Hmrc Invoice Requirements

Understanding HMRC Invoice Requirements

When it comes to running a business in the UK, understanding the HMRC (Her Majesty’s Revenue and Customs) invoice requirements is crucial to ensure compliance and avoid any potential penalties. In this comprehensive guide, we will explore the essential elements that make up a valid HMRC invoice, the legal obligations businesses must adhere to, and the consequences of non-compliance. Additionally, we will provide practical tips and best practices to help you create HMRC-compliant invoices effortlessly.

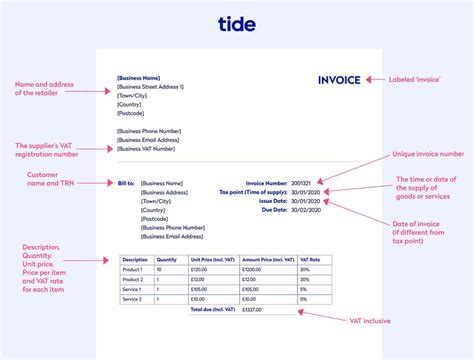

Key Components of an HMRC Invoice

An HMRC invoice serves as a vital document for both businesses and the tax authorities. It outlines the goods or services provided, the associated costs, and any applicable taxes. Here are the key components that should be included in an HMRC-compliant invoice:

- Invoice Number: Assign a unique identifier to each invoice to easily track and manage them.

- Date of Issue: Clearly state the date the invoice was issued to help with record-keeping and tax calculations.

- Supplier Details: Provide your business name, address, and contact information, including your HMRC Unique Taxpayer Reference (UTR) number.

- Customer Information: Include the customer’s name, address, and any relevant contact details.

- Description of Goods or Services: Provide a detailed description of the products or services rendered, including quantities, unit prices, and any applicable discounts or surcharges.

- Tax Information: Specify the applicable tax rate (e.g., VAT) and calculate the tax amount accurately. Ensure you are registered for the correct taxes and provide the appropriate tax identification numbers.

- Total Amount: Calculate and display the total amount due, including any taxes and additional charges.

- Payment Terms: Outline the payment due date and any specific payment instructions or preferred methods of payment.

- Additional Notes: Include any relevant information, such as delivery terms, warranty details, or specific terms and conditions agreed upon with the customer.

Legal Obligations and Compliance

Adhering to HMRC invoice requirements is not only a best practice but also a legal obligation for businesses operating in the UK. Here are some key legal considerations:

- VAT Registration: If your business is VAT-registered, you must include the VAT registration number on your invoices. Additionally, ensure you charge and account for VAT correctly based on the applicable rates.

- Record-Keeping: HMRC requires businesses to maintain accurate and complete records of their financial transactions, including invoices. Retain invoices for a minimum of six years to comply with tax regulations.

- Late Payment Penalties: Failing to issue invoices within a reasonable timeframe or not providing clear payment terms may result in late payment penalties for both businesses and customers.

- Anti-Money Laundering (AML) Compliance: Depending on the nature of your business, you may need to comply with AML regulations. Ensure your invoices include the necessary information to meet these requirements.

Best Practices for Creating HMRC-Compliant Invoices

To ensure your invoices meet HMRC standards and avoid any potential issues, consider the following best practices:

- Use Invoice Software: Utilize user-friendly invoice software or accounting platforms that generate HMRC-compliant invoices automatically. These tools often come with built-in features to simplify the process and reduce errors.

- Automate Invoice Generation: Set up automated invoice generation processes to save time and minimize manual errors. Many accounting software solutions offer this functionality.

- Keep Invoices Consistent: Maintain a consistent format and structure for all your invoices. Consistency helps with easy identification and makes it simpler to locate specific information.

- Regularly Review and Update: Review your invoice templates periodically to ensure they remain up-to-date with any changes in tax rates, regulations, or business practices. Stay informed about any HMRC updates to avoid non-compliance.

- Provide Clear Payment Instructions: Clearly communicate your preferred payment methods and any associated fees or deadlines. This helps customers understand their obligations and ensures timely payments.

