How To Find Council Tax

Understanding your council tax obligations is crucial for managing your finances and ensuring compliance with local regulations. In this comprehensive guide, we will walk you through the process of finding your council tax information, providing you with the tools and knowledge to navigate this essential aspect of your financial responsibilities.

Step 1: Understand Council Tax Basics

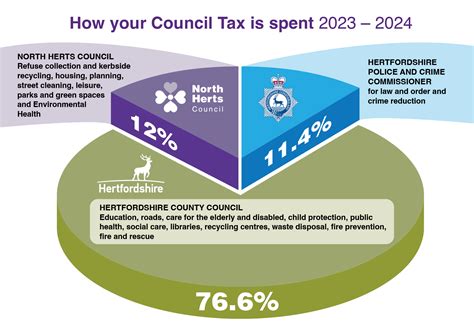

Council tax is a local tax levied by local authorities in the United Kingdom to fund various public services. It is typically paid by the owner or occupier of a residential property. The amount of council tax you owe depends on factors such as the value of your property, the number of people living in your household, and any applicable discounts or exemptions.

Council tax is divided into different bands, with each band representing a range of property values. The bands are typically labeled A to H, with Band A being the lowest value and Band H being the highest. The council tax bill you receive will indicate the band your property falls into.

Step 2: Locate Your Council Tax Information

To find your council tax information, you have several options:

1. Check Your Council Tax Bill

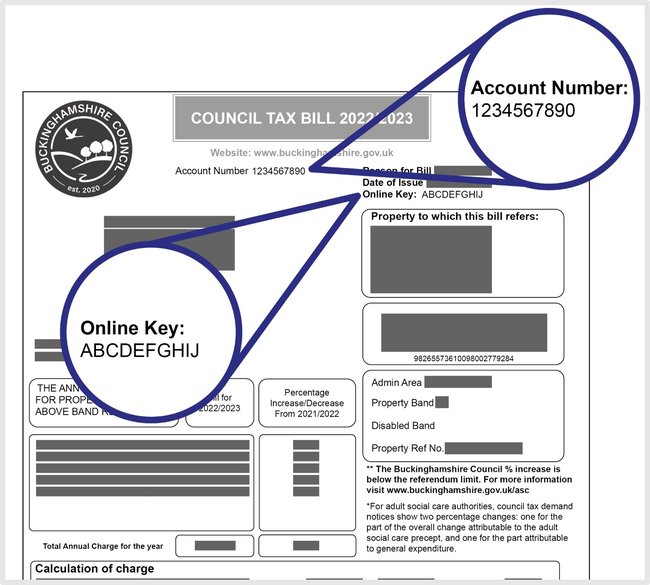

If you have recently received a council tax bill, it will contain all the necessary details. The bill will include information such as:

- Your council tax account number

- The band your property falls into

- The amount of council tax you owe for the current year

- Payment deadlines and instructions

2. Contact Your Local Council

If you haven’t received a council tax bill or need further assistance, you can contact your local council’s customer service team. They can provide you with your council tax account details and answer any questions you may have.

3. Use Online Council Tax Tools

Many local councils offer online services and tools to help residents access their council tax information. These tools may include:

- Online council tax calculators: These calculators estimate your council tax based on your property’s value and other factors.

- Council tax lookup tools: These tools allow you to search for your council tax band and other relevant details by entering your postcode or property details.

- Online council tax accounts: Some councils provide online portals where you can view your council tax balance, make payments, and manage your account.

Step 3: Understand Your Council Tax Bill

Once you have located your council tax information, it’s essential to understand the components of your council tax bill. Here are some key elements to look out for:

1. Council Tax Bands

As mentioned earlier, council tax bands are based on the value of your property. The band is determined by an official valuation process and remains the same until there is a significant change in your property’s value or local council boundaries.

2. Council Tax Charges

The council tax charges on your bill represent the amount you need to pay for the current financial year. It is calculated based on the band your property falls into and any applicable discounts or exemptions.

3. Payment Options and Deadlines

Your council tax bill will outline the different payment options available to you, such as direct debit, online payments, or paying by phone. It will also provide information on payment deadlines to ensure you avoid late payment penalties.

4. Discounts and Exemptions

If you are eligible for any discounts or exemptions, they will be listed on your council tax bill. Common discounts include single occupancy discounts, discounts for people with severe mental impairments, and discounts for students. Exemptions may apply to certain properties, such as empty homes or properties used for specific purposes.

Step 4: Pay Your Council Tax

Once you have understood your council tax obligations, it’s important to make timely payments to avoid penalties and ensure the continued provision of local services. Here are some tips for paying your council tax:

1. Set Up a Direct Debit

Setting up a direct debit is a convenient way to pay your council tax. It ensures that your payments are automatically deducted from your bank account on a regular basis, reducing the risk of missing deadlines.

2. Explore Payment Plans

If you are facing financial difficulties, you can contact your local council to discuss payment plans. They may offer options such as spreading your payments over a longer period or providing temporary relief.

3. Make Payments Online

Most local councils provide online payment portals where you can make secure payments using your council tax account details. This method is quick, convenient, and can be done from the comfort of your own home.

Step 5: Keep Your Council Tax Information Up-to-Date

It’s crucial to keep your council tax information accurate and up-to-date to avoid any potential issues. Here are some key points to consider:

1. Notify Changes in Circumstances

If there are any changes in your household, such as a new occupant, a change in tenancy, or a move to a different property, you must inform your local council. Failure to do so may result in incorrect billing or penalties.

2. Review Your Council Tax Band

If you believe your council tax band is incorrect, you have the right to request a review. Contact your local council’s valuation office to initiate the review process and provide any necessary evidence to support your claim.

3. Stay Informed About Council Tax Changes

Local councils may make changes to council tax rates, bands, or discounts from time to time. Stay informed by regularly checking your council’s website or signing up for their newsletters to ensure you are aware of any updates that may affect your council tax obligations.

Step 6: Seek Assistance if Needed

If you have any questions or concerns regarding your council tax, don’t hesitate to seek assistance. Your local council’s customer service team is there to help. They can provide guidance on payment options, discounts, and any other council tax-related matters.

Conclusion

Finding and understanding your council tax information is an essential step in managing your financial responsibilities. By following the steps outlined in this guide, you can navigate the council tax system effectively, ensure timely payments, and maintain compliance with local regulations. Remember to keep your council tax information up-to-date and seek assistance whenever needed to avoid any potential issues.

What happens if I don’t pay my council tax?

+If you fail to pay your council tax, you may receive reminders and eventually a court summons. Non-payment can result in legal action and additional charges. It’s important to contact your local council if you are facing difficulties paying your council tax to discuss potential solutions.

Can I appeal my council tax band?

+Yes, you have the right to appeal your council tax band if you believe it is incorrect. Contact your local council’s valuation office to initiate the appeal process. You will need to provide evidence to support your claim, such as recent property valuations or comparable property sales.

Are there any discounts or exemptions available for council tax?

+Yes, there are various discounts and exemptions available for council tax. These include discounts for single occupants, people with severe mental impairments, and students. Certain properties may also be exempt, such as empty homes or properties used for specific purposes. Check with your local council to see if you are eligible for any discounts or exemptions.