Hardship Fund Dwp

The Department for Work and Pensions (DWP) in the United Kingdom offers various support programs to assist individuals facing financial difficulties. One such program is the Hardship Fund, which aims to provide immediate financial aid to those in dire need. This fund is designed to offer a safety net for vulnerable individuals and families, helping them bridge the gap during challenging times.

The Hardship Fund, often referred to as the DWP Hardship Loan, is a valuable resource for those who find themselves in unexpected financial crises. It offers a helping hand to those who may not qualify for other benefits or loans, ensuring they have access to essential funds when they need it the most.

Understanding the Hardship Fund

The Hardship Fund is a discretionary program, meaning that the DWP has the authority to decide who receives the financial assistance and the amount granted. This flexibility allows the DWP to adapt to the unique circumstances of each applicant, ensuring a personalized approach to providing support.

The fund is primarily intended for individuals who are already in receipt of certain benefits, such as Universal Credit or Jobseeker's Allowance. However, in exceptional cases, those not receiving these benefits may also be considered for assistance. The key criterion for eligibility is demonstrating a genuine need for immediate financial aid.

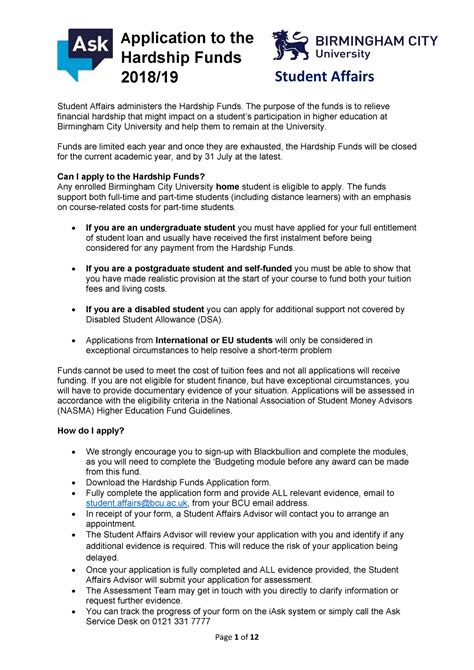

How to Apply for the Hardship Fund

If you believe you may be eligible for the Hardship Fund, the first step is to contact your local Jobcentre Plus office. A work coach or a DWP advisor will assess your situation and guide you through the application process. Here's a general overview of what you can expect:

1. Initial Assessment

During your first interaction with the DWP, explain your circumstances and why you require immediate financial assistance. Be prepared to provide details about your financial situation, including any recent changes or unexpected expenses.

2. Supporting Evidence

To strengthen your application, gather relevant documents that support your claim. This may include bank statements, utility bills, or any other proof of financial hardship. The more evidence you can provide, the better your chances of a successful application.

3. Interview and Decision

A DWP advisor will schedule an interview to discuss your application in detail. This is your opportunity to explain your situation and answer any questions they may have. After the interview, the advisor will carefully consider your case and make a decision regarding your eligibility for the Hardship Fund.

Repaying the Hardship Loan

It's important to note that the Hardship Fund is a loan, not a grant. This means that if you receive financial assistance, you will be expected to repay the loan over time. The repayment terms are designed to be flexible and manageable, taking into account your individual circumstances.

The DWP will work with you to set up a repayment plan that suits your financial situation. This may involve deducting a small amount from your benefit payments each month until the loan is repaid in full. It's crucial to maintain open communication with the DWP throughout the repayment process to ensure a smooth and stress-free experience.

Benefits of the Hardship Fund

The Hardship Fund offers several advantages to those in need:

- Immediate Assistance: Unlike traditional loan applications, the Hardship Fund provides rapid access to funds, ensuring you can address urgent financial needs promptly.

- Discretionary Approach: The DWP's flexibility allows for a personalized assessment of your situation, ensuring a tailored solution to your financial challenges.

- No Interest or Fees: The Hardship Loan does not incur any additional charges or interest, making it an affordable option for those already facing financial difficulties.

- Repayment Flexibility: The repayment terms are designed to be manageable, allowing you to focus on your financial recovery without added stress.

Eligibility Criteria

While the DWP has the discretion to decide on each application, there are general criteria that applicants should meet. These include:

- Being in receipt of certain benefits, such as Universal Credit or Jobseeker's Allowance.

- Demonstrating a genuine need for immediate financial assistance.

- Providing supporting evidence to validate your financial situation.

- Being willing and able to repay the loan within a reasonable timeframe.

What to Expect During the Application Process

The application process for the Hardship Fund can vary depending on your individual circumstances. However, here's a general overview of what you can expect:

1. Contact the DWP

Reach out to your local Jobcentre Plus office or the DWP helpline to express your interest in applying for the Hardship Fund. They will guide you through the initial steps and provide you with the necessary information.

2. Provide Information

Share details about your financial situation, including any recent changes or unexpected expenses. Be prepared to discuss your income, outgoings, and any other relevant financial information.

3. Gather Supporting Documents

Collect any documents that support your claim, such as bank statements, utility bills, or letters from creditors. These will help the DWP understand your financial position and make an informed decision.

4. Interview and Decision

Attend an interview with a DWP advisor to discuss your application in detail. They will assess your circumstances and make a decision regarding your eligibility for the Hardship Fund. If approved, you will receive information about the loan amount and repayment terms.

Notes

🌟 Note: Remember, the Hardship Fund is a discretionary program, and the DWP has the final say on eligibility. While this guide provides a general overview, it's essential to consult with a DWP advisor for accurate and up-to-date information specific to your situation.

💰 Note: The Hardship Loan is intended for short-term financial relief. It is crucial to explore other long-term financial solutions to ensure sustained financial stability.

🗒️ Note: Keep track of all communication with the DWP, including dates, times, and the names of the advisors you speak with. This will be helpful if you need to refer back to your application or have any queries during the process.

Conclusion

The DWP's Hardship Fund is a valuable resource for individuals facing unexpected financial hardships. By offering immediate financial aid and flexible repayment terms, it provides a much-needed safety net for those in need. Remember, the application process is tailored to your individual circumstances, so be prepared to provide detailed information and supporting evidence. With the right support and guidance, the Hardship Fund can help you navigate through challenging times and regain financial stability.

Frequently Asked Questions

Who is eligible for the Hardship Fund?

+

The Hardship Fund is primarily for individuals receiving certain benefits, such as Universal Credit or Jobseeker’s Allowance. However, exceptional cases may be considered, so it’s best to discuss your situation with a DWP advisor.

How much can I borrow from the Hardship Fund?

+

The loan amount is determined on a case-by-case basis, considering your financial circumstances and needs. It can range from a few hundred pounds to a few thousand pounds.

What if I can’t repay the Hardship Loan?

+

If you encounter difficulties repaying the loan, it’s crucial to communicate with the DWP promptly. They can work with you to adjust the repayment plan or provide additional support to help you get back on track.

Are there any other financial assistance programs available?

+Yes, the DWP offers various other support programs, such as the Budgeting Loan and the Social Fund. These programs have different eligibility criteria and purposes, so it’s advisable to explore all options with a DWP advisor.

Can I apply for the Hardship Fund online?

+While some DWP services are available online, the Hardship Fund application process typically requires an in-person assessment. It’s best to contact your local Jobcentre Plus office to discuss your options and initiate the application.