Hsbc Basic Bank Account

The HSBC Basic Bank Account is a simple and straightforward banking solution designed to meet the essential financial needs of individuals. With a focus on convenience and accessibility, this account offers a range of features that cater to those who require a no-frills banking experience. In this blog post, we will explore the key aspects of the HSBC Basic Bank Account, its benefits, and how it can be a practical choice for managing your finances.

Account Features and Benefits

The HSBC Basic Bank Account provides a solid foundation for managing your money effectively. Here are some of its notable features and advantages:

- Low Account Fees: This account typically comes with minimal or no monthly maintenance fees, making it an affordable option for those on a tight budget.

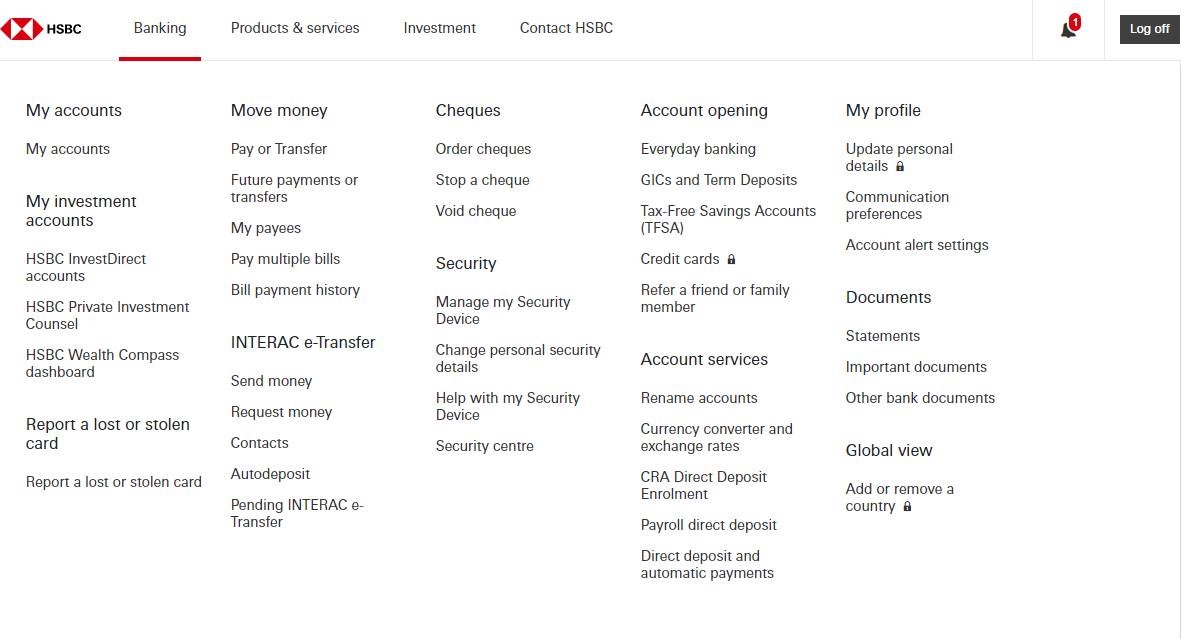

- Easy Access to Funds: With the Basic Bank Account, you can access your money conveniently through a network of ATMs and branches. Additionally, online and mobile banking services are available, allowing you to manage your account anytime, anywhere.

- Direct Deposits and Payments: You can set up direct deposits to receive your salary or benefits directly into your account. Furthermore, the account enables you to make payments easily, including bill payments and transfers to other accounts.

- Overdraft Protection: In certain cases, the account may offer overdraft protection, providing a safety net for unexpected expenses. This feature can help prevent overdraft fees and keep your finances on track.

- Mobile Check Deposit: Some versions of the Basic Bank Account allow you to deposit checks using your mobile device, eliminating the need to visit a physical branch.

