Gov Uk Business Tax Account

Setting up and managing your business taxes can be a complex and time-consuming process, but with the right tools and knowledge, it can become more straightforward. The Gov.uk Business Tax Account is a valuable resource for UK-based businesses, offering a centralized platform to manage various tax-related tasks efficiently. In this blog post, we will explore the features and benefits of the Gov.uk Business Tax Account, guiding you through the process of utilizing this platform to streamline your tax management.

Understanding the Gov.uk Business Tax Account

The Gov.uk Business Tax Account is an online service provided by HM Revenue and Customs (HMRC) specifically designed for businesses. It serves as a digital hub where businesses can access and manage their tax affairs, simplifying the often-daunting task of tax compliance.

This platform offers a range of features and benefits, making it an essential tool for any business owner or accountant. By centralizing tax-related tasks, it aims to reduce the administrative burden and provide a more organized approach to tax management.

Key Features of the Gov.uk Business Tax Account

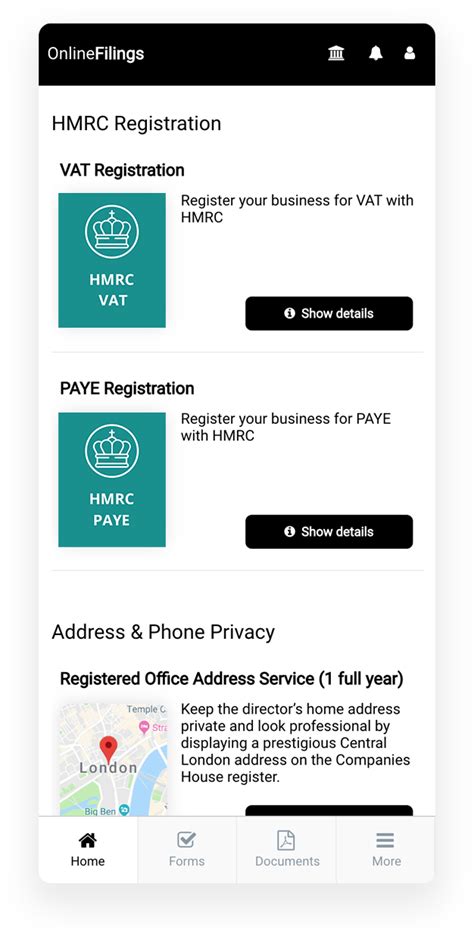

- Tax Registration and Management: The platform allows you to register for various taxes, including Income Tax, National Insurance, and Value Added Tax (VAT). You can also manage existing tax registrations, update your business details, and make necessary amendments.

- Filing Tax Returns: One of the most significant advantages is the ability to file tax returns online. Whether it's for Income Tax, Corporation Tax, or VAT, you can complete and submit your returns directly through the platform, ensuring timely compliance.

- Payment and Refunds: Gov.uk Business Tax Account provides a convenient way to make tax payments and track your refund status. You can set up direct debits, pay by card, or use other payment methods, all within the platform.

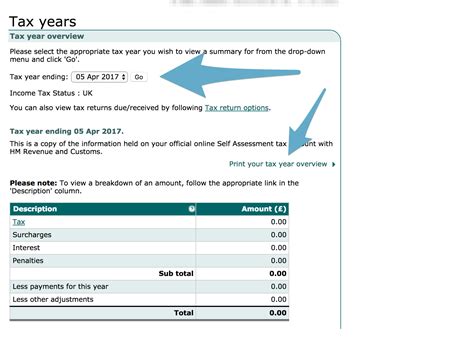

- Real-Time Information: The platform offers real-time access to your tax records, allowing you to stay updated on your tax liabilities, payments, and refunds. This feature ensures that you have the latest information at your fingertips.

- Tax Calculators and Guides: To assist businesses in understanding their tax obligations, the platform provides tax calculators and comprehensive guides. These resources can help you estimate your tax liabilities and navigate the complex world of business taxes.

- Secure Communication: Gov.uk Business Tax Account offers a secure messaging system, enabling you to communicate directly with HMRC. This feature ensures that sensitive tax-related discussions remain confidential and provides a convenient way to seek guidance.

Getting Started with Gov.uk Business Tax Account

To begin using the Gov.uk Business Tax Account, you'll need to register your business with HMRC. Here's a step-by-step guide to help you get started:

- Visit the Gov.uk Website: Go to the official Gov.uk website and navigate to the "Business and self-employed" section. From there, you can find the link to the Business Tax Account.

- Register Your Business: Click on the "Register your business" option and follow the instructions. You'll need to provide basic business information, including your business name, address, and contact details.

- Choose Your Taxes: During the registration process, you'll be prompted to select the taxes you need to manage. This could include Income Tax, VAT, National Insurance, or other applicable taxes.

- Create an Account: Once you've registered your business, you'll need to create an online account. This account will serve as your gateway to the Business Tax Account platform.

- Log In and Explore: After creating your account, log in to the Business Tax Account. You'll find a user-friendly dashboard where you can access various tax-related tasks and manage your business's tax affairs.

Managing Your Taxes Effectively

Now that you have set up your Gov.uk Business Tax Account, it's time to delve into the platform's features and utilize them to manage your taxes efficiently.

Filing Tax Returns

Filing tax returns is a critical aspect of tax management. The Gov.uk Business Tax Account simplifies this process by providing a user-friendly interface for completing and submitting tax returns online. Here's a brief overview of the steps involved:

- Access Your Account: Log in to your Business Tax Account and navigate to the "Tax Returns" section.

