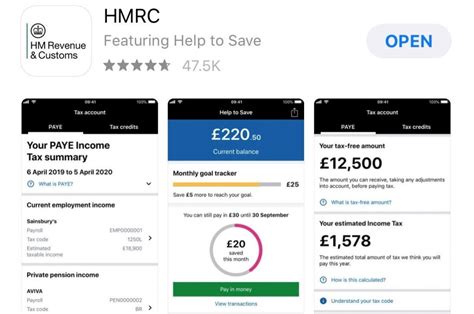

View and Manage Your Tax Affairs

Your HMRC account provides a comprehensive overview of your tax situation. You can:

- Check your tax code and understand how it's calculated.

- View your tax records, including previous tax years.

- See your National Insurance contributions and check if you're on track for your State Pension.

- Access your Self Assessment tax return and other relevant forms.

Make Tax Payments and Manage Direct Debits

With your HMRC account, you can make tax payments easily and securely. You can also set up and manage direct debits for regular tax payments, ensuring you never miss a deadline.

Receive Tax Refunds

If you're entitled to a tax refund, your HMRC account will notify you. You can then claim your refund directly through your account, making the process convenient and efficient.

Update Your Personal Details

Life changes, and so do your personal details. Your HMRC account allows you to update your name, address, and other contact information easily. This ensures that HMRC always has your correct details on file.

Apply for Tax Credits and Benefits

If you're eligible for tax credits or other benefits, you can apply directly through your HMRC account. This simplifies the application process and reduces the need for paperwork.

Access Useful Resources and Guides

HMRC provides a wealth of resources and guides to help you understand your tax obligations. You can access these resources through your account, ensuring you have the information you need to stay compliant.

Maximizing Your HMRC Online Experience

To get the most out of your HMRC online account, consider the following tips:

-

Stay Informed: HMRC regularly updates its website with important tax information and changes to legislation. Make it a habit to check for updates regularly.

-

Use the Help and Support Section: If you encounter any issues or have questions, the HMRC website has a comprehensive help and support section. You can find answers to common queries or contact HMRC directly for assistance.

-

Set Up Email or Text Alerts: You can choose to receive email or text alerts for important tax deadlines, changes to your account, or other relevant notifications.

-

Keep Your Password Secure: As mentioned earlier, it's crucial to keep your password safe and secure. Regularly update your password and avoid sharing it with others.

ℹ️ Note: If you have multiple tax affairs to manage, such as personal tax and business tax, consider creating separate accounts for each. This can help you stay organized and ensure you're not missing any important details.

HMRC Contact Information

While the HMRC online account is a convenient way to manage your tax affairs, there may be times when you need to contact HMRC directly. Here's how you can reach them:

Telephone

You can call HMRC on their general enquiry line at 0300 200 3300. This line is open Monday to Friday, 8 am to 8 pm, and Saturday, 8 am to 4 pm. You can also find specific contact numbers for different tax matters on the HMRC website.

HMRC provides an email address for general enquiries: enquiries@hmrc.gov.uk. However, please note that email is not a secure method for sending sensitive information.

Post

If you prefer to correspond via post, you can write to HMRC at the following address:

HM Revenue and Customs

HX2 7HU

United Kingdom

Remember to include your name, address, and National Insurance number in your correspondence.

Conclusion

Designing your HMRC account is a crucial step towards efficient tax management. By following this guide, you can navigate the registration process and explore the various features of your online account. Remember to keep your account secure, stay informed about tax updates, and reach out to HMRC if you have any questions or concerns. With a well-designed HMRC account, you can stay on top of your tax affairs and ensure compliance with UK tax laws.

What is the purpose of an HMRC online account?

+

An HMRC online account allows you to manage your tax affairs digitally, including viewing tax records, making payments, and applying for tax credits.

How do I register for an HMRC online account?

+To register, visit the HMRC website, navigate to the “Accounts” or “Services” section, and follow the prompts to create your account. You’ll need to provide personal details and verify your identity.

Can I manage both personal and business tax through one HMRC account?

+Yes, you can manage multiple tax affairs through one HMRC account. However, it’s recommended to create separate accounts for better organization and clarity.

Is it safe to provide my personal information on the HMRC website?

+Yes, the HMRC website is secure, and your personal information is protected. However, always ensure you’re on the official HMRC website and never share your login details with anyone.