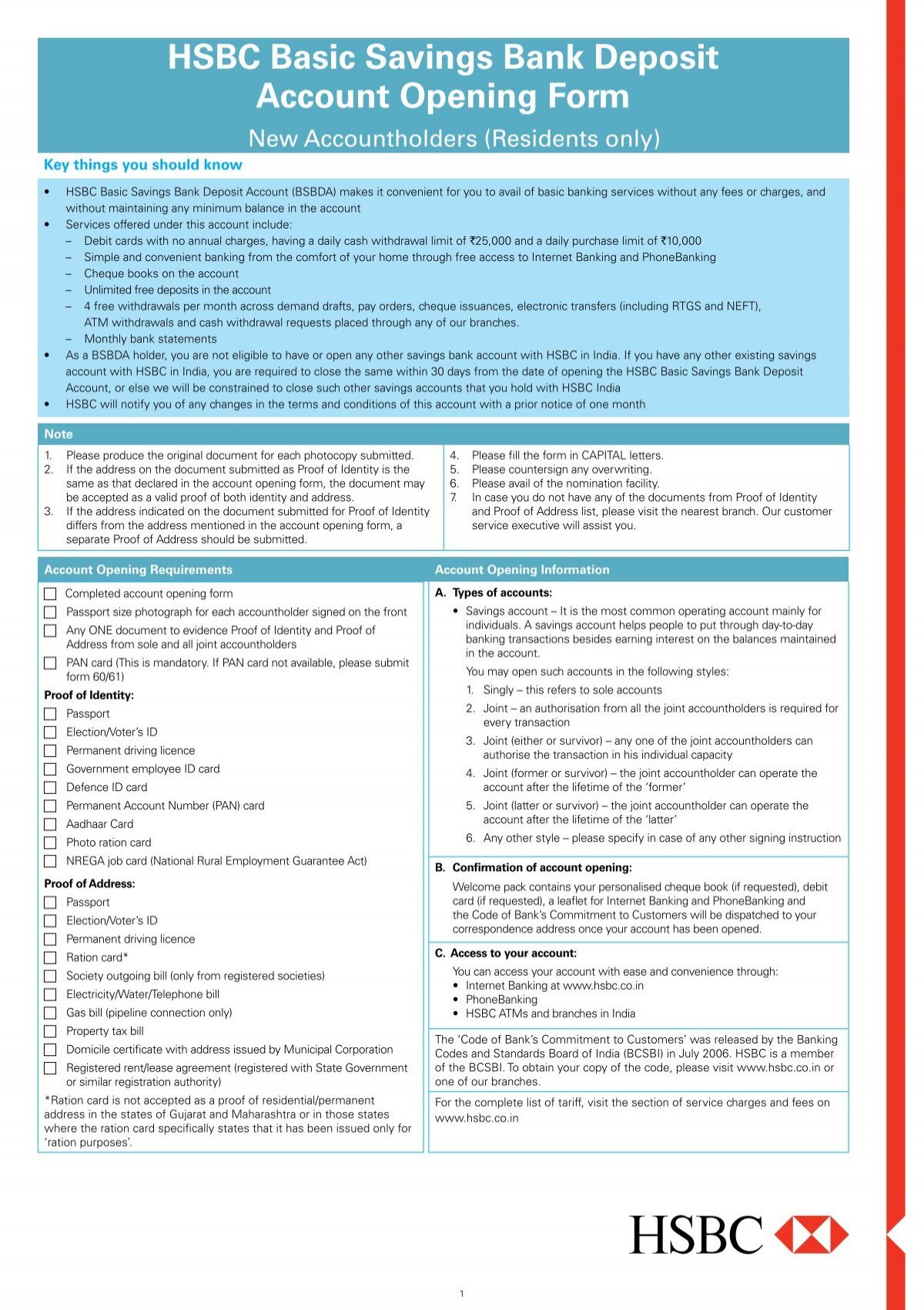

Eligibility and Requirements

The HSBC Basic Bank Account is designed to be accessible to a wide range of individuals. To open an account, you generally need to meet the following criteria:

- Be a resident of the country where the account is offered.

- Provide valid identification, such as a driver's license or passport.

- Have a minimum initial deposit, which may vary depending on the region.

- Agree to the terms and conditions of the account.

It's important to note that eligibility requirements may differ based on your location and the specific version of the Basic Bank Account you are interested in. Always check with your local HSBC branch or visit their official website for detailed information.

