Pro's Guide To Instant Council Tax Name Switch

Changing the name on your council tax account is a straightforward process that can be done instantly with the right steps. This guide will walk you through the entire procedure, ensuring a seamless and efficient name switch. Whether you've recently moved into a new property, gotten married, or simply need to update your details, this guide has you covered.

Understanding Council Tax and Name Changes

Council tax is a local tax that funds essential services provided by local authorities in England, Scotland, and Wales. It is a crucial source of revenue for these authorities, allowing them to maintain and improve public services such as schools, roads, and waste management. As a resident, it is your responsibility to ensure that your council tax details are accurate and up-to-date, including your name and any other relevant information.

Name changes on council tax accounts are common and can occur due to various reasons, such as marriage, divorce, or a simple change of name preference. It is important to notify your local authority about any name changes to avoid any potential issues with your council tax liability or the receipt of important correspondence.

Instant Council Tax Name Switch: A Step-by-Step Guide

Follow these simple steps to instantly switch your name on your council tax account:

-

Gather Your Documents

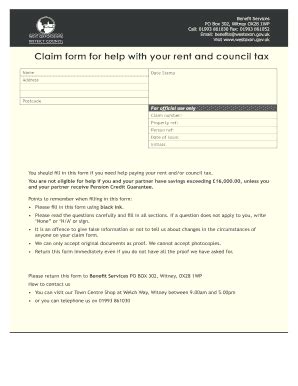

Before initiating the name switch process, ensure you have the following documents ready:

- Proof of your new name, such as a marriage certificate, deed poll, or divorce papers.

- Your council tax account number or any other relevant reference details.

- Contact information for your local authority's council tax department.

-

Contact Your Local Authority

The first step is to get in touch with your local authority's council tax department. You can do this by phone, email, or in person. Provide them with your account details and explain that you need to change the name on your council tax account.

-

Provide Your New Name and Proof

Once you've established contact, you'll need to provide your local authority with the following information:

- Your full name, both before and after the change.

- The date the name change took effect.

- A copy of your proof of name change document.

Ensure that the document you provide is clear and legible. If you're sending it via email or uploading it online, consider using a PDF or a high-quality image format.

-

Wait for Confirmation

After submitting your request and proof, your local authority will process the name change. This usually takes a few days, but it can vary depending on the authority and the volume of requests they receive.

During this time, you may receive a confirmation email or letter acknowledging your request. Keep an eye on your inbox and mailbox for any updates.

-

Check Your Council Tax Account

Once the name change has been processed, log into your online council tax account (if you have one) to verify the update. Ensure that your new name is reflected accurately and that there are no other discrepancies.

If you don't have an online account, consider setting one up. It provides a convenient way to manage your council tax affairs and receive important notifications.

-

Update Your Billing Address (If Necessary)

If you've moved to a new property and need to update your billing address along with your name, be sure to inform your local authority. This ensures that you receive council tax bills and correspondence at your correct address.

-

Keep Records and Documentation

It's always a good idea to keep records of your name change request and any correspondence with your local authority. This can be useful for future reference and helps ensure a smooth process if any issues arise.

Tips for a Smooth Name Switch

- Ensure your proof of name change document is valid and up-to-date. Outdated or expired documents may cause delays in the process.

- If you're unsure about any aspect of the name switch process, don't hesitate to contact your local authority for clarification. They are there to assist and guide you through the procedure.

- Keep your contact information, especially your email and phone number, up-to-date with your local authority. This ensures you receive important updates and notifications promptly.

- If you have any specific requirements or circumstances, such as a change of name due to gender reassignment, be sure to inform your local authority. They can provide additional support and guidance to ensure a respectful and inclusive process.

Common Questions and Concerns

Here are some frequently asked questions and concerns regarding council tax name changes:

What if I don’t have proof of my name change?

If you don’t have official proof of your name change, such as a marriage certificate or deed poll, you may still be able to change your name on your council tax account. Contact your local authority to discuss alternative options, such as providing a statutory declaration or a letter from a relevant authority.

Can I change my name and address at the same time?

Yes, you can change both your name and address on your council tax account simultaneously. Simply inform your local authority of both changes and provide the necessary documentation. This ensures that your council tax records are accurate and up-to-date.

Will my council tax bill be affected by the name change?

Changing your name on your council tax account should not affect your council tax liability. The amount you pay is based on the property’s value and the number of people living there, not the names on the account. However, it is always a good idea to review your bill after any changes to ensure accuracy.

How long does the name switch process usually take?

The time it takes for a name switch to be processed can vary depending on your local authority and the volume of requests they receive. Typically, it takes a few days to a week. However, during busy periods, such as the start of a new financial year, it may take longer. Keep in mind that some authorities may have specific deadlines for name change requests, so it’s best to plan and initiate the process well in advance.

Can I change my name on my council tax account if I’m a tenant?

Yes, tenants can also change their names on council tax accounts. If you rent a property and need to update your name, follow the same steps outlined in this guide. Remember to provide your local authority with your tenancy agreement or other relevant documents to support your request.

Conclusion

Changing your name on your council tax account is a straightforward process that can be completed quickly and efficiently. By following the steps outlined in this guide and staying organized, you can ensure a smooth and stress-free name switch. Remember to keep your local authority informed of any changes to your name, address, or other relevant details to maintain accurate council tax records.

FAQ

How often can I change my name on my council tax account?

+There is no limit to the number of times you can change your name on your council tax account. However, it is important to ensure that each name change is legitimate and supported by valid documentation. Frequent, unnecessary name changes may raise concerns and lead to further scrutiny from your local authority.

Can I change my name on my council tax account if I’m not the bill payer?

+Yes, you can change your name on the council tax account even if you are not the bill payer. This is especially relevant for tenants who may have moved into a property with an existing council tax account. Simply follow the steps outlined in this guide, providing the necessary documentation to support your name change request.

What should I do if I receive a council tax bill with the wrong name after the name switch?

+If you receive a council tax bill with the wrong name after completing the name switch process, contact your local authority immediately. Provide them with your account details and explain the situation. They will investigate the issue and correct any errors on their end. It is important to keep a record of your correspondence and any updates you receive from the local authority.