Insurance Administrator Jobs

Insurance Administrator Jobs: Unlocking Career Opportunities

In the dynamic world of insurance, insurance administrators play a crucial role in ensuring smooth operations and providing exceptional customer service. These professionals are the backbone of the insurance industry, handling a wide range of administrative tasks and contributing to the overall success of insurance companies. If you’re considering a career in insurance administration, this guide will provide valuable insights into the job responsibilities, skills required, career paths, and the impact of technology on this field.

Job Description and Responsibilities

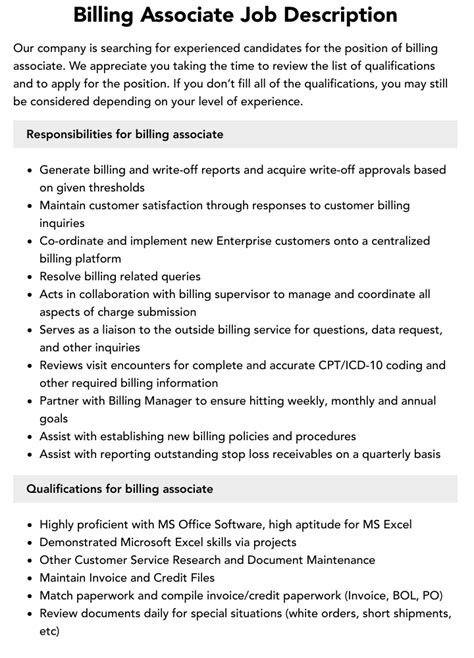

Insurance administrators are responsible for the efficient management of various administrative tasks within insurance companies. Their duties encompass a wide range of activities, including:

Policy Processing: Insurance administrators are involved in the entire policy lifecycle, from application processing to policy issuance and renewal. They ensure that all necessary information is collected, policies are accurately prepared, and documentation is maintained.

Customer Service: Providing excellent customer service is a key aspect of an insurance administrator’s role. They interact with clients, answer inquiries, and assist with policy changes, claims, and other insurance-related matters. Building strong relationships with clients and ensuring their satisfaction is a top priority.

Claims Processing: When policyholders file claims, insurance administrators play a vital role in the claims process. They review and evaluate claims, ensure compliance with insurance regulations, and work closely with adjusters and other professionals to process claims efficiently.

Data Management: Administrators are responsible for maintaining accurate and up-to-date records of policyholder information, claims data, and other relevant documentation. They utilize specialized software and databases to manage and retrieve information effectively.

Compliance and Regulations: Staying updated with insurance industry regulations and ensuring compliance is essential. Insurance administrators must be well-versed in industry standards and guidelines to avoid legal issues and maintain the company’s reputation.

Team Collaboration: Effective collaboration with other departments, such as underwriting, sales, and marketing, is crucial. Insurance administrators often act as a liaison, ensuring smooth communication and coordination between different teams.

Skills and Qualifications

To excel in insurance administration, a combination of technical and soft skills is required. Here are some key skills and qualifications that insurance administrators should possess:

Insurance Knowledge: A solid understanding of insurance products, policies, and industry terminology is essential. Insurance administrators should be well-versed in various types of insurance, such as life, health, property, and casualty insurance.

Organizational Skills: Excellent organizational skills are a must. Insurance administrators handle a high volume of information and tasks, so the ability to prioritize, manage deadlines, and maintain a systematic approach is crucial.

Attention to Detail: Accuracy and attention to detail are critical in insurance administration. Administrators must ensure that all policies, documents, and data are accurate and compliant with regulations.

Communication Skills: Strong communication skills, both written and verbal, are vital. Insurance administrators interact with clients, colleagues, and external partners, so the ability to convey information clearly and effectively is essential.

Customer Service Orientation: A customer-centric approach is key. Insurance administrators should possess excellent customer service skills, empathy, and the ability to build trust and rapport with clients.

Technical Proficiency: Proficiency in using various software applications, databases, and insurance-specific systems is necessary. Insurance administrators should be comfortable with technology and adapt to new tools and platforms.

Problem-Solving Abilities: The ability to identify and resolve issues efficiently is valuable. Insurance administrators often encounter complex situations and must find creative solutions while maintaining a calm and professional demeanor.

Career Paths and Opportunities

Insurance administration offers a wide range of career paths and opportunities for growth and advancement. Here are some common career trajectories:

Entry-Level Positions: Entry-level insurance administrators typically start as assistants or clerks, gaining valuable experience and learning the fundamentals of insurance administration. They assist with basic tasks, data entry, and policy processing.