Opening an Account

Opening an HSBC Basic Bank Account is a straightforward process. Here's a step-by-step guide to help you get started:

- Choose Your Account: Visit the HSBC website or contact your local branch to explore the different versions of the Basic Bank Account available in your region. Compare the features and benefits to find the one that best suits your needs.

- Gather Required Documents: Prepare the necessary identification documents, such as a valid ID or passport, and any other supporting documents requested by HSBC.

- Complete the Application: You can apply online or visit your nearest HSBC branch. Provide accurate and complete information during the application process.

- Make the Initial Deposit: Depending on the account version, you may need to make an initial deposit to activate your account. This amount can vary, so be sure to check the requirements.

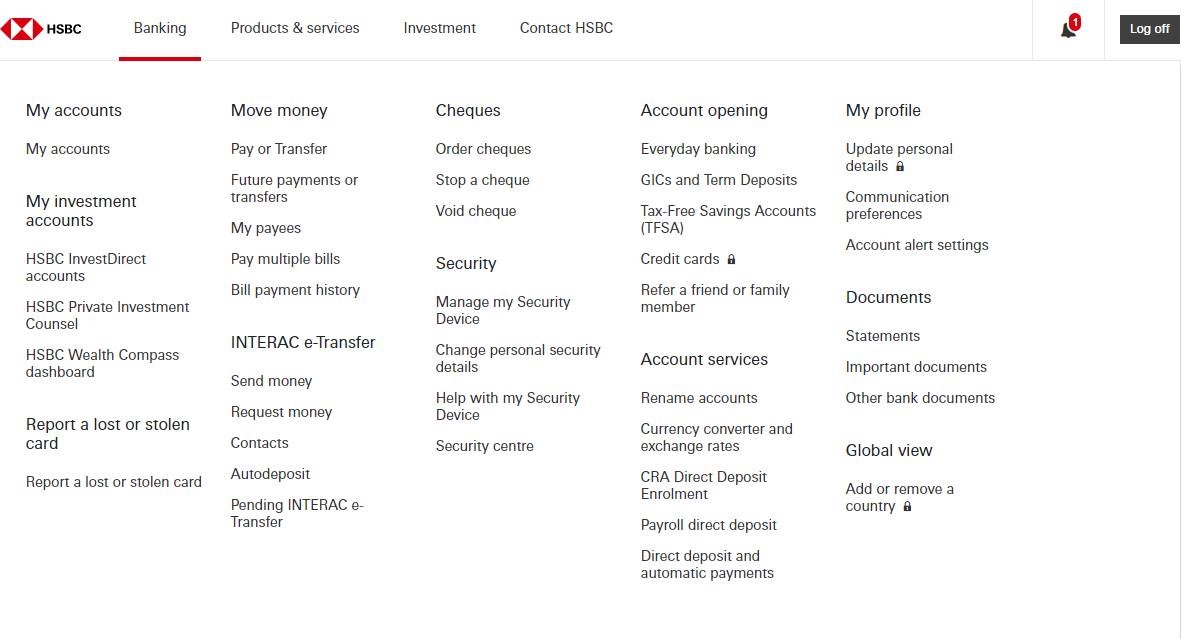

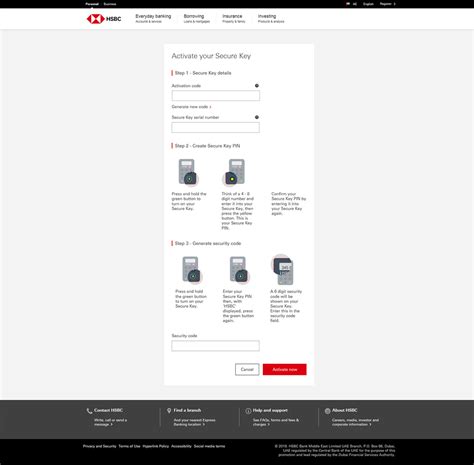

- Set Up Online Banking: Once your account is opened, consider setting up online banking to access your account conveniently from anywhere. This will allow you to monitor your balance, make transfers, and manage your finances efficiently.