Consequences of Non-Compliance

Failing to comply with HMRC invoice requirements can have serious consequences for businesses. Here are some potential outcomes:

- HMRC Investigations: HMRC has the authority to investigate businesses for non-compliance. This can lead to audits, fines, and even criminal charges in severe cases.

- Late Payment Penalties: Businesses and customers may face late payment penalties if invoices are not issued promptly or if payment terms are not clearly communicated.

- Reputational Damage: Non-compliance can damage your business’s reputation and credibility, especially if it leads to legal disputes or negative publicity.

- Loss of Tax Benefits: In some cases, non-compliance may result in the loss of tax benefits or incentives, impacting your business’s financial health.

Practical Tips for Effective Invoice Management

To streamline your invoice management process and ensure compliance, consider the following tips:

- Implement an Invoice Approval Process: Establish a clear approval process for invoices to ensure accuracy and consistency. This can involve multiple levels of approval, depending on the size and structure of your business.

- Use Digital Invoicing: Embrace digital invoicing solutions to streamline the process and reduce paper waste. Digital invoices are easily searchable, can be sent electronically, and are more environmentally friendly.

- Set Reminders for Payment Due Dates: Implement a system to send payment reminders to customers as the due date approaches. This helps reduce late payments and improves cash flow.

- Reconcile Invoices Regularly: Regularly reconcile your invoices with your financial records to identify any discrepancies or errors. This practice ensures the accuracy of your financial statements and helps detect potential fraud.

