Paying Council Tax Online

Simplifying Your Council Tax Payments: A Step-by-Step Guide to Online Payment

Paying your council tax online is a convenient and efficient way to manage your financial obligations. With just a few clicks, you can ensure that your payments are up to date and avoid any potential penalties or late fees. In this comprehensive guide, we will walk you through the process of paying your council tax online, providing you with a seamless and hassle-free experience.

Understanding Council Tax

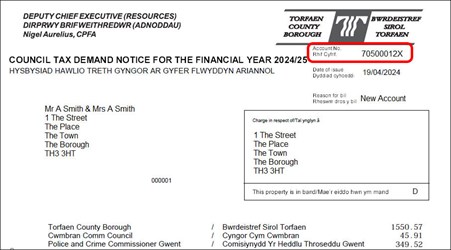

Council tax is a local tax collected by local authorities in the United Kingdom. It contributes to the funding of essential services such as education, social care, and local infrastructure. Understanding your council tax obligations is crucial to ensure timely payments and avoid any unnecessary financial burdens.

Your council tax bill is calculated based on the value of your property and the number of people living in it. It is typically paid in installments throughout the year, with the option to pay in full if preferred. Online payment offers a flexible and convenient way to manage these installments, providing you with control over your financial commitments.

Step 1: Access Your Online Account

To begin the online payment process, you will need to access your online account with your local authority. Most councils provide an online platform where residents can manage their council tax payments and other services. Here's how to get started:

- Visit the official website of your local authority.

- Look for a section dedicated to council tax or online services.

- Click on the "Log In" or "Sign In" button to access your account.

- Enter your unique username and password. If you have forgotten your login details, follow the instructions provided on the website to reset them.

If you do not have an online account, you can create one by following the registration process outlined on the website. This typically involves providing your personal details, council tax reference number, and creating a secure password.

Step 2: Check Your Council Tax Balance

Once you have logged into your online account, the next step is to check your council tax balance. This will give you an overview of your current payment status and any outstanding amounts. Here's how to do it:

- Navigate to the "Council Tax" or "Payments" section of your online account.

- Look for an option to "Check Balance" or "View Balance."

- Your current council tax balance will be displayed, along with any outstanding installments or penalties.

It is important to regularly check your council tax balance to ensure that you are up to date with your payments. This will help you avoid any surprises and allow you to plan your finances effectively.

Step 3: Select Your Payment Method

After checking your balance, it's time to select your preferred payment method. Most local authorities offer a range of options to cater to different preferences and circumstances. Here are some common payment methods you may encounter:

- Direct Debit: This is a popular and convenient option, allowing you to set up automatic payments from your bank account. You can choose to pay your council tax in full or in installments, with the amount and frequency determined by your local authority.

- Credit/Debit Card: You can make a one-time payment using your credit or debit card. This method is ideal if you prefer to pay your council tax in full or if you want to make a quick payment to avoid any late fees.

- Online Banking: Some local authorities provide the option to pay your council tax through your online banking platform. You can transfer the funds directly from your bank account to the council's account, ensuring a secure and convenient payment process.

- Cheque or Postal Order: Although less common, some councils still accept payments by cheque or postal order. You will need to make the payment payable to your local authority and send it to the specified address.

It is important to note that certain payment methods may incur additional fees or have specific requirements. Always review the terms and conditions before selecting your preferred payment option.

Step 4: Make Your Online Payment

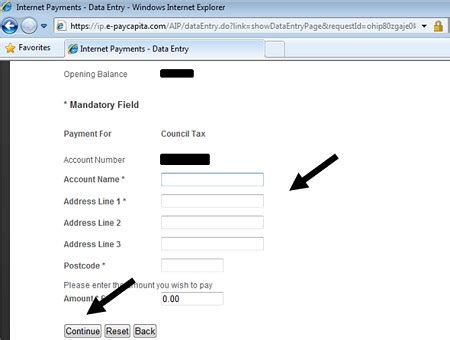

Once you have selected your payment method, it's time to make your online payment. Follow these steps to complete the process:

- Choose the "Make a Payment" or "Pay Now" option on your online account.

- Select your preferred payment method from the available options.

- Enter the required details, such as your bank account information, card details, or any other necessary information.

- Review the payment summary to ensure accuracy. This will include the amount, payment method, and any associated fees.

- Click on the "Submit" or "Confirm" button to finalize your payment.

After submitting your payment, you will receive a confirmation message or email. It is important to keep a record of your payment for future reference. Some local authorities may provide a unique reference number or transaction ID, which can be used to track your payment status.

Step 5: Manage Your Payments

Online payment platforms often provide additional features to help you manage your council tax payments effectively. Here are some key aspects to consider:

- Payment History: You can view your payment history, including the dates, amounts, and methods used for previous payments. This can be useful for budgeting and financial planning.

- Payment Reminders: Many online platforms offer the option to set up payment reminders. You can receive notifications via email or text message, reminding you of upcoming payment deadlines.

- Payment Schedule: If you have chosen to pay your council tax in installments, you can view your payment schedule. This will outline the due dates and amounts for each installment, helping you stay organized and avoid late payments.

- Direct Debit Management: If you have set up a Direct Debit, you can manage your payments directly from your online account. This includes the ability to cancel or amend your Direct Debit instructions, providing flexibility and control over your financial commitments.

By utilizing these management features, you can stay on top of your council tax payments and ensure a smooth and stress-free process.

Frequently Asked Questions

What happens if I miss a council tax payment?

+

If you miss a council tax payment, you may incur late fees or penalties. It is important to contact your local authority as soon as possible to discuss your options and arrange a payment plan if necessary.

Can I pay my council tax in installments?

+

Yes, most local authorities offer the option to pay your council tax in installments. The number of installments and the payment schedule may vary, so it is best to check with your local authority for specific details.

Are there any additional fees for online payments?

+

Some local authorities may charge a small fee for certain online payment methods, such as credit/debit card payments. It is important to review the terms and conditions or contact your local authority for more information.

Can I pay my council tax if I have moved house?

+

If you have moved house, you will need to notify your local authority and provide them with your new address. You can then make arrangements to pay your council tax for your new property. It is important to update your details promptly to avoid any disruptions in your payments.

Conclusion

Paying your council tax online is a straightforward and convenient process that empowers you to manage your financial obligations effectively. By following the steps outlined in this guide, you can ensure timely payments, avoid penalties, and stay on top of your council tax responsibilities. Remember to regularly check your balance, select a suitable payment method, and utilize the management features provided by your online account. With a few simple clicks, you can streamline your council tax payments and contribute to the vital services provided by your local authority.