🌟 Note: Always review the terms and conditions carefully before opening an account. HSBC may have specific requirements or restrictions, so it's essential to understand all the details to ensure a smooth banking experience.

Managing Your Account

Once you have opened your HSBC Basic Bank Account, it's important to understand how to manage it effectively. Here are some key aspects to consider:

- Monitoring Your Balance: Regularly check your account balance to stay on top of your finances. This can be done through online banking, mobile apps, or by visiting an HSBC branch.

- Setting Up Direct Deposits: If you receive regular income or benefits, consider setting up direct deposits to have your money automatically deposited into your account. This can save time and ensure your funds are readily available.

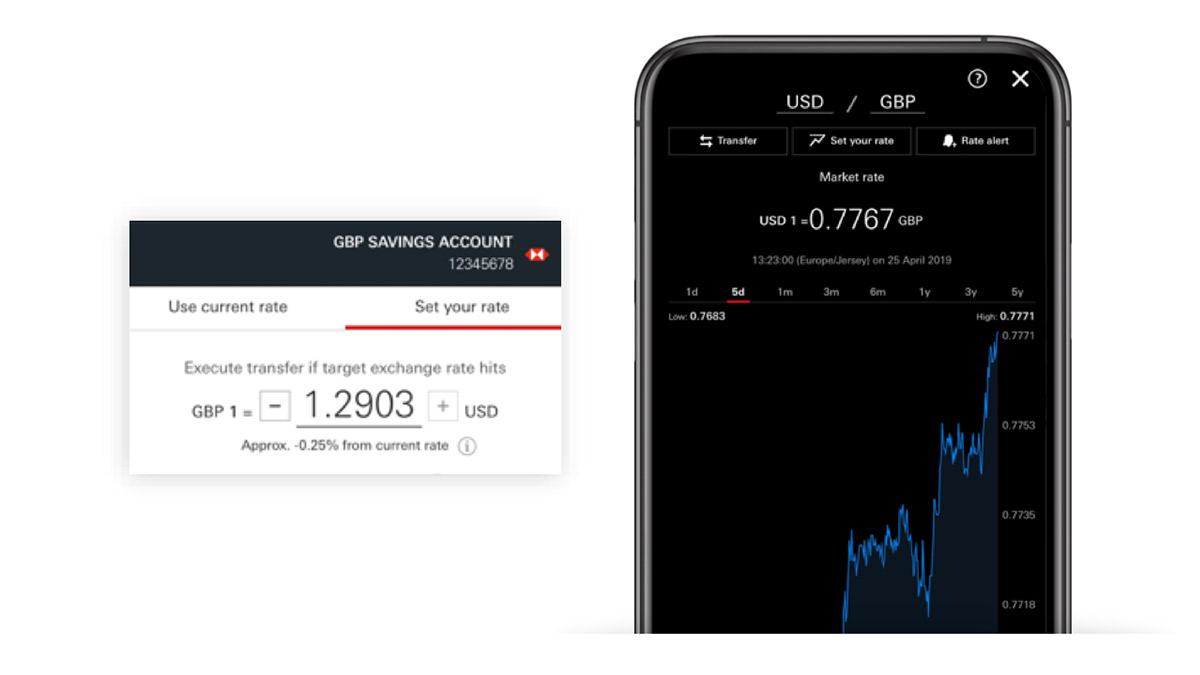

- Making Payments: The Basic Bank Account allows you to make various payments, including bill payments, transfers to other accounts, and even international transfers. Familiarize yourself with the different payment options and choose the most suitable method for your needs.

- Overdraft Protection: If your account offers overdraft protection, understand how it works and the associated fees. This feature can be beneficial in emergencies, but it's essential to manage it responsibly to avoid incurring unnecessary charges.

- Mobile Banking: Take advantage of HSBC's mobile banking services to access your account on the go. With mobile banking, you can deposit checks, transfer funds, and stay updated with real-time notifications.

Fees and Charges

While the HSBC Basic Bank Account aims to be affordable, it's important to be aware of any potential fees and charges associated with the account. Here are some common fees you may encounter:

- Monthly Maintenance Fee: Some versions of the account may have a small monthly fee to cover administrative costs. However, many Basic Bank Accounts offer fee-free options, so be sure to choose the right account for your needs.