- Select the Tax Type: Choose the type of tax return you need to file, such as Income Tax, Corporation Tax, or VAT.

- Complete the Return: Follow the on-screen instructions to enter the required information. The platform will guide you through the process, ensuring you provide all necessary details.

- Review and Submit: Once you've completed the tax return, carefully review the information for accuracy. Finally, submit the return to HMRC.

Making Tax Payments

Timely tax payments are crucial to avoid penalties and maintain a good relationship with HMRC. The Gov.uk Business Tax Account offers various payment options to suit your preferences:

- Direct Debit: Set up a direct debit to automate your tax payments. This ensures that your taxes are paid on time without the need for manual transactions.

- Credit or Debit Card: You can use your credit or debit card to make tax payments. This option is convenient for one-time payments or if you prefer not to set up a direct debit.

- Other Payment Methods: The platform also supports other payment methods, such as BACS (Bankers' Automated Clearing Services) or CHAPS (Clearing House Automated Payment System). These methods are suitable for larger payments or specific tax types.

Tracking Refunds

If you're eligible for a tax refund, the Gov.uk Business Tax Account provides a simple way to track its status. Here's how you can stay updated on your refund:

- Log in to Your Account

- Navigate to the "Payments and Refunds" section.

- Locate the refund you're tracking and check its current status.

- If you have any questions or concerns, you can use the secure messaging system to communicate with HMRC.

Benefits of Using Gov.uk Business Tax Account

Adopting the Gov.uk Business Tax Account offers several advantages for businesses, making tax management more efficient and streamlined.

- Time-Saving: By centralizing tax-related tasks, you can save valuable time. The platform's user-friendly interface and automated processes reduce the time spent on manual data entry and paperwork.

- Convenience: With the ability to manage your taxes online, you can access your account from anywhere with an internet connection. This flexibility allows you to work on your tax affairs at your convenience.

- Real-Time Updates: The platform provides real-time access to your tax records, ensuring that you have the latest information. This helps you stay on top of your tax liabilities and make informed decisions.

- Improved Compliance: Gov.uk Business Tax Account simplifies the tax compliance process. By providing clear guidelines and calculators, it helps businesses understand their tax obligations and ensures timely filing of tax returns.

- Secure Communication: The secure messaging system allows you to communicate directly with HMRC, ensuring the confidentiality of sensitive tax-related discussions. This feature provides a convenient and efficient way to seek guidance and resolve queries.

Tips for Effective Tax Management

While the Gov.uk Business Tax Account is a powerful tool, there are a few best practices to keep in mind to ensure a smooth tax management experience.

- Keep Your Account Updated: Regularly update your business details and tax registrations to ensure accuracy. This includes changes in business address, contact information, or tax liabilities.

- Set Reminders: Use the platform's reminder system to stay on top of important tax deadlines. You can receive notifications for upcoming tax return filing dates, payment due dates, and other critical milestones.

- Seek Professional Advice: If you have complex tax affairs or specific queries, consider seeking professional advice from an accountant or tax advisor. They can provide expert guidance and ensure you're complying with all relevant tax regulations.

- Stay Informed: Keep yourself updated on any changes or updates to tax laws and regulations. The Gov.uk Business Tax Account provides resources and guides to help you understand these changes and their impact on your business.

Conclusion

The Gov.uk Business Tax Account is a valuable resource for UK-based businesses, offering a centralized and efficient way to manage tax-related tasks. By utilizing this platform, you can streamline your tax management, save time, and ensure compliance with HMRC regulations. With its user-friendly interface and comprehensive features, the Gov.uk Business Tax Account empowers businesses to take control of their tax affairs and focus on their core operations.

FAQ

How do I register for the Gov.uk Business Tax Account?

+

To register for the Gov.uk Business Tax Account, visit the official Gov.uk website and navigate to the “Business and self-employed” section. From there, you can find the link to the Business Tax Account. Follow the registration process, providing the required business information and selecting the taxes you need to manage. Once registered, create an online account to access the platform.

Can I file tax returns for multiple businesses through the Gov.uk Business Tax Account?

+

Yes, the Gov.uk Business Tax Account allows you to manage tax affairs for multiple businesses. During the registration process, you can select the taxes for each business, and the platform will provide separate sections for each entity. This feature is particularly useful for businesses with multiple tax registrations or those operating under different legal entities.

Is the Gov.uk Business Tax Account secure?

+

Absolutely! The Gov.uk Business Tax Account employs robust security measures to protect your sensitive tax information. HMRC uses encryption technology to ensure that your data is secure during transmission and storage. Additionally, the platform offers a secure messaging system, allowing you to communicate directly with HMRC while maintaining the confidentiality of your tax-related discussions.

What if I encounter technical issues while using the Gov.uk Business Tax Account?

+

If you experience any technical issues or have questions about using the platform, HMRC provides comprehensive support. You can access the help section within the Gov.uk Business Tax Account, which offers detailed guides and troubleshooting tips. Additionally, you can contact HMRC’s helpline for further assistance. Their support team is trained to handle technical queries and provide guidance on using the platform effectively.

Can I use the Gov.uk Business Tax Account for personal tax affairs?

+

No, the Gov.uk Business Tax Account is specifically designed for businesses. If you’re an individual looking to manage your personal tax affairs, HMRC provides separate platforms and services for that purpose. Visit the Gov.uk website to explore the options available for personal tax management.