Look Up Business Rates

Understanding business rates is crucial for any enterprise owner or manager, as these rates can significantly impact a company's financial health and planning. Business rates, also known as non-domestic rates, are a type of property tax levied on non-residential properties in the United Kingdom. This includes commercial properties like offices, shops, warehouses, and even some agricultural buildings.

These rates are an essential part of the UK's tax system, contributing to local government funding. They are a complex topic, and a thorough understanding of how they work can help businesses make informed decisions and potentially save money.

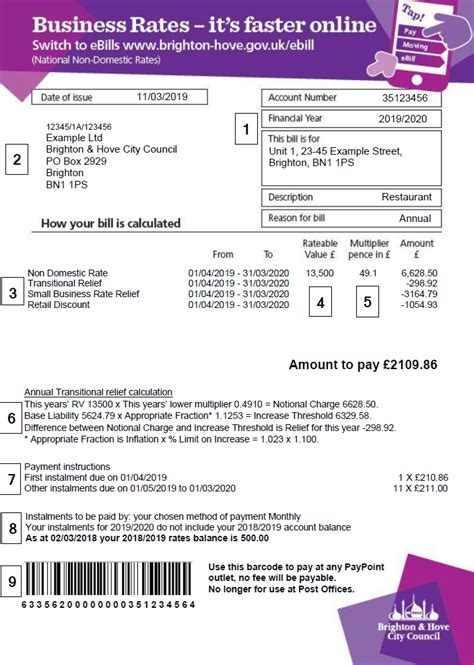

How Business Rates are Calculated

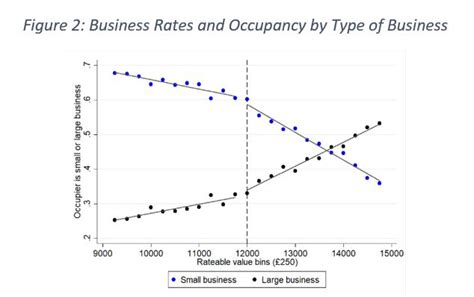

The calculation of business rates is based on the rateable value of a property. This value is an assessment of the annual rent the property could achieve if it were available to let on a full repairing and insuring basis. It's important to note that the rateable value is not necessarily the same as the property's market value or the rent actually being paid.

The rateable value is determined by the Valuation Office Agency (VOA), an executive agency of Her Majesty's Revenue and Customs (HMRC). The VOA conducts regular revaluations to ensure that rateable values remain up-to-date and accurate. The last revaluation took place in 2017, and the next one is scheduled for 2023.

The rateable value is then multiplied by the multiplier, which is set annually by the government. This multiplier is used to calculate the actual business rates bill. The multiplier for 2022-2023 is £0.512 for England, £0.560 for Wales, and £0.595 for Scotland.

To illustrate, if a property has a rateable value of £50,000 and the multiplier is £0.512, the business rates bill would be calculated as follows:

£50,000 x £0.512 = £25,600

So, the business rates bill for this property would be £25,600 for the year.

Reliefs and Exemptions

There are several reliefs and exemptions available to reduce the burden of business rates. These include:

- Small Business Rate Relief: Properties with a rateable value of less than £51,000 may be eligible for a discount of up to 100% on their business rates bill.

- Rural Rate Relief: Businesses located in rural areas may be eligible for a discount of up to 100% on their business rates bill.

- Charity and Community Amateur Sports Club Relief: Charities and community amateur sports clubs may be eligible for a 100% discount on their business rates bill.

- Discretionary Relief: Local authorities have the power to grant discretionary relief to certain businesses, such as those that are improving the local area or are new to the area.

Appealing Business Rates

If you believe that the rateable value of your property is incorrect, you have the right to appeal. This is known as making a check, challenge, appeal (CCA). The CCA process involves three stages:

- Check: This is an informal review where you can discuss any issues with the VOA. You can do this at any time.

- Challenge: If the check stage does not resolve your concerns, you can make a formal challenge. This must be done within six months of the billing date.

- Appeal: If your challenge is unsuccessful, you can appeal to an independent valuation tribunal. You must do this within two months of receiving the decision on your challenge.

Managing Business Rates

Effective management of business rates can help businesses control their overheads and improve their financial position. Here are some strategies to consider:

- Review your rates regularly: Keep an eye on your business rates bill and ensure it accurately reflects your property's rateable value. Regular reviews can help you identify any potential savings.

- Apply for reliefs and exemptions: Make sure you are aware of all the reliefs and exemptions you may be eligible for and apply for them accordingly. This can significantly reduce your business rates bill.

- Consider rate mitigation strategies: There are various strategies, such as entering into a lease surrender or assigning your lease, that can help reduce your liability for business rates. Consult a professional advisor for guidance.

Conclusion

Business rates are an essential aspect of running a business in the UK, and understanding them is crucial for financial planning and management. By staying informed about the calculation process, reliefs, and exemptions, and by regularly reviewing and managing your business rates, you can ensure that your business is not paying more than it should.

Remember, seeking professional advice can provide further insights and strategies tailored to your specific business needs.

What is the difference between business rates and council tax?

+

Business rates are a tax on non-residential properties, while council tax is a tax on residential properties. Business rates are paid by businesses, while council tax is paid by individuals or households.

How often are business rates revalued?

+

Business rates are revalued every five years. The last revaluation was in 2017, and the next one is scheduled for 2023.

Can I appeal my business rates bill?

+

Yes, you have the right to appeal your business rates bill if you believe the rateable value of your property is incorrect. The appeal process involves a check, challenge, and appeal stage.

Are there any reliefs or exemptions available for business rates?

+

Yes, there are several reliefs and exemptions available, including small business rate relief, rural rate relief, charity relief, and community amateur sports club relief. Local authorities also have the power to grant discretionary relief.

How can I reduce my business rates liability?

+

There are several strategies to reduce your business rates liability, such as applying for reliefs and exemptions, regularly reviewing your rates, and considering rate mitigation strategies like lease surrenders or assignments.