- ATM Fees: Using ATMs outside the HSBC network may incur fees. It's advisable to use HSBC ATMs whenever possible to avoid additional charges.

- Overdraft Fees: If you exceed your account balance and overdraft protection is not available, you may incur overdraft fees. These fees can vary, so it's essential to understand the terms and conditions to avoid unexpected charges.

- International Transfer Fees: Sending money internationally may attract fees, depending on the destination and the amount transferred. Always check the fee structure before initiating an international transfer.

💡 Note: Review the fee schedule provided by HSBC to familiarize yourself with all potential charges. Being aware of these fees can help you budget effectively and avoid unnecessary expenses.

Additional Benefits and Services

The HSBC Basic Bank Account may offer additional benefits and services beyond the basic features. Here are some potential advantages to look out for:

- HSBC Premier Benefits: Depending on your region, you may be eligible for HSBC Premier benefits when you open a Basic Bank Account. These benefits can include access to exclusive offers, priority services, and personalized financial advice.

- Rewards Programs: Some versions of the account may come with rewards programs, allowing you to earn points or cash back on your everyday spending. These rewards can be redeemed for various benefits, such as travel, merchandise, or statement credits.

- Fraud Protection: HSBC takes security seriously and offers fraud protection measures to safeguard your account. This includes monitoring for suspicious activities and providing tools to help you protect your personal and financial information.

- Customer Support: HSBC provides dedicated customer support to assist you with any queries or issues you may have. Whether it's through online chat, phone, or in-branch visits, their team is ready to help you navigate your banking needs.

Comparing Basic Bank Accounts

When considering the HSBC Basic Bank Account, it's beneficial to compare it with other similar accounts offered by different banks. Here's a table highlighting some key features to help you make an informed decision:

| Bank | Account Name | Monthly Fee | Overdraft Protection | Mobile Banking |

|---|---|---|---|---|

| HSBC | Basic Bank Account | Varies (Some fee-free options) | Available in certain cases | Yes |

| Bank A | Standard Checking Account | $10 per month | Not offered | Yes |

| Bank B | No-Fee Checking | None | Limited overdraft protection | Yes, with additional features |

| Bank C | Essential Banking Account | Waived with direct deposit | Overdraft line of credit | Basic mobile app |

This table provides a simplified comparison of basic bank accounts from different banks. Remember that specific features and fees may vary, so it's crucial to research and compare accounts based on your individual needs and preferences.

Conclusion

The HSBC Basic Bank Account offers a straightforward and cost-effective banking solution for individuals seeking a simple and accessible financial management tool. With its low fees, easy access to funds, and convenient features, it can be an excellent choice for those who prioritize convenience and affordability. By understanding the account's features, eligibility criteria, and potential fees, you can make an informed decision and enjoy a seamless banking experience with HSBC.

Can I open a Basic Bank Account if I have bad credit?

+

Yes, the HSBC Basic Bank Account does not typically require a credit check. It is designed to be accessible to a wide range of individuals, regardless of their credit history.

Are there any age restrictions for opening a Basic Bank Account?

+

Age restrictions may vary depending on your region. Generally, individuals over the age of 18 can open an account independently. For minors, a parent or guardian may need to be involved in the account opening process.

Can I upgrade my Basic Bank Account to a different type of account later on?

+

Yes, you can upgrade your Basic Bank Account to a different type of account, such as a premium or business account, as your financial needs evolve. HSBC provides various account options to cater to different stages of life and business requirements.

Is the Basic Bank Account suitable for students?

+

Absolutely! The Basic Bank Account can be an excellent choice for students as it offers a low-cost and convenient way to manage their finances. Many students appreciate the account’s simplicity and the ability to access funds easily while studying.

What are the benefits of using HSBC’s mobile banking app?

+

HSBC’s mobile banking app provides a convenient way to manage your account on the go. You can check your balance, make transfers, deposit checks, and receive real-time notifications. The app also offers additional features like mobile check deposit and personalized account alerts.