Senior Administrator: With experience and expertise, insurance administrators can advance to senior positions. Senior administrators take on more complex tasks, manage teams, and oversee the overall administrative operations of the insurance company.

Specialization: Insurance administrators can specialize in specific areas, such as life insurance, health insurance, or property and casualty insurance. Specialization allows for in-depth knowledge and expertise in a particular field, leading to higher-level positions and increased responsibilities.

Underwriting Support: Some insurance administrators transition into underwriting support roles. They assist underwriters in evaluating risks, reviewing applications, and preparing policy recommendations. This role requires a deep understanding of insurance products and risk assessment.

Claims Management: Experienced insurance administrators may pursue careers in claims management. They oversee the entire claims process, manage claims adjusters, and ensure timely and accurate claim settlements. This role demands strong leadership, problem-solving, and analytical skills.

Insurance Brokerage: Insurance administrators can also explore opportunities in insurance brokerage. They work as intermediaries between insurance companies and clients, providing personalized insurance solutions and advice. This role requires strong sales and customer relationship skills.

Impact of Technology on Insurance Administration

Technology has revolutionized the insurance industry, and insurance administration is no exception. The introduction of advanced software, automation, and digital tools has transformed the way administrative tasks are performed. Here’s how technology is shaping the field:

Automation: Automation has streamlined many administrative processes, reducing manual effort and increasing efficiency. Tasks such as policy processing, data entry, and document management are now automated, allowing administrators to focus on more complex and value-added tasks.

Digital Platforms: Insurance companies are increasingly adopting digital platforms and online portals. Insurance administrators utilize these platforms to manage policies, process claims, and communicate with clients. Digital tools enhance convenience, speed up processes, and improve overall customer experience.

Data Analytics: Data analytics plays a crucial role in insurance administration. Administrators utilize data analysis tools to gain insights, identify trends, and make informed decisions. This enables them to optimize processes, improve customer service, and enhance overall operational efficiency.

Artificial Intelligence (AI): AI is being integrated into insurance administration to automate repetitive tasks, improve accuracy, and enhance decision-making. AI-powered chatbots, for example, can handle basic customer inquiries, freeing up administrators’ time for more complex tasks.

Cybersecurity: With the increasing reliance on technology, cybersecurity has become a top priority. Insurance administrators must ensure the security of sensitive data and implement robust measures to protect against cyber threats.

Conclusion: A Fulfilling Career in Insurance Administration

Insurance administration offers a rewarding career path for individuals with a passion for organization, customer service, and the insurance industry. With a combination of technical skills, industry knowledge, and a customer-centric approach, insurance administrators can make a significant impact on the success of insurance companies.

As the insurance industry continues to evolve, insurance administrators will play a vital role in adapting to new technologies, regulations, and customer expectations. Their dedication to excellence, attention to detail, and commitment to providing exceptional service will drive the industry forward.

So, if you’re considering a career in insurance administration, embrace the challenges, seize the opportunities, and unlock a world of possibilities in this dynamic and fulfilling field.

FAQ

What qualifications are required to become an insurance administrator?

+

To become an insurance administrator, a high school diploma or equivalent is typically the minimum requirement. However, many employers prefer candidates with a bachelor’s degree in business administration, finance, or a related field. Additionally, having relevant work experience in the insurance industry or customer service can be advantageous.

What are the key responsibilities of an insurance administrator?

+

Insurance administrators have a wide range of responsibilities, including policy processing, customer service, claims management, data management, and compliance. They ensure the accurate and timely processing of insurance policies, provide excellent customer support, handle claims efficiently, maintain organized records, and ensure compliance with industry regulations.

How can I enhance my career prospects as an insurance administrator?

+

To enhance your career prospects, consider obtaining professional certifications such as the Certified Insurance Service Representative (CISR) or the Certified Insurance Counselor (CIC). These certifications demonstrate your expertise and commitment to the industry. Additionally, staying updated with industry trends, attending workshops and conferences, and networking with professionals can open up new opportunities for growth and advancement.

What are the challenges faced by insurance administrators?

+

Insurance administrators often face challenges such as handling complex policies, managing high volumes of data, and dealing with customer complaints or claims disputes. Staying up-to-date with changing regulations, adapting to new technologies, and ensuring data security are also common challenges in this field.

How does technology impact the role of insurance administrators?

+

Technology has significantly transformed the role of insurance administrators. Automation and digital platforms have streamlined administrative tasks, allowing administrators to focus on more complex and strategic responsibilities. Data analytics and AI have also enhanced decision-making processes and improved overall efficiency in the insurance industry.