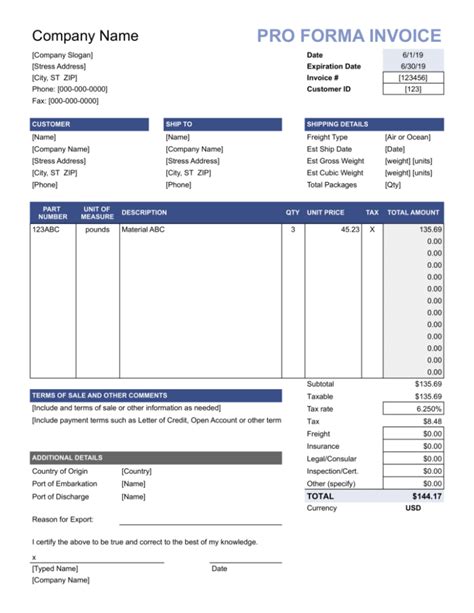

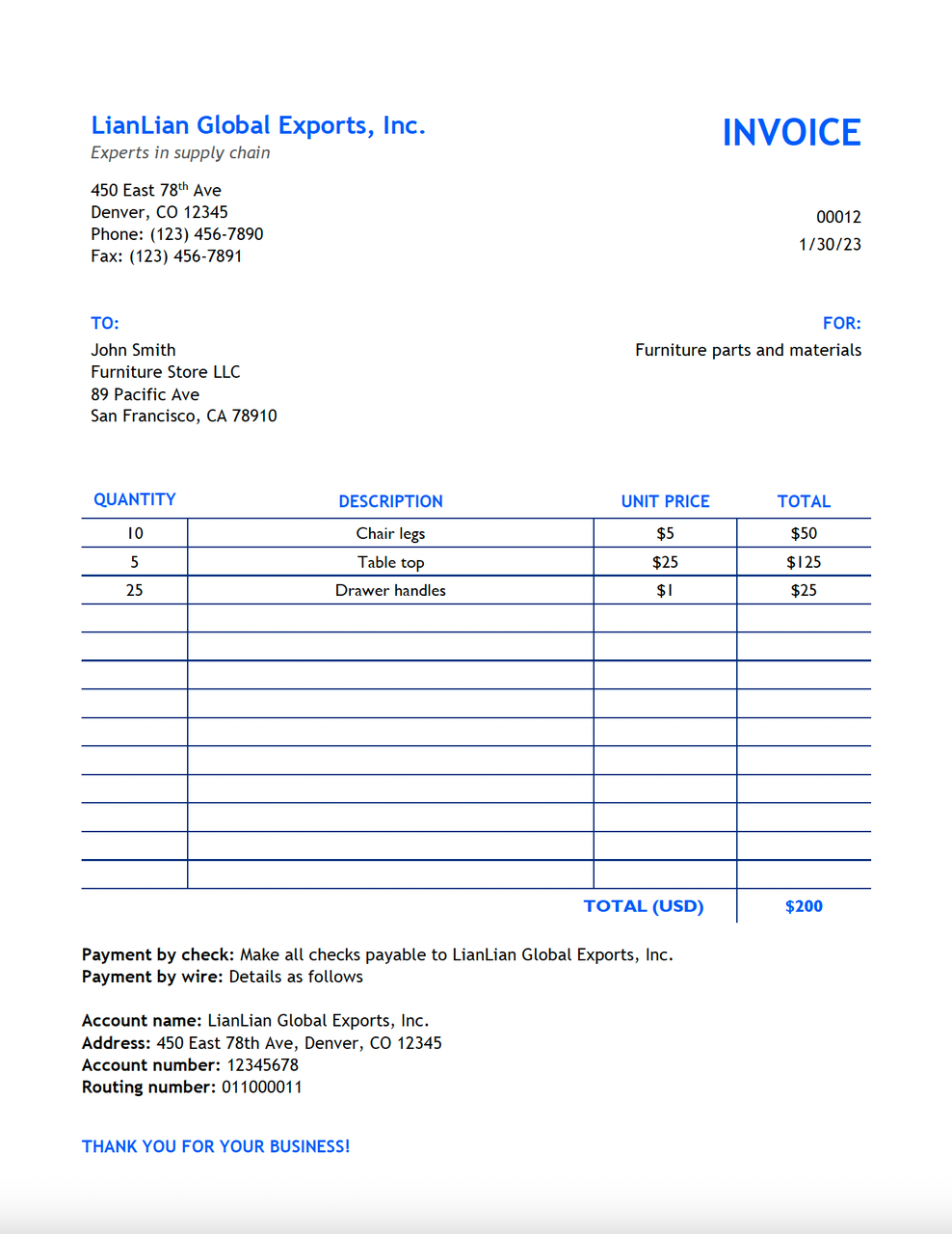

Sample HMRC Invoice Template

To assist you in creating HMRC-compliant invoices, here is a sample template you can use as a starting point:

| Invoice Number | Date of Issue | Supplier Details | Customer Information |

|---|---|---|---|

| INV-001 | 2023-08-15 |

Business Name Address Contact Information HMRC UTR: 123456789 |

Customer Name Address Contact Details |

Description of Goods or Services: - Item 1: [Description], Quantity: [Qty], Unit Price: [Price], Total: [Total Price] - Item 2: [Description], Quantity: [Qty], Unit Price: [Price], Total: [Total Price]

Tax Information: - Tax Rate: [Rate]%, Tax Amount: [Amount]

Total Amount: [Total Amount Due]

Payment Terms: - Payment Due: [Due Date] - Payment Methods: [Methods]

Additional Notes: - [Any relevant notes or terms and conditions]

Notes:

📝 Note: Ensure you have the necessary permissions and licenses to use the HMRC UTR number and VAT registration details on your invoices.

💡 Tip: Regularly review HMRC guidelines and stay updated with any changes in tax regulations to maintain compliance.

Final Thoughts

Understanding and adhering to HMRC invoice requirements is essential for businesses operating in the UK. By creating accurate, compliant invoices, you not only avoid potential penalties but also establish a professional and trustworthy image. With the right tools, best practices, and a commitment to compliance, managing your invoices can be a seamless process, allowing you to focus on the growth and success of your business.

FAQ

What happens if I issue an incorrect HMRC invoice?

+

Issuing an incorrect HMRC invoice can lead to various consequences. HMRC may request corrections, issue penalties, or even initiate an investigation. It’s crucial to review invoices thoroughly before sending them to customers.

Can I use my own invoice template as long as it includes all the required information?

+Yes, you can use your own invoice template as long as it meets all the HMRC requirements. However, it’s important to ensure that your template is up-to-date with the latest regulations and includes all the necessary components.

How long should I keep HMRC invoices for record-keeping purposes?

+HMRC requires businesses to retain invoices and other financial records for a minimum of six years. This ensures that you have the necessary documentation in case of an audit or inquiry.