Income Tax Band Uk

Understanding the income tax bands in the UK is crucial for individuals to know how their earnings are taxed and to ensure they're paying the correct amount. This guide will provide an in-depth look at the UK's income tax system, covering the different tax bands, rates, and thresholds, as well as offering insights into how tax is calculated and when you might need to pay it.

Tax Bands and Rates

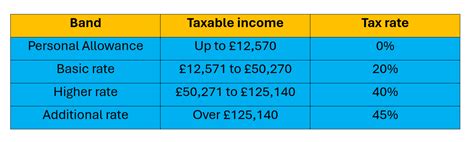

The UK's income tax system is divided into different tax bands, each with its own rate. These bands are determined by the amount of an individual's taxable income and are adjusted annually by the government. The current tax bands and rates for the 2023-24 tax year are as follows:

-

Personal Allowance: This is the amount of income you can earn before you start paying income tax. For the 2023-24 tax year, the personal allowance is £12,570. Any income above this amount is taxed.

-

Basic Rate: Income between the personal allowance and £50,270 is taxed at the basic rate of 20%. This means that if your taxable income falls within this range, you'll pay 20% tax on the portion above the personal allowance.

-

Higher Rate: Income above £50,270 and up to £150,000 is taxed at the higher rate of 40%. If your income falls within this band, you'll pay 40% tax on the portion above £50,270.

-

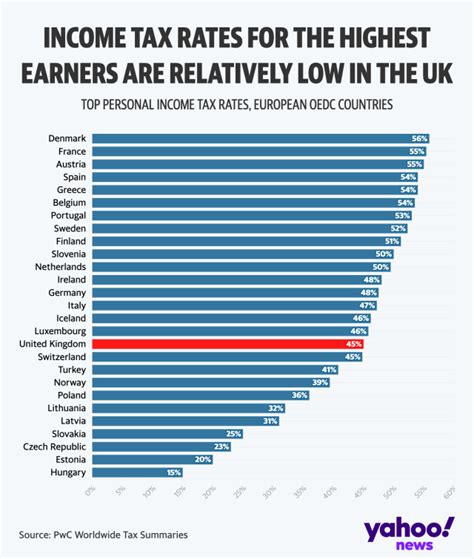

Additional Rate: Income above £150,000 is taxed at the additional rate of 45%. This is the highest tax band and applies to those with the highest incomes.

It's important to note that these tax bands and rates are for the standard UK tax system. There are separate rules and rates for Scotland, which are beyond the scope of this guide.

How Tax is Calculated

Calculating your income tax liability involves a few simple steps. First, you need to determine your taxable income, which is your total income from all sources minus any allowances and deductions. This includes income from employment, self-employment, pensions, investments, and more.

Once you have your taxable income, you can apply the appropriate tax rates to the relevant bands. For example, if your taxable income is £30,000, you would pay:

- 20% on the first £12,570 (personal allowance) = £2,514

- 20% on the next £17,430 (£30,000 - £12,570) = £3,486

- Total tax liability: £2,514 + £3,486 = £6,000

This calculation assumes you have no other allowances or deductions. If you have additional sources of income or are entitled to certain allowances, these would need to be factored into the calculation.

Tax Thresholds and Changes

Tax thresholds are the points at which your income moves from one tax band to another. These thresholds are set by the government and can change annually. For example, the threshold between the basic and higher rate tax bands for the 2023-24 tax year is £50,270. If your income exceeds this amount, you'll start paying tax at the higher rate of 40% on the portion above this threshold.

It's important to keep an eye on these thresholds, as any changes can impact your tax liability. For instance, if the higher rate threshold is increased, you may pay less tax if your income is close to or above this threshold.

When Do You Pay Income Tax?

Income tax is typically paid through the Pay As You Earn (PAYE) system if you're employed. Your employer will deduct the correct amount of tax from your wages or salary before you receive your pay. If you're self-employed, you'll need to calculate your own tax liability and make payments directly to HM Revenue and Customs (HMRC) through the Self Assessment system.

For most individuals, tax is paid on an ongoing basis throughout the tax year. However, if you have additional income or gains that aren't covered by PAYE, you may need to make additional tax payments or file a Self Assessment tax return.

Notes

⚠️ Note: The information provided here is a general guide and may not cover all specific scenarios. For detailed advice on your personal tax situation, it's recommended to consult a qualified tax advisor or HMRC.

Conclusion

Understanding the UK's income tax bands and rates is essential for managing your finances effectively. By knowing the personal allowance, basic rate, higher rate, and additional rate thresholds, you can estimate your tax liability and plan your finances accordingly. Remember to stay informed about any changes to tax laws and thresholds, as these can impact your tax position. For more detailed information and advice, be sure to consult the official HMRC website or seek professional guidance.

FAQ

What is the personal allowance for the current tax year?

+

The personal allowance for the 2023-24 tax year is £12,570. This is the amount of income you can earn before you start paying income tax.

Are there any changes to the tax bands for the upcoming tax year?

+

Tax bands and rates can change annually. It’s important to stay updated with the latest information from HMRC or a trusted tax advisor to ensure you’re aware of any changes that may impact your tax liability.

How do I calculate my tax liability if I have multiple sources of income?

+

If you have multiple sources of income, you’ll need to calculate your total taxable income from all sources. Then, apply the appropriate tax rates to the relevant bands based on your total income. It’s recommended to seek professional advice if you’re unsure about your tax calculations.

What happens if I don’t pay my income tax on time?

+

Failure to pay income tax on time can result in penalties and interest charges. It’s important to ensure you meet all tax deadlines and make payments as required. If you’re unable to pay your tax liability, you should contact HMRC as soon as possible to discuss your options.

Are there any tax-free allowances or deductions I should be aware of?

+

Yes, there are various tax-free allowances and deductions that can reduce your taxable income. These include pension contributions, gift aid donations, and certain business expenses. It’s important to understand which allowances and deductions you’re entitled to and how they can impact your